[ad_1]

Jump to winners | Jump to methodology

The right move at the right time

The past year has been a smoke-catching exercise for the mortgage industry. The Top Mortgage Employers 2022 are organizations that have dealt with the challenging circumstances and successfully readjusted – but interestingly, in different ways.

In the face of rising interest rates and rapid inflation, companies have had to downsize as business dwindled.

Chelsea Balak, vice president of operations at wemlo, one of the Top Mortgage Employers, emphasizes that transparency and communication are crucial. At wemlo, they openly discuss with their staff what is happening in the market. “Employees impacted by layoffs should be offered decent severance packages and can benefit from additional support like job placement assistance,” she says.

“Few organizations have been left unscathed by the industry-wide reduction in capacity”

Christie Cimring, Mattamy Home Funding

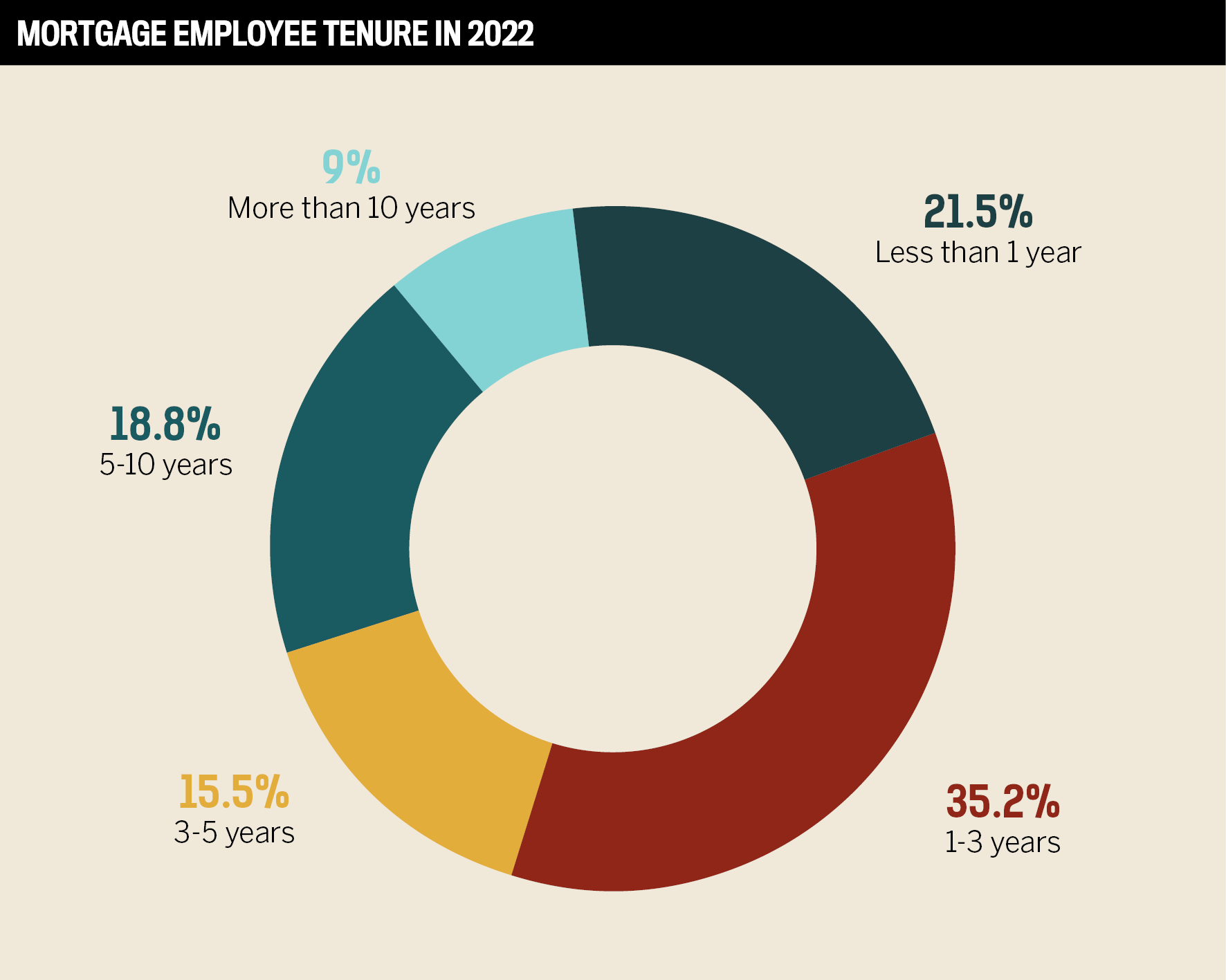

Director of people operations at Mattamy Home Funding, one of MPA’s Top Employers, Christie Cimring cites “employees rejecting burnout and pulling the plug on unsatisfactory positions” as another reason for the declining tenure.

“Now that the pandemic is receding, [employees] are rethinking their values around work-life balance after the disruption of COVID-19.”

To determine the top US mortgage employers that stepped up their game to provide valuable benefits and collaborative cultures, MPA invited organizations to describe their offerings and business practices through a survey. We then asked employees from the nominated companies to fill out their own anonymous survey to rate their satisfaction with a number of key factors such as compensation, employee development, culture, and work environment. Companies with a satisfaction rating of 80% or greater were included in the Top Mortgage Employers list.

“In a perfect world, market changes would never happen, and there would never be a need to have layoffs”

Gabriel Gillen, Family First Funding

Survivor’s guilt and support

During the refinance boom, mortgage employers were hiring workers in droves to meet demand. There was a sudden underwriter shortage and not enough qualified applicants, resulting in hiring practices that led to a historic record of employee turnover.

“They weren’t intentional in their growth practices and didn’t always provide new hires with the training and support they needed to succeed,” explains Balak. “This approach led to high turnover rates and unhappy employees.”

However, things have changed. According to Sara Walkowiak, senior recruiter at Houston-based staffing agency Professional Alternatives, the number of applicants per job has increased by approximately 200% over the past eight months.

“There are a lot of experienced, talented mortgage people, but since the interest rates increased, cuts were made,” Walkowiak explains. “It happens in the industry. Once the guidelines change and people tighten up on what they want to accept and won’t accept, [many factors] come into play.”

Mattamy Home Funding adopts a holistic approach to the situation. “Amid layoffs, it’s imperative to recognize the feelings and accommodate the needs of employees still in the workforce who are dealing not only with seeing colleagues lose their jobs but also with personal challenges that are often invisible, undefined, and complicated,” Cimring comments. “Leaders must show that they care by communicating transparently about the situation and listening while workers process survivor’s guilt.”

The company operates a noteworthy scheme, which gives employees a 5.5% rebate when purchasing one of its builder’s homes – a relief amidst the housing affordability crisis.

Melissa Koehler, SVP of human resources at Sourcepoint’s parent company, Firstsource, echoes Cimring’s sentiments that empathy is critical when faced with layoffs. Koehler explains that Sourcepoint, also a Top Mortgage Employer, provides career assistance through résumé-writing and interviewing courses to help laid-off workers get back on their feet.

“Just as important is ensuring that your employees who have survived the layoffs feel secure and motivated,” she stresses. “Going above and beyond in one-on-one and group connects is key to doing this, and continuous communication that is candid, transparent and motivating can help survivors move through the grief that comes with any major layoff.”

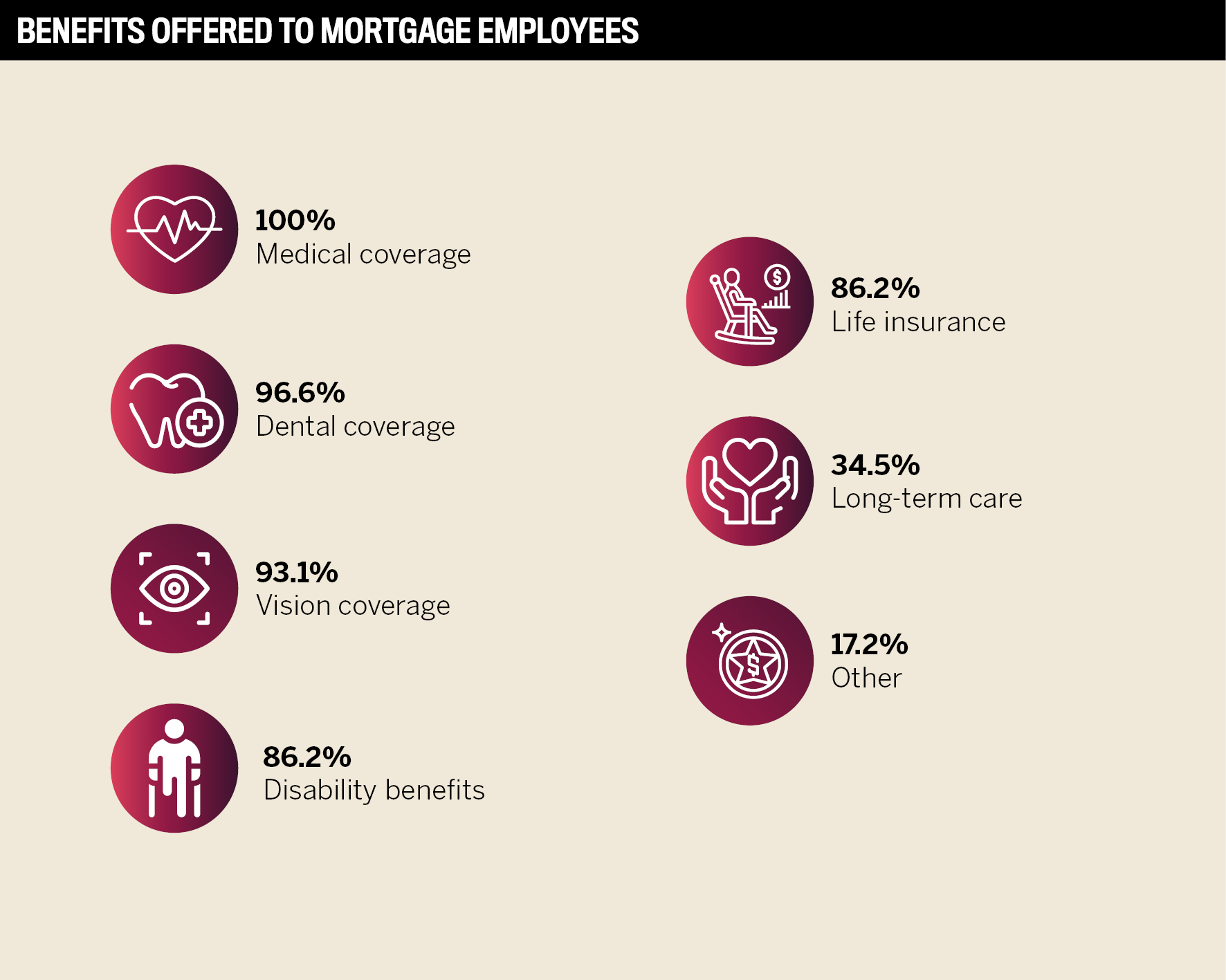

At wemlo, there is also a focus on being connected to their workforce. “Employees that survive layoffs should immediately be engaged in long-term growth plans to ensure they feel secure in their role and can see longevity in their position, and time with the company,” adds Balak. In addition, loan processors at wemlo receive “competitive compensation packages and access to robust benefits that are not generally available to processors in independent contractor positions”.

“In the near future, we see a continued consolidation of the market with limited new openings and companies taking the opportunity to review their tools, platforms, and processes for maximum efficiency”

Melissa Koehler, Firstsource

Lull in hiring demand

Rampant inflation sparked a wave of employee terminations, reflecting a shift from companies’ hiring binges to mass layoffs. Several lenders and brokers have either downsized or slowed down hiring as they tighten their belts to ride out the housing recession.

Balak expects the rest of 2022 to be tough for most mortgage lenders. “Historically, operations layoffs could be avoided by adding some new sales teams and ‘filling in’ the volume that may have dipped as a result of a change in housing or interest rates. The drastic drop in refinance volume created a gap in volume that cannot be replaced with a quick recruiting push,” she says.

Cimring agrees: “It’s definitely a challenging time in the industry. Few organizations have been left unscathed by the industry-wide reduction in capacity. Where reductions have been the result, the remainder of the year will likely focus on ensuring remaining team members are upskilled, reskilled and cross-trained.”

While Mattamy Home Funding is not immune to the downturn, the company has continued to expand and now operates in 26 states. This allows the firm to cast a wider talent net when hiring ramps back up, since it isn’t constrained to a local market.

Companies with great culture and workplace flexibility were able to hire and retain quality talent while continuing to effectively grow their teams, explains Balak.

“Culture leans into an emotional connection and a feeling of belonging. An employee is less likely to leave a company if they feel a strong sense of emotional connection to the brand and their team members,” she says. “When days get tough, which is common when the economy becomes unpredictable, a sense of community is what keeps teams together.”

The great pivot

“In a perfect world, market changes would never happen, and there would never be a need to have layoffs, with the exception of poor performance,” says Gillen. “Businesses have a responsibility to their staff and key stakeholders to work efficiently, produce a profit, and provide services at a level that will create repeat and future business referrals.

“Some organizations outsource certain activities or a percentage of their operations staff in an effort to be able to scale up or back down quickly without having to lay off employees. This seems to work and helps avoid having to cut direct employees. However, there is a great deal of oversight and management required to outsource effectively.”

The Family First Funding president encourages other mortgage companies to think about three choices over the next 12-18 months: (1) Do you merge with another company to create economies of scale and lower overall expenses? (2) Do you trim expenses, reduce staff, and hunker down until the market turns? (3) Do you double down and invest in your business growth and go on a large-scale recruiting and retention spree?

“As a company, we have thinned our margins considerably in an effort to give our staff a competitive advantage so that they may win more business,” Gillen explains. “We have increased our budget and spending in key areas which drive new business opportunities to our staff. We have always been purchase-centric as we believe purchase volume is the most recession-proof business and purchases still occur in a rising interest rate environment. There is a smaller population of new loans across the country, so market share is more important than ever.”

Gillen believes in prioritizing and developing technology within systems and processes to automate some time-consuming manual work.

“I think technology will continue to play a larger role within our industry,” he says. “Artificial intelligence and computer programs will handle a larger percentage of the non-sales functions within the mortgage application process. This should create much greater efficiencies for companies and allow them to close more loans with their existing staff and scale without having to outsource. Many lenders have adopted these technologies already and have seen the rewards of making these changes. Those that have not yet done so are quickly surrendering to tech and now see why this is the new way of originating a mortgage.”

Future predictions

MPA’s Top Mortgage Employers have contrasting views on where the mortgage industry is headed.

“In the near future, we see a continued consolidation of the market with limited new openings and companies taking the opportunity to review their tools, platforms, and processes for maximum efficiency,” Koehler says.

“I see it going in a different direction, not so much on the production side,” says Walkowiak. “I see foreclosures happening. Mortgage services will be busy. Foreclosure lawyers will be busy. I see employers hiring temporary workers versus permanent employees.”

Meanwhile wemlo continues to hire to support its growth trajectory, asserting that the importance of broker-to-customer relationships has remained unaffected and reliable loan processing continues to act as a “foundation of the mortgage industry.”

“A majority of the industry is tied to mortgage applications, not mortgage customers,” Balak reiterates.

“While the job market is continuing to evolve and will look different based on the industry, however, a few things are here to stay,” Cimring says. “These include the demand for remote work and increased flexibility, coupled with increased candidate expectations relating to compensation and benefits. I think we will see the addition of new careers in response to new market needs, automation and AI will allow for more meaningful work, and skills-based hiring will provide wider candidate pools.”

“I do not believe there is a ‘future-proof’ solution to unexpected global events,” Gillen concludes. “When terrible things happen across the world, every business is impacted in one way or another. I believe that each of these events that occur educates businesses on what can happen and should serve as a reminder when making future decisions.”

501+ employees

- Academy Mortgage Corporation

- American Financial Network

- Bank of England Mortgage

- New American Funding

- Paramount Residential Mortgage Group

- Sourcepoint

101-500 employees

- A&D Mortgage

- Deephaven

- Family First Funding

- Inlanta Mortgage

- Intercoastal Mortgage

- Kwik Mortgage Corporation

- Peoples Mortgage Company

- Premier Nationwide Lending

- Taylor Morrison Home Funding

26-100 employees

- Atlantic Home Mortgage

- LenderHomePage

- Mattamy Home Funding

- wemlo

10-25 employees

- Carrero Mortgage Advisors

- Neal Communities Funding

The process of finding and recognizing the best employers in the US mortgage industry took place over two phases. First, MPA invited organizations to submit their details through a survey, where they were able to describe their offerings and business practices. Then, employees from the nominated companies were asked to fill out their own anonymous survey to rate their satisfaction with a number of key factors such as compensation, employee development, culture, and work environment.

Each company was required to meet a minimum number of employee responses based on overall size. Companies that achieved a satisfaction rating of 80% or greater were included in the Top Mortgage Employers list.

78.6% said their company offered continuing education programs or reimbursement

[ad_2]

Source link