[ad_1]

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

US president Joe Biden pledged to boost federal support for Puerto Rico yesterday after a hurricane caused flooding and left more than 1mn people without electricity.

In a call to Pedro Pierluisi, the governor of the US territory, from Air Force One, Biden said the number of support personnel on the ground to help with response and recovery efforts would “increase substantially”, the White House said.

Hurricane Fiona made landfall in Puerto Rico on Sunday, causing damage to infrastructure and buildings and leaving about 1.3mn without electricity on Monday evening, according to Poweroutage.us.

Puerto Rico’s second-largest city, Ponce, received more than 30 inches of rainfall over a two-day period, according to a gauge operated by the US Geological Survey.

The Caribbean island previously suffered from the devastating Hurricanes Irma and Maria in 2017, which killed thousands of people and cost billions of dollars.

Thanks for reading FirstFT Americas. Here is the rest of the day’s news — Gordon

Five more stories in the news

1. Investors ditch vaccine stocks after Joe Biden says ‘pandemic is over’ Investors wiped more than $10bn off the market value of the main Covid-19 vaccine makers yesterday after US president Joe Biden said “the pandemic is over” in a 60 Minutes interview on Sunday. Shares in Moderna, BioNTech and Novavax fell heavily.

2. Ecuador reaches $1.4bn debt restructuring deal with China The government of centre-right president Guillermo Lasso said it had reached a deal with two Chinese banks to extend the maturity on loans and reduce interest rates and amortisation. China has been Ecuador’s most important financial partner for the past decade, beginning under leftist former president Rafael Correa, who was in office from 2007-2017.

3. Hedge funds take aim at UK asset managers Hedge funds from Ken Griffin’s Citadel to Steve Cohen’s Point72 are betting that a tumble in the shares of UK fund management groups, including Abrdn, Ashmore and Hargreaves Lansdown, will accelerate as a brutal bear market dents their investment performance and ability to attract business.

4. Goldman hunts for revenues in EU transaction banking push The Wall Street lender is rolling out transaction banking services in the EU with a new team in Frankfurt as it seeks to diversify beyond trading and advice services. Goldman is also considering opening transaction banking offices in Amsterdam and Japan.

5. Queen Elizabeth’s state funeral marks culmination of national mourning Queen Elizabeth II completed the journey to her final resting place at Windsor yesterday after a momentous state funeral at Westminster Abbey, as world leaders joined Britons in mourning the country’s longest-serving monarch.

The day ahead

UN General Assembly The general debate at the UNGA kicks off today and runs through to next Monday. World leaders are convening in person for the annual event for the first time since the start of the Covid-19 pandemic in 2020. The UNGA comes as the war in Ukraine, tense US-China relations, soaring inflation, natural disasters and a looming recession pose some of the most immediate challenges for countries across the world.

Fed policy meeting: The US Federal Reserve’s Federal Open Market Committee will begin a two-day meeting today that is expected to result in a 0.75 percentage point increase in interest rates for the third time in a row. The Fed will release its decision tomorrow. Equity markets in Asia and Europe turned higher ahead of the start of the closely watched meeting while Sweden’s Riksbank kicked off a big week for central banks with its biggest interest rate increase in three decades.

US housing data Potential home buyers are being discouraged by the confluence of high house prices and rising mortgage rates, data released today is expected to confirm. New monthly residential construction is expected to have held steady in August at an annualised pace of roughly 1.45mn homes, according to economists polled by Refinitiv but building permits are thought to have decreased by 75,000, or 4.5 per cent, to 1.61mn.

Canadian inflation Canadian consumer prices are expected to have ticked down by 0.1 per cent on a monthly basis in August, according to economists polled by Refinitv. Headline annual inflation is predicted to have moderated to 7.3 per cent year-on-year, down from 7.6 per cent in July, and a 40-year high of 8.1 per cent in June.

What else we’re reading

America needs a proper risk strategy for China US-China tensions have risen to worrisome levels, particularly around the issue of Taiwan, argues Rana Foroohar. There is clearly a growing effort by the White House to separate its supply chains and financial markets from Chinese influence. But, she asks, what is the strategy for dealing with the economic fallout?

Putin, Xi and the limits of friendship Gideon Rachman turns to the Ukraine conflict and how it is being viewed in Beijing. The war has weakened Russia, destabilised Eurasia and strengthened the western alliance, he says. None of that looks good for the Chinese government. Chinese state media love to stress the inexorable decline of the west, he argues. But, suddenly, the western alliance is looking rather sprightly.

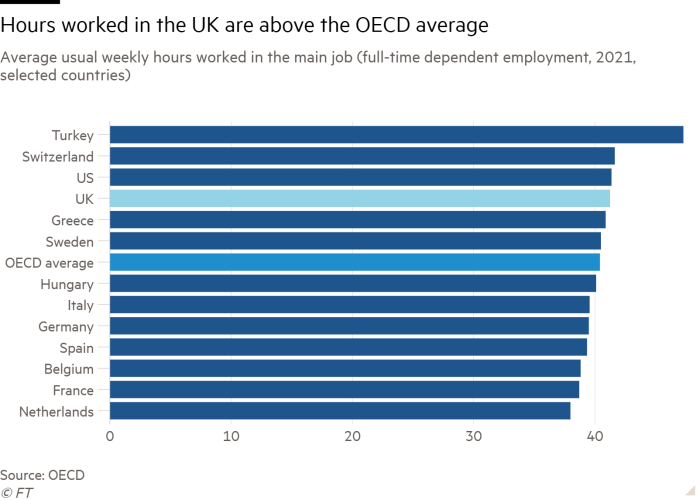

Are the British the worst idlers in the world? In the 2012 book Britannia Unchained, five Conservative MPs argued: “Once they enter the workplace, the British are among the worst idlers in the world.” Given that two of the book’s authors were Prime Minister Liz Truss and chancellor Kwasi Kwarteng, Sarah O’Connor says it is worth asking: is there any truth to it?

Bolsonaro still has backers in Brazilian business Less than two weeks before Brazil’s elections and it might appear from the outside that business has deserted President Jair Bolsonaro. Yet, whisper it quietly, says Latin America Editor Michael Stott, as many Brazilian business executives and bankers still prefer Bolsonaro to the frontrunner, leftwing former president Luiz Inácio Lula da Silva.

Indonesia’s unexpected success story As sharply rising US interest rates add to economic problems in the developing world, Indonesia appears unruffled, and its economy is prospering. Yet even as investors pile in, some worry about the sustainability of Indonesia’s newfound stability, particularly its politics.

Middle managers — on the new front line of office life Middle managers have had to deal with upheavals wrought by the pandemic, and the staff turnover through the so-called Great Resignation. Now, many are charged with overseeing hybrid work plans and managing teams’ pay expectations in a period of high inflation. Emma Jacobs spoke to recruitment managers, advisers and academics to see how business is coping.

Your feedback

As millions tuned in to watch the funeral of Queen Elizabeth II, FirstFT readers around the world shared their thoughts about the late monarch.

“Tested in so many different times — always a rock, pledging her entire life to service until the day she died. Just remarkable, especially today when viewed against our (US in particular) environment of divisiveness, hatefulness and lack of civility. One American’s view: I feel we have lost this wonderful role model of how one should lead and behave” — Deborah Kelly, Denver, Colorado

“I am anxious about the future and what it means for the country both at home, and in the eyes of the world. At the same time, I am excited about Charles taking the throne. I am a sustainability person and the world needs to change. Charles has been banging that drum for years” — Wayne McCance, Hampshire, England

“With her passing, what will the course for Britain be? And what of its traditions that hold a country together, give it meaning, purpose and the will of its people?” — Beatrice, New York City

Thank you to all those readers who shared their views. If you have any thoughts about this newsletter please hit reply or email firstft@ft.com.

Recommended newsletters for you

Disrupted Times — Documenting the changes in business and the economy between Covid and conflict. Sign up here

Asset Management — Sign up here for the inside story of the movers and shakers behind a multitrillion-dollar industry

[ad_2]

Source link