[ad_1]

We’ve long reported on the impact of more personal relationships with clients, talking often about the “emotional connection” that benefits advisors and clients alike. In our most recent project, we simplified this study to focus on whether or not a client considers their financial advisor a friend. If you’re curious, 55% said they did, 35% said they did not, and 10% weren’t sure.

Why does this matter? After all, you don’t feel an urge to be friends with your mechanic, dentist or dry cleaner. Financial services are a little different. Your client relationships are long-term, personal and built on trust. From the client’s standpoint, as they develop a deeper bond with you, they become more confident that you (as a friend) are acting in their best interests.

From the advisor standpoint, becoming friends has a wide variety of business implications. In our most recent survey on 1,002 affluent investors with $500,000 or more in investable assets, we found that:

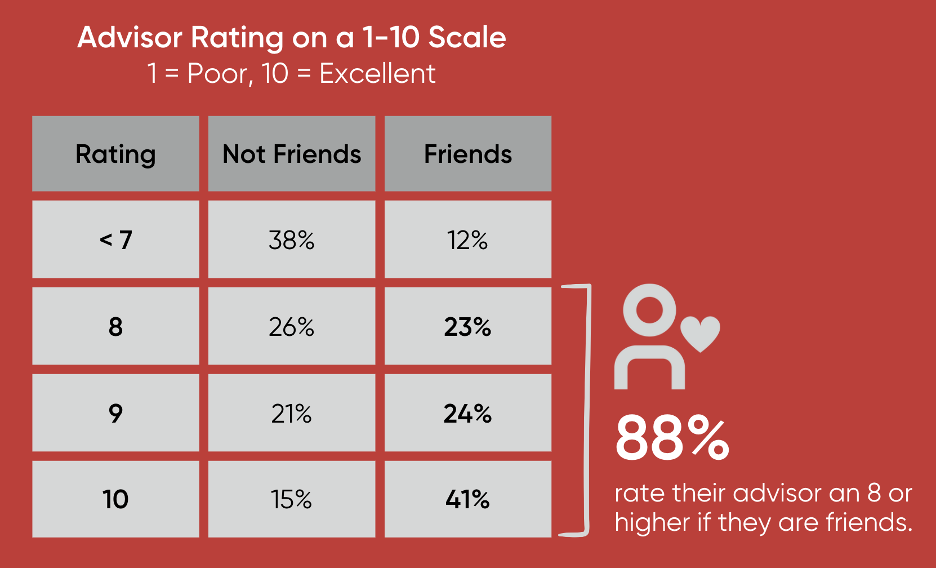

1. Friendship improves your clients’ perceptions of you.

We tend to give friends a bit of latitude that we may not afford to others. If someone likes you as a person, they’re more likely to look past your flaws and to see the good in you. Notice how this plays out when clients are asked to rate you on a 1-10 scale:

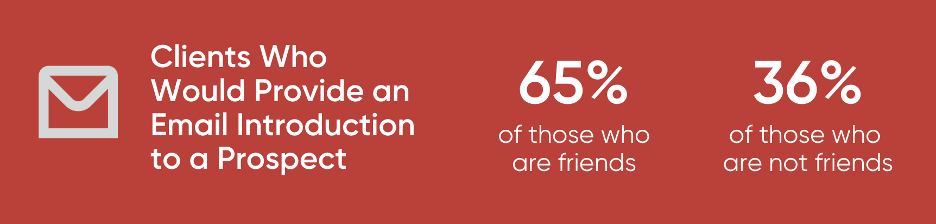

2. Friendship increases your clients’ willingness to introduce you.

If a client likes you personally, they want to see you succeed. The increased level of advocacy is one of the biggest benefits of developing client friendships. Consider the following statistics on willingness to provide an email introduction:

3. Friendship decreases the odds that clients leave you.

This one isn’t surprising. It’s harder for a client to leave an advisor who’s a friend than an advisor who isn’t. There are feelings involved. You’ve got history. You may still see each other socially. It’s just harder. Consider the difference highlighted below:

The type of client friendship we’re suggesting benefits everyone involved. You benefit from the increased loyalty and advocacy. They benefit from having more trust in the person managing their investments. You both benefit from a more positive and fun working relationship.

If you’re looking to make friends in your business, get tactical. What routines could you establish? What activities could you measure? Perhaps it’s one lunch per week? Maybe it’s one personal check-in call per day? There are many ways to achieve this, but it starts with intention.

This article featured some of our latest affluent investor research. Download the full report.

Stephen Boswell is a partner with The Oechsli Institute, a firm that specializes in research and training for the financial services industry. @StephenBoswell www.oechsli.com

[ad_2]

Source link