[ad_1]

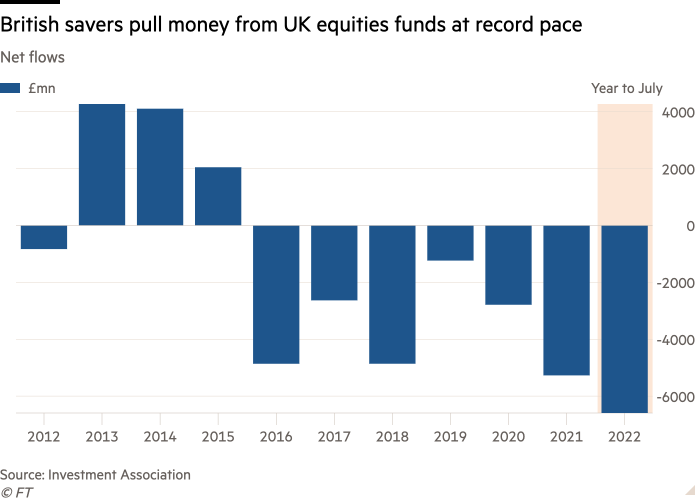

UK savers have fled funds investing in British business, pulling £6.6bn from these assets so far this year, making 2022 already the biggest year of outflows in a decade.

The rout for funds with UK equities strategies in the first part of this year has outstripped the £4.8bn withdrawn in 2016, the year of the Brexit referendum, according to data from the Investment Association (IA), a trade body. UK-focused funds have recorded net outflows every year since the Brexit vote.

Withdrawals accelerated in July, the most recent month covered by the IA’s data, marking 12 consecutive months of net outflows. The pace of selling appears to have picked up in August, according to separate data from funds provider Calastone, which tracks both retail and professional investors. It said the five worst months for UK funds since at least 2015 all took place in 2022.

The lack of faith in British stocks from UK retail investors and their advisers underscores the economic challenges facing Liz Truss as she took over as UK prime minister this week.

“The government must recognise that the UK is sliding down the ranks of the largest economies in the world, and to reverse this decline it must introduce policies that make the UK more attractive for inward investment,” said Alan Custis, head of UK equities at Lazard Asset Management.

The pound traded at its weakest level since the mid-1980s as Truss took office, while the yield on the UK government’s ten-year bonds reached 3 per cent for the first time since 2014. Both market moves reflect investors’ fears about the country’s darkening economic outlook.

“The UK’s new prime minister faces an in tray of burning issues that need urgent attention. These include a cost of living crisis sparked by inflation at a 40-year high, rocketing energy prices, a raft of strikes and the unresolved difficulties of the UK’s decision to leave the European Union,” analysts at Schroders wrote.

Investors have blamed lingering uncertainty over the Brexit process for the haemorrhaging of cash from UK funds since 2016, which totalled £21bn to the end of last year. However, the UK funds sector has also suffered from a broader trend away from home-market bias on the part of retail investors.

“UK equity fund outflows have been persistent since the Brexit referendum in 2016. This is also reflective of an adjustment away from a home bias towards more globally diverse equity exposure,” said Miranda Seath, director of market insight at the IA.

“Rising and persistent inflation and a weakening pound have placed an increasing strain on the domestic economy, but this is not just a UK phenomenon.”

A relatively better performance by UK stocks this year compared with global markets has not reversed retail investors’ flight from British strategies. The MSCI UK Index has fallen 10 per cent in the year to the end of last month, compared with a 17 per cent drop for the MSCI World.

However, analysts note the fortunes of UK-listed companies are not always tied to the British economy.

“It is important to remember when the economic headlines are grim that the UK equity market is highly international in nature, with around two-thirds of the earnings of UK listed companies made outside the UK,” said Jason Hollands, managing director at UK wealth manager Evelyn Partners (formerly Tilney, Smith & Williamson).

“When it comes to the largest multinational companies, economic exposure to the US and emerging markets are more of an influence than the domestic UK economy. Sensitivity to the domestic economy is . . . greater when it comes to small and medium sized companies,” he added.

The sell-off in global markets so far this year has been mirrored by steep withdrawals from investment funds, as the war in Ukraine and tightening central bank policy spooked UK savers. The IA reported June was the second-worst month on record for fund sales, with total net outflows of £4.5bn. Total outflows slowed to just £129mn in July, as markets staged a brief rebound.

[ad_2]

Source link