[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Good evening,

What can we learn from the latest round of data on global labour markets and their implications for monetary policy?

Official figures from the US today showed jobs growth slowing in August after a bumper July, but still with a healthy 315,000 new posts. However, the unemployment rate edged up from 3.5 per cent to 3.7 per cent.

“The labour market is moving in the right direction for policymakers,” said one economist. “An uptick in unemployment along with a modest increase in the participation rate means that the labour market in August is less tight than it was in July.”

Data earlier this week indicated there were roughly two vacancies per employed worker, with many firms still struggling with shortages. Wages in turn are rising as companies compete for staff, fuelling concerns of a wage-price spiral as businesses charge more for their products, leading workers to demand even higher pay.

Across the Atlantic, new eurozone data yesterday showed the unemployment rate falling below 6.6 per cent of the workforce for the first time.

The strength of the labour market and the risk of wages rising sharply have fuelled calls for the European Central Bank to accelerate interest rate rises, with a possible 0.75 percentage point increase next week. Eurozone inflation is currently at a record 9.1 per cent, way above the ECB’s target of 2 per cent.

Australia is applying a different approach to labour shortages — the country has the second worst record in the OECD after Canada — by increasing the pool of workers.

Its home affairs minister announced today that it would allow tens of thousands more immigrants into the country and ease its dependence on lower-paid temporary workers as part of its response to the “global war for talent”.

One Australian MP said the country risked a “brain drain” unless its visa system was improved. “We have too many engineers that are Uber drivers at the moment and yet we have skill shortages,” she said.

Latest news

-

US labour chief says jobs market can withstand Fed rate hikes (Bloomberg)

-

All French nuclear reactors to restart by winter (AP)

-

Russia’s Gazprom set to resume Nord Stream 1 gas flows as planned (Reuters)

For up-to-the-minute news updates, visit our live blog

Need to know: the economy

G7 countries have backed a price cap on Russian oil to limit the Kremlin’s earnings from energy and its ability to wage war in Ukraine. Russian president Vladimir Putin said yesterday that Moscow would stop selling oil to any countries attempting to do so.

The EU has reached an agreement with member states to advance a €5bn loan to Ukraine as part of a €9bn package to prop up Kyiv’s finances.

Latest for the UK and Europe

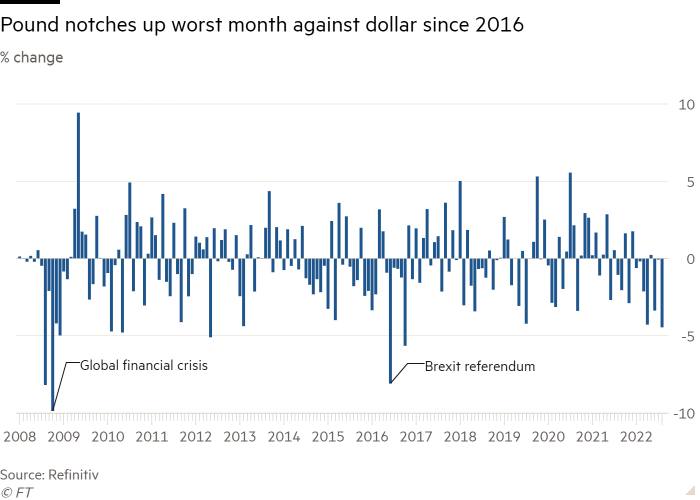

Sterling in August had its worst monthly fall against the dollar since the Brexit referendum against a backdrop of economic and political uncertainty. Outgoing UK prime minister Boris Johnson used his final speech to defend his handling of the pandemic, while the FT editorial board said Liz Truss — the favourite to succeed him — would need to junk some of her ideological rigidity to deal with a worsening crisis. The next British PM will be announced on Monday. In the meantime, here’s what business wants from the new leader.

UK campaigners have warned that the number of households in fuel poverty would more than double in January to at least 12mn unless the new prime minister takes “immediate” action to help with bills.

Brussels has reiterated its warnings about the UK ditching the Northern Ireland protocol, the agreement which governs trade relations between the province, the rest of the UK and the EU, calling it a “provocative act”.

Eurozone industrial producer prices rose by a record 37.9 per cent in the year to July, driven by a huge 97.2 per cent jump in the cost of energy. Here’s how Brussels plans to reduce electricity prices.

Don’t miss your chance to join the FTWeekend Festival online or in-person tomorrow. There’s a great line up of speakers, including two former UK health secretaries, as well as experts on how to eat and live well, not to mention culture, politics, and big ideas. Get your discounted ticket at ft.com/festival using the code “Festival2022”.

Global latest

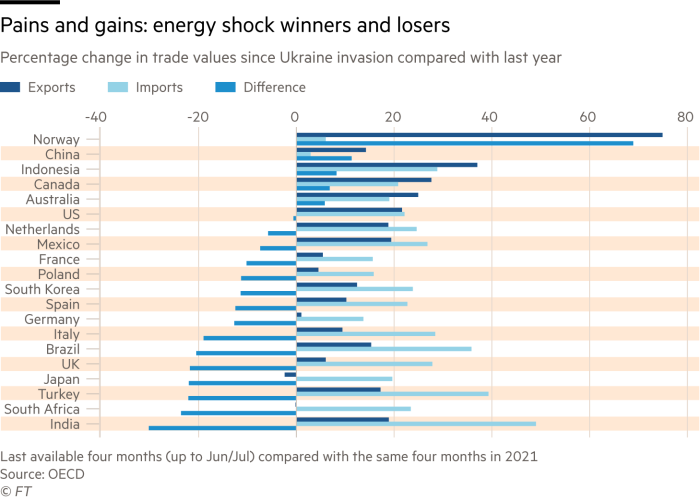

Commentator Martin Sandbu discusses an overlooked aspect of the energy shock: the “astounding” transfer of money from energy importers to exporters. To take one example: Saudi Arabian exports over the previous five years were around $20bn a month, but since Russia’s invasion of Ukraine this has shot up to $40bn.

Also benefiting is Joe Biden, says our Energy Source newsletter. The US president has managed a turnround in the political narrative as petrol prices fall, his climate bill passes and American shale oil and gas insulate the country from the kind of doomy prognosis engulfing Europe.

One of the beneficiaries from China’s slowdown — PMI data yesterday showed manufacturing activity shrank in August — has been the environment. The country’s carbon emissions fell 8 per cent in the second quarter, the fourth consecutive drop for the world’s biggest emitter. Drought however is causing serious problems for hydroelectric power.

Argentina’s vice-president Cristina Fernández de Kirchner, one of Latin America’s best-known politicians, survived an assassination attempt after her attacker’s gun failed to fire. Political tension has been rising this year as inflation heads towards 90 per cent a year and the peso plunges in value on the black market.

Zambia’s $1.3bn IMF bailout will be a test of how the fund responds to the wave of debt distress in countries that have borrowed heavily from China.

Need to know: business

The UK’s top chicken producer said it would have to pay £1mn a week extra for carbon dioxide to stun birds for slaughter after a supplier pushed up prices following the end of production at CF Industries, the country’s biggest supplier. As well as the poultry and pig industries, CO₂ is also crucial for brewing, carbonated drinks production, food packaging and refrigeration.

New “anti-woke” investment funds with names such as “Maga” and “God Bless America” are facing scrutiny from US regulators over whether their titles are fully compatible with their portfolios. US editor-at-large Gillian Tett says Republican targeting of ESG laws is bad for business.

Russian banks lost Rbs1.5tn ($25bn) in the first half of 2022 after western sanctions cut the country out of large parts of the global financial system, preventing them from trading in the dollar, euro and other convertible currencies and leading to losses on currency swaps.

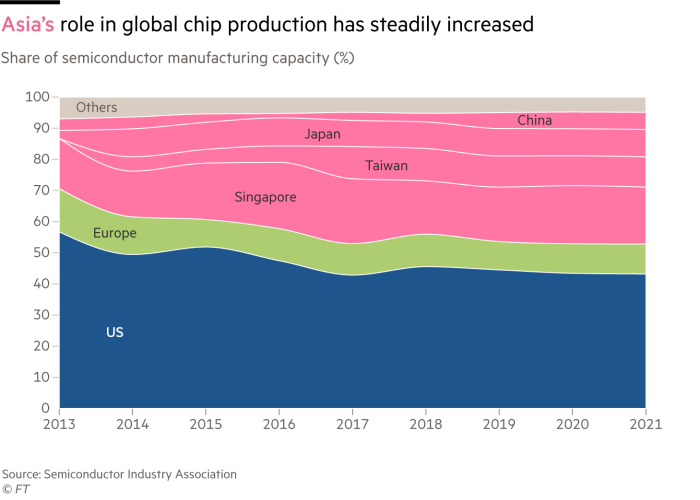

India is stepping up efforts in chipmaking as geopolitical tensions continue to wreak havoc on global supply chains. As our Big Read explains, the country is keen to offer itself as a democratic alternative tech hub to China. The US is restricting exports of top Nvidia chips used in artificial intelligence to China and Russia.

Science round-up

Melbourne could become a global centre for developing new antiviral therapies to deal with future pandemics after receiving the largest donation in Australian medical history. “We wanted to create a second shield for humanity,” said donor Geoff Cumming.

US regulators cleared vaccines by Moderna and BioNTech/Pfizer targeting the dominant strain of the Omicron variant as well as the original strain of coronavirus despite a lack of human trials. The EU followed suit, paving the way for the messenger RNA jabs to be rolled out in autumn, when authorities expect cases to rise.

Experts believe China’s zero-Covid policy will continue into next year, while hopes are pinned on a “super vaccine” that could stop the disease from spreading or a weaker mutation emerging with less serious health consequences. The megacity of Chengdu is the latest to be locked down.

Covid-19 has also generated an “epidemiological aftershock”, leaving people susceptible to a large range of other conditions and piling extra pressure on already stretched health systems. Global health editor Sarah Neville’s Big Read lays out the challenges ahead.

Covid cases and vaccinations

Total global cases: 597mn

Total doses given: 12.6bn

Get the latest worldwide picture with our vaccine tracker

Some good news

From a new era of astronomy to a possible end to animal testing, 2022 is proving to be a great year for positive science stories. Here’s our top five.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link