[ad_1]

Short-term UK borrowing costs surged to the highest level since 2008 as blistering inflation data heightened expectations that the Bank of England will need to lift borrowing costs sharply to slow price growth.

Two-year gilt yields, which are sensitive to monetary policy expectations, soared as much as 0.3 percentage points on Wednesday to 2.45 per cent.

Longer-term bonds came under slightly softer selling pressure, with the 10-year yield rising as much as 0.19 percentage points to 2.32 per cent.

The moves cascaded to other global bond markets, with German, Italian and US government debt under pressure.

The intense selling in short-dated UK debt highlights how many investors increasingly view the BoE as lagging behind in its efforts to fight inflation, which is running at its highest level in more than 40 years. Worries are also mounting that these efforts will tip the country into a prolonged recession.

Rising two-year gilt yields are “telling us the market thinks the [BoE] bank rate needs to go higher”, said James Athey, investment director at Abrdn.

Athey added that the positioning of some investors, who had hoped inflation was near peaking, had “exacerbated” Wednesday’s moves since they were now having to shift to a more hawkish outlook for monetary policy.

In currencies, the pound slipped 0.4 per cent lower against the dollar to $1.20 and 0.4 per cent against the euro to €1.18.

Trading activity in fixed income and currency markets tends to slow during August with many market participants on holiday, something that may amplify the scale of price fluctuations.

Wednesday’s moves come after fresh data showed the UK’s annual inflation rate rose to 10.1 per cent in July — up from 9.4 per cent in June and greater than economists’ forecasts of 9.8 per cent.

The Office for National Statistics noted that a “wide range of price rises” had pushed up the inflation rate in July, with food leading the way. “The main problem was the breadth of price increases,” said Silvia Dall’Angelo, senior economist at Federated Hermes.

Goldman Sachs economists said they expected prices “to remain elevated throughout 2022 and 2023 due to supply chain disruptions, strong wage growth, and higher energy prices”.

The UK data contrast the US inflation report earlier this month, which showed consumer price growth in the world’s largest economy slowed to 8.5 per cent in July, from 9.1 per cent in June. The easing US cost pressures had increased hopes that global inflation could be at or near peaking.

“The encouraging evidence that the upward pressure on underlying inflation from global factors has started to ease will be of little comfort to the Bank of England given the signs that this is being replaced by more persistent domestic inflationary pressures,” said Ruth Gregory, senior UK economist at Capital Economics.

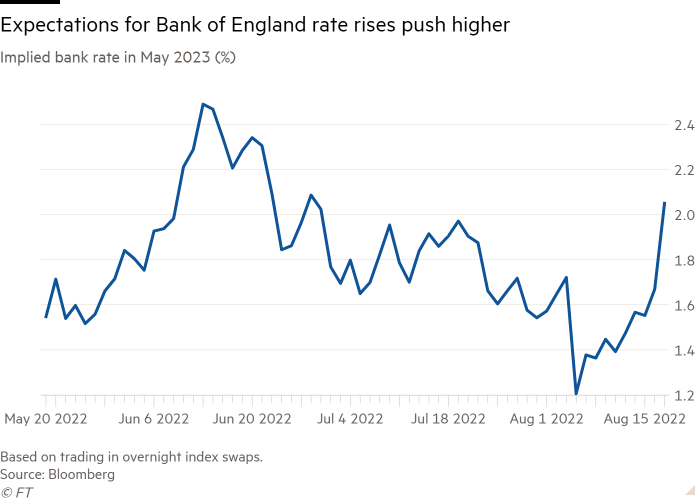

Trading in money markets now suggests traders are braced for the BoE to increase its main interest rate by 2.05 percentage points by May 2023, compared with 1.67 percentage points on Tuesday.

Gregory said she expected the BoE to raise rates by 0.5 percentage points next month, after raising them by the same margin this month in the biggest rise in 27 years. The central bank has already increased its main interest rate from 0.1 per cent in November 2021 to 1.75 per cent this month.

The hawkish pivot in market pricing left two-year gilt yields trading around 0.15 percentage points above their 10-year counterparts, the most significant “inversion” of Britain’s yield curve since the 2008 global financial crisis.

Investors typically demand higher borrowing costs for the risk of buying bonds maturing long into the future, meaning yield curves normally slope upwards. An inverted curve is a strong signal that markets are expecting a more aggressive BoE will deal a strong blow to the country’s economy.

The yield curve inversion signals markets are anticipating a short-term tightening in BoE monetary policy, followed by a recession and then a “bit of easing” from the central bank, said Dall’Angelo.

The central bank earlier this month warned that the UK would slump into a 15-month recession later in 2022, with gross domestic product shrinking by more than 2 per cent from peak to trough.

“We’re almost getting to the stage that central banks are almost going to have to engineer an unemployment market that’s close to the financial crisis to bring inflation back under control,” said Craig Inches, head of rates and cash at Royal London Asset Management, pointing to the BoE and other global counterparts such as the US Federal Reserve that are also battling hot inflation.

[ad_2]

Source link