[ad_1]

One scoop to start: Carlyle Group’s departed chief executive Kewsong Lee asked for a pay package worth up to $300mn over five years and resigned from the US private equity group after its co-founders refused to even discuss the deal, multiple people with knowledge of the matter told DD.

And one invitation to start: Have you obtained your ticket to DD Live yet? Join us on October 12 as we gather the biggest names in M&A, private equity and corporate finance. To gain access to the event and find more details go here.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

-

The transformation of private equity

-

The Magic Circle heads to America

-

IPO lawyers run out of work

Private equity becomes a country club

In the fashionable enclaves in and around New York and London, dealmakers have long perfected the art of being gracious at home, then returning to the city to rip each other’s throats out.

Now many of the cues that work well at the country club have been embraced by the private equity industry, long considered Wall Street’s most cut-throat terrain.

As DD’s Antoine Gara explains in this feature, private equity’s growth into a $10tn goliath has linked firms more closely together than ever before and caused a collective realisation that they can make more money than the sums at stake in a single deal negotiation if they work together as partners.

Marc Rowan, the face of Apollo Global Management — long considered among the most ruthless firms to ever occupy Wall Street — said so much at a conference this year.

“Private equity started 35 years ago as a dark art. Now it is an asset class,” he said. “There are no permanent friends or permanent enemies any more.”

The much-feared Apollo is now often the first or second financing call for a competitor looking to buy a publicly traded company. Would-be competitors find their best chance to buy or sell assets comes from each other. Collaboration is also the quickest way to grow assets and lucrative management fees, or realise profits ahead of another fundraising.

Since Rowan’s comments, DD has been looking for the perfect example of how these new social cues work.

Hellman & Friedman and Permira’s $10bn takeover of software group Zendesk in June was mostly unremarkable. The company sells “customer service software and sales CRM”.

But it was a culmination of a web of complex relationships built over the past decade between firms that has led to tens of billions of dollars in activity, massive windfalls and the deployment of enormous amounts of capital.

Antoine’s feature sketches it all out in great detail, including new information such as Blackstone’s initial consideration of participating in a consortium that was looking to source an equity cheque totalling more than $10bn.

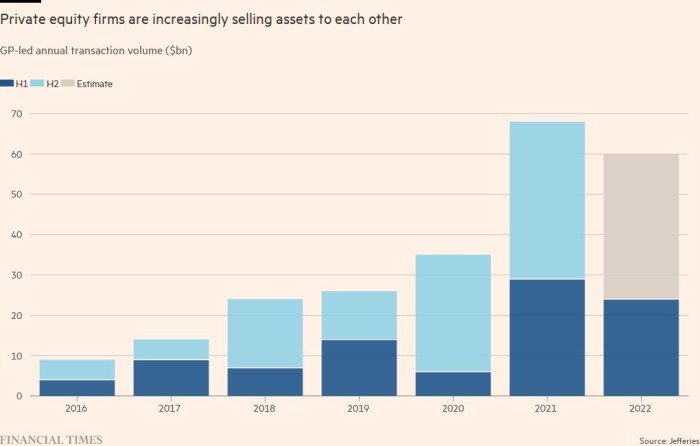

Zendesk is just a small example within a systematic change in finance, which is pulling an ever-greater share of activity to private markets.

With banks mostly sidelined from financing markets due to hung loans, initial public offerings frozen, and corporations hesitant to strike deals, it’s private equity firms that are driving activity.

The industry’s share of M&A has never been higher. A string of deals — each worth about $10bn — have now been struck without the use of banks. Billions more in liquidity has been realised by PE sellers without the need for public markets.

With increased power comes regulation. The biggest M&A story of the year, broken by the DD’s James Fontanella-Khan and the FT’s Stefania Palma, is a more hostile approach taken to private equity deals by regulators such as the US Department of Justice and Federal Trade Commission.

Outside threats like regulation underscore that the new bonds and increased power of private equity firms are yet to be fully tested by challenges such as a deep recession.

The British law firms trying to crack America

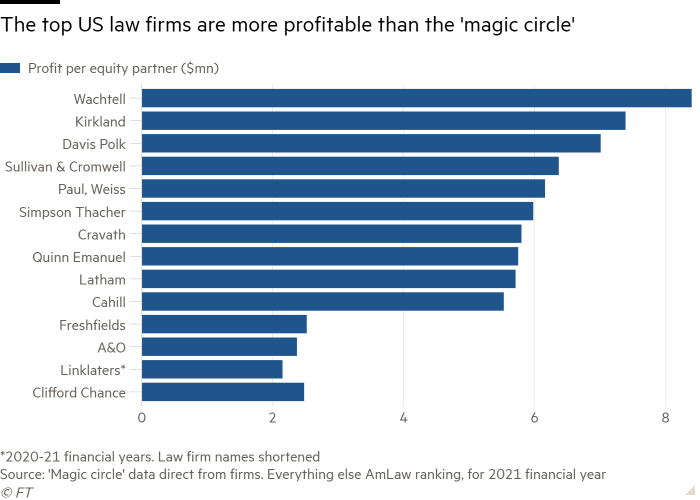

DD has explained over the past few years how US law firms have been raiding British talent as they edge in on UK law firms’ territory. Backed by a stronger dollar, a larger domestic market and a nonstop work ethic, firms like Kirkland & Ellis and Latham & Watkins are becoming features of the UK market, not sideshows.

But what about the UK firms that have tried to go the other way?

London’s “magic circle” (a group of prestigious firms including Clifford Chance, Freshfields Bruckhaus Deringer and Allen & Overy) have mostly failed to make their mark on the world’s biggest and most profitable legal market, despite entering New York as early as the 1970s.

They’re now staging an expensive push to compete with America’s most powerful law firms on their own turf, including by breaking pay ceilings to lure star partners and moving into the west coast to target Silicon Valley clients, the FT’s Kate Beioley reports.

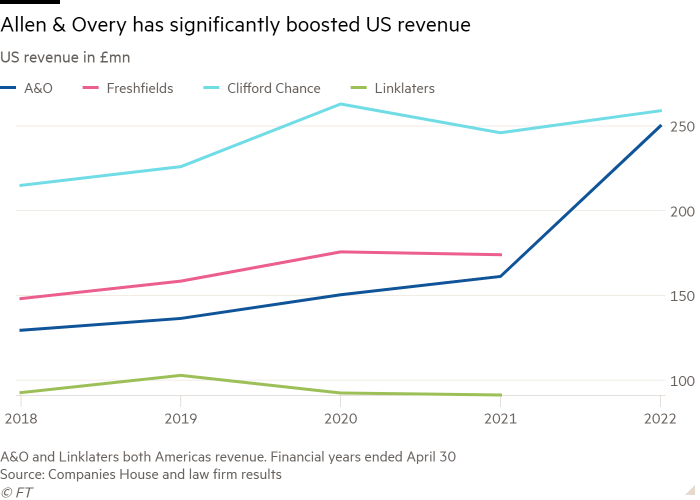

Freshfields hired Cleary Gottlieb Steen & Hamilton deals star Ethan Klingsberg in 2019 for a reputed $10mn a year — far higher than its previous pay rules would allow. Allen & Overy has launched four new offices since the start of 2021, including in Los Angeles and San Francisco, and hired 40 US partners in the past two and a half years.

The potential prize is huge. Although the “magic circle” dominates in Europe, being a truly global heavyweight means cracking the US, too. They’re making headway: Allen & Overy boosted its share of US revenue from 9 to 13 per cent between its 2020-21 and 2021-22 financial years. Freshfields has scored a spot on notable deals for Google and AstraZeneca.

But the path to US domination is fraught with risks. In the US, deep ties to private equity groups mean outfits such as Kirkland are able to hand partners far higher sums than magic circle profits and pay structures allow.

US hopefuls Clifford Chance, Allen & Overy, Freshfields and Linklaters have all made changes to the “lockstep” remuneration model that has for decades dictated partners’ pay based on time served, rather than performance.

In 2020, Allen & Overy extended the range of “equity points” (aka profit entitlements) that could be awarded to star lawyers from its previous range of 20 to 50 equity points. Those points, then worth about £45,000, paired with the firm’s extension of its bonus pool improved its American hiring prospects.

But weakening those rules to splash the cash is no guarantee that star hires will stick around, and offering outsized pay deals in one country risks aggravating partners in another.

Long-term growth will depend on whether the magic circle can boost profit and productivity too, something US law firms are renowned for. In the words of Clifford Chance’s former managing partner Tony Williams: “They’re making good progress, but they’re not yet transforming the market.”

Capital markets lawyers kick their feet up

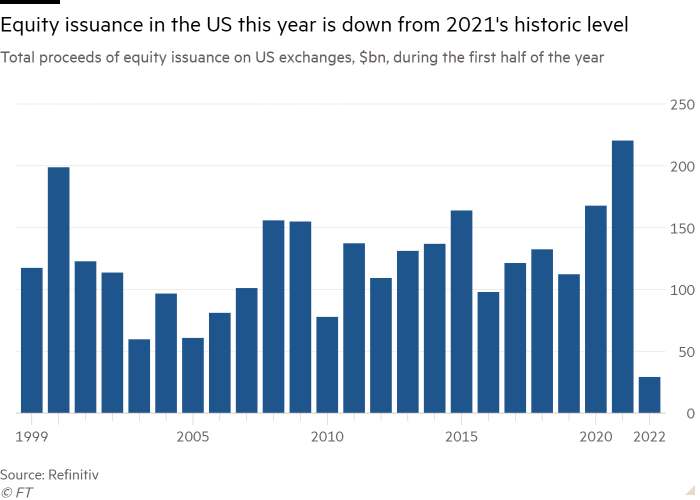

As a near two-year marathon of IPOs, blank-cheque deals and megamergers slows, capital markets lawyers are experiencing an unfamiliar sensation: free time.

Many lawyers are finally finding time to walk down the aisle after putting off wedding plans during the rush of listings in 2020 and 2021, Skadden Arps’s global head of capital markets David Goldschmidt told the FT.

Staff at Paul Weiss, Fried Frank and Skadden, who were told they can work remotely for three or four weeks over August, may be settling into vacation rentals for dips in the pool over the lunch breaks they’ll actually use.

The industry remains hopeful that the markets hangover will eventually subside. Peter Giacchi, who runs Citadel Securities’ floor trading team at The New York Stock Exchange, said more clarity on interest rate rises from the Federal Reserve next month could open a short window for listings before November’s US midterm elections.

Grocery delivery app Instacart and Mobileye, the self-driving car unit of chipmaker Intel, are expected to be first out of the gate.

But the tentative listings do little to help firms’ current cash crunch.

The cheap-money era has left many companies with enough cash to keep them out of the red for now, meaning fewer restructurings and corporate collapses to tide law firms over until the IPO market picks back up.

Not everyone is losing out. The IPO drought could trigger an increase in structured deals such as pre-IPO convertible notes that can be used to raise capital without accepting a lower valuation through a traditional equity raise, said several bankers, setting private markets dealmakers up for a win.

Job moves

-

Freshfields Bruckhaus Deringer has hired private credit lawyer Lisa Stevens as a restructuring partner in London. She joins from Kirkland & Ellis.

-

Law firm Wilson Sonsini Goodrich & Rosati has hired Joseph Slights III, a former vice-chancellor of the Delaware Court of Chancery, as a member of its corporate governance practice in Wilmington, Delaware.

-

White & Case has hired M&A lawyer Di Yu as a partner in London. She joins from law firm Slaughter and May.

Smart reads

Rough seas ahead Carpet king Geoff Wilding managed to turn £20,000 into superyacht money through a controversial derivatives bet with the 120-year-old flooring group he chairs. The company, under attack from short sellers, isn’t sailing as smoothly as its seafaring boss, DD’s Rob Smith writes for Alphaville.

A tale of two markets City bankers, lawyers and professional services workers are receiving inflation-busting pay increases on top of their already ballooning salaries, The Guardian reports, further widening the labour market divide.

Open for business Gujarat International Finance Tec-City, India’s ambitious special economic zone has had a slow start luring international traders from Singapore. Seven years after its inauguration, foreign bankers are finally taking notice, the FT’s Chloe Cornish writes.

News round-up

SoftBank’s record $23bn loss could push Masayoshi Son to reconsider taking group private (FT)

Corporate America fumes over Biden’s tax and climate package (FT)

Netflix aims to become a serious player in the gaming sphere (FT)

Pardon likely for Samsung chief as company faces chip challenge (Nikkei Asia)

ANZ once more bets on an acquisition to spur growth (FT Opinion)

Recommended newsletters for you

[ad_2]

Source link