[ad_1]

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

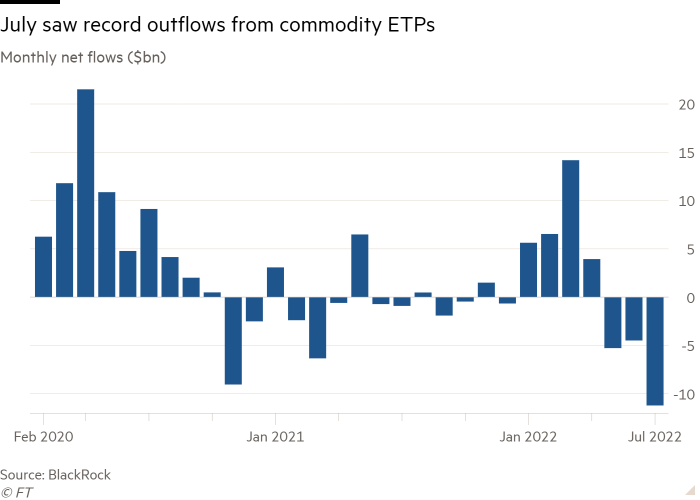

Investors pulled record amounts of money out of commodity exchange traded products (ETPs) in July, but industry observers said the rush for the exits ignored some long-term factors.

About $11.2bn was pulled from commodity ETPs globally, surpassing the combined outflows of $9.7bn recorded in May and June and marking the third month in a row of net outflows, according to data from BlackRock. The previous record was set in April 2013 when investors withdrew $9.5bn.

However, Alessandro Sanos, global director of sales strategy and execution for Refinitiv, a data provider, said large investors were actually buying. “In commodities you always have two views. Someone will be going short and someone will be going long. At the moment, institutional investors are increasing their capital allocation to commodities.”

Sanos, who also serves on the CTA Commodity Trading Advisory board and the Climate Neutral Commodity board, said institutional investors were thinking long-term. “If you really want to go down the path to a low-carbon future, it will take decades to rewire the economy and the entire industrial complex as we know it,” he argued.

Bob Minter, director of exchange traded fund strategy at abrdn, an asset manager, said the outflows were an indication that investors tend to suffer from “recency bias”.

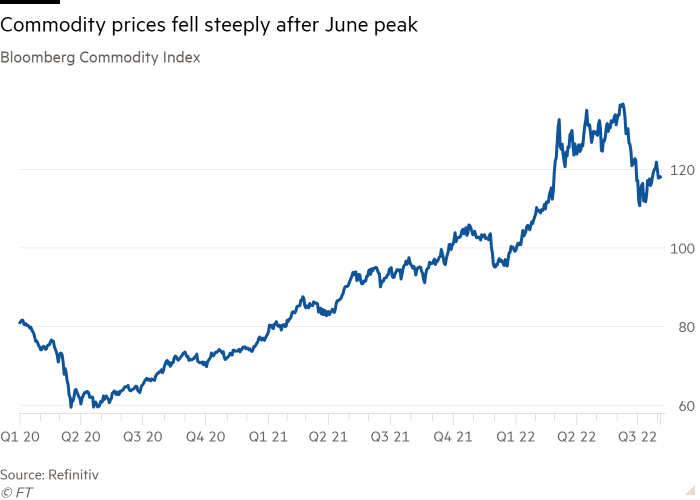

The broad-based Bloomberg Commodity Index fell nearly 20 per cent from its peak on June 9 but has recovered slightly since then.

Like Sanos, Minter said the energy transition was going to be a driver for commodity price increases, because there was likely to be a shortage of the commodities needed to create the transition. It can take decades for a copper mine to move from approval to production, for example.

Commodity ETPs include gold products, and broad-based funds often have a large exposure to the precious metal. Data from RBC Capital Markets indicate that $18bn was withdrawn from ETPs focused on precious metals in July, against only $600mn from base metal vehicles and $2.6bn from energy funds.

“On the bearish side is recession,” Minter conceded. “Our view of the recession is that it is a short-term issue that is affecting sentiment, but after that we should see metal supply is at all-time lows and no one is long.”

Cameron Brandt, director of research at EPFR, a data provider, said complex factors were influencing flows.

“Given supply constraints and the current inflation picture, you’d expect flows to be stronger, even with the concerns about a recessionary hit on the demand side,” Brandt said.

But he pointed out that a settlement in the Ukraine war, for example, could trigger rapid swings in supplies and prices of commodities.

“Throw in the fact energy majors feel they have to shift investment from what they are good at — finding, extracting and delivering fossil fuels — to clean energy products that are new to everybody and operate in markets heavily influenced by government policy, and the forecasting of future value in the commodities and energy sectors becomes even harder,” Brandt said.

However, Minter was firm in his belief that money would eventually flow back into the vehicles.

“If you think that we’re getting a massive multiyear recession, then I’m wrong. But if it’s a run-of-the-mill recession then we’re going to have a problem with supply,” he said.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

[ad_2]

Source link