[ad_1]

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

BlackRock is on the verge of being dethroned as the manager of the world’s largest bond exchange traded fund.

The shake-up comes during a tumultuous year for fixed-income funds, with the Bloomberg US Aggregate Bond Index, followed by several large funds, tumbling 10.5 per cent since December amid surging inflation.

On top of these losses, iShares’ Core US Aggregate Bond ETF (AGG), the dominant force in the sector since at least the mid-2010s, has suffered net outflows of $815mn this year, according to FactSet data.

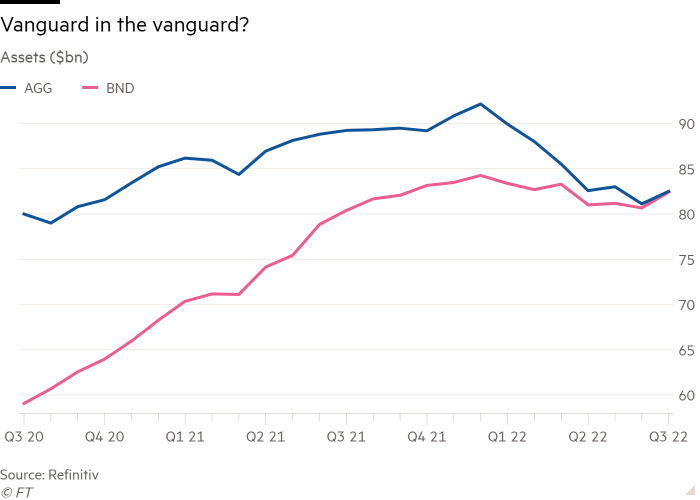

As a result, its total assets have slipped from a peak of $92.2bn at the end of 2021 to $82.5bn.

This is just $100mn ahead of the Vanguard Total Bond Market ETF (BND), which has raked in $6.9bn so far this year, according to FactSet, despite the turmoil, meaning its total assets have dipped just $1.9bn to $82.4bn.

This is a far cry from two years ago, when BND held just $59.1bn and trailed AGG by more than $20bn.

“There’s about to be a new bond ETF king. A shift in leadership is probably going to happen in the next few weeks,” said Todd Rosenbluth, head of research at VettaFi.

US investors have redeemed money from fixed-income mutual funds for past seven months, to the tune of $305bn, according to data from the Investment Company Institute.

While much of this selling will simply be investors looking to cut exposure to the bond market full-stop, some may be fuelled by investors having a rare opportunity to sell mutual funds and rotate to cheaper ETFs without incurring capital gains tax, Rosenbluth thinks. This in turn may have disproportionately helped BND.

“We believe there’s been a trend to tax-loss harvest away from more expensive bond mutual funds as losses have persisted. Vanguard has been a greater beneficiary of this due to its strong brand with mutual fund investors and their advisers,” he said.

Unlike many Vanguard ETFs, BND has not benefited from an ongoing trend among the company’s investors to switch from a mutual fund to its sister ETF without having to pay capital gains tax.

Vanguard’s patented “ETF-as-a-share class structure” has fuelled such flows in many of its funds, but BND is one of just four vehicles for which such conversions are not permitted.

The sister vehicle is, at about $200bn, already the largest bond mutual fund in the world, having seized the crown from Pimco’s Total Return Fund in 2015.

Elisabeth Kashner, director of global fund analytics at FactSet, believed the divergence in flows was largely due to Vanguard and BlackRock tending to target different types of investors.

“They have slightly different client bases,” she said. “Vanguard prioritises protecting long-term buy-and-hold investors over supporting liquidity. BlackRock does the opposite, which attracts tactical traders.”

Her analysis suggests that the importance BlackRock places on ETF liquidity leads it to support funds such as AGG in the capital markets to maintain its status as a trading vehicle.

This includes measures such as allowing authorised participants — the market makers that create and redeem ETF shares — significant flexibility in the baskets of bonds they provide in exchange for new shares and providing APs with transparency around bond pricing sources.

In contrast, Vanguard’s focus on its ETF and mutual fund shareholders means it is less flexible about the baskets of bonds it returns to APs when they want to redeem shares in its ETFs, instead optimising these redemption baskets for tax management and portfolio management needs, Kashner said.

Vanguard’s focus on cost-efficiency and buy-and-hold investors leads it to place higher transaction costs on ETF traders for the benefit of ongoing shareholders, she added.

“It’s not surprising, then,” Kashner said, “that AGG has seen outflows during a period where traders preferred tactical fixed-income tools over broad-based ones”.

“Meanwhile, Vanguard investors keep on keeping on — it’s who they are. BND has largely served as an asset aggregator and can go months without redemptions.

“AGG serves as a trading vehicle with a steady history of creations and redemptions. It will likely see inflows when traders’ sentiments reverse.”

Janel Jackson, global head of ETF capital markets and index and broker relations at Vanguard, said: “We have continued to see strong inflows into our funds and ETFs, whereas they [BlackRock] see two-way flow. I really think this is a testament to investors’ continued trust in Vanguard.”

Jackson said iShares “had more institutional investors” while “Vanguard has more buy-and-hold long-term investors who don’t really react to market events.”

“The team is really excited about the possibility of taking the lead, but market dynamics can always change,” she added.

Carolyn Weinberg, global head of product for iShares and index investments at BlackRock, said it did “not focus on any one particular ticker” and instead lauded “tremendous growth” across its complex of almost 300 fixed-income ETFs.

According to its figures, these ETFs have seen net inflows of $58bn so far this year, out of $128bn taken in by the wider industry. In contrast, fixed-income mutual funds have seen global outflows of $277bn.

“To me that’s the story. It’s really about fixed-income ETF growth. In volatile markets we are seeing money turning to the transparency, liquidity and efficiency of ETFs,” Weinberg said.

“We have a strong view that the industry needs to grow. If that means that other funds may grow, that’s fabulous. We applaud that and support it. We are champions for industry progress.”

Click here to visit the ETF Hub

[ad_2]

Source link