[ad_1]

When you talk to Dallas-based Lacey Shrum, you come to realize she has both a playful, witty sense of humor and a sharp, serious entrepreneurial mindset.

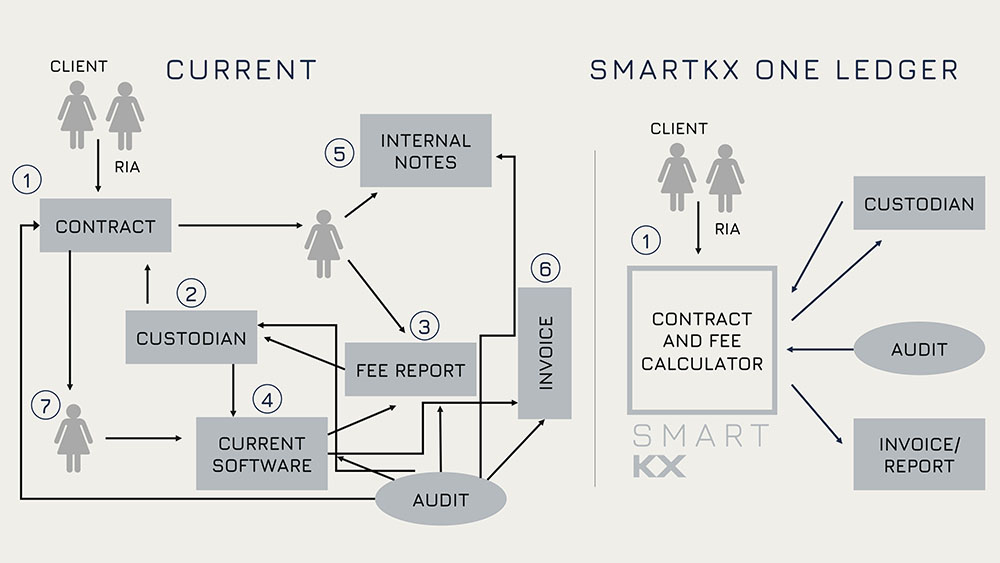

Smart Kx’s platform (Kx is short for contract) is meant to help registered investment advisors ensure that agreed-upon client fees are documented correctly and are calculated exactly as the contract describes, and do it clearly and automatically without manual processes or risk exposure.

The attorney and compliance expert and consultant turned tech entrepreneur recently spoke to us about her cloud-based startup.

WealthManagement.com: How did you get your start?

Lacey Shrum: I grew up in Montana and was headstrong and got it in my head I would go to school in Texas [and attended University of Texas Austin]. I got a job with the private client office of Bernstein Global Wealth Management after. It was a super strange time to start a career in financial services [2008] and I decided to go to law school [received her JD from SMU]. After that I did compliance work for an RIA and I didn’t know it would happen at the time but I came to love technology.

I took a developer class—I don’t code any of my own stuff now—but the class had me looking at it and working on projects and I got a sense [of how things work]. And when Bitcoin kicked off I became fascinated … I thought if I can bring these two things together, if I found the right problem that needs to be solved. That was probably the biggest influence on being a tech founder.

My work at the RIA … all these intermediaries holding things together like daisy chains; and with blockchain we can solve that problem of things breaking down and it can all be on one ledger.

WM: So why start Smart Kx, why another billing application?

LS: Every firm I worked with as a [compliance and operations] consultant failed every SEC audit exam. The SEC would come in and say “Show us for the last two years how you [created their client agreement/contract], which includes how you will bill them and then show us the billing record. The [portfolio management] system may be checking the calculation and that it is correct but not that the fee and the contract match. They were never in agreement. It seemed like a sleeper issue, in that billing is required by firms but the incorrect fee problem is lurking, everyone has it, the SEC says firms are failing, but billing technology is often just an add-on to all other technologies, a side offering. The industry is sleeping on the issue.

WM: What were the reasons behind the failures?

LS: It varied to some extent but boils down to the firm couldn’t find what agreement the client was being billed under or the fee arrangement was not in place. Billing is so manual and the firms often rely on one person, often an admin and no one else knows how to do it but advisors or others in the firm can make exceptions. Many times advisors make tiny adjustments for clients or [one-off] exceptions, sometimes written on a post-it note. And all too often these exceptions do not get recorded in all the right places—and there is no single point of reference.

WM: And this is a big problem in the industry?

LS: Well, last summer, the SEC examined 130 advisors and found most of them failed the question: “Do your fees match your contracts?” So yes, it is a pretty prevalent problem.

WM: How does what you have built alleviate this?

LS: The main way to think about what we are doing is that many advisors have the fee calculator in an Excel spreadsheet or somewhere. That tool is on one hand. The agreement that says that tool has to do this thing is in a completely different place [in a contract document]. One in left hand and the other in the right hand, and the only thing that makes sure this adds up is the human manual process—and it will never always add up.

When you build the fee schedule that is fully disclosed in writing and that piece also actually is the calculator—that is the technology piece we have built. Instead of you having to put together a fee schedule and then draft that for each client, and instead of all these different places where the fee schedule would reside, you have a single source of truth. The fee schedule is here and keeps the books and records and instead of five sources of truth you have one.

WM: And how did things get this way, billing seems like such a fundamental aspect of what advisors do?

LS: It is just one of those things where the grains of sand have piled up over time. The Wall Street Journal just did a big story on fee calculation and how to tell if your advisor is billing you correctly.

It’s not really transparent to figure out. The client usually has no access to the actual calculation. You can try to back into the numbers but you can’t do it because it is not being fully documented. It may not be punched in in detail in the ADV what a firm’s general math practice is.

WM: What has surprised you most as you have worked on this problem?

LS: I think the biggest shocker has been how advisors rely on billing quarterly in advance, how rigid it is for them. When you meet with advisors and ask why they are doing things this way, they respond that billing is hard enough and why would I do it more than four times a year? Most are still doing it because they don’t know how to switch. To switch you would have to change your whole billing system.

WM: So, is that how advisors find you? They are finally trying to address the pain of making a switch?

LS: Usually they have been examined or are up for one. Sometimes they have that one key employee that they are reliant on. The risk is that this person is young and leaving or that they could leave or the person is older and retiring. It is the realization that if something happens to him or her it will be detrimental.

Or some times it is that the him or her is overly stressed—the owner of the firm will say “Excel isn’t that hard”—when a client complains about a bill being off, and the person will be almost in tears.

And I have had to deal with tears; often these people are so invested in their job and take it so seriously and take responsibility for what they are doing. More than once I’ve heard something to the effect of “this is just too much of a burden for me to bear.”

WM: And what does the typical advisory firm you work with look like?

LS: Typically they are tech-focused and want to automate. Usually they are also growing, either by acquisition or organic growth or a couple of advisors combining into one firm and need to get everything in sync.

Size-wise, we have clients up to $500 million to $600 million in AUM. Usually these are ensemble firms with multiple advisors doing multiple things and they are mostly focused on fee-based investment advice.

[ad_2]

Source link