Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

The power struggle unfolding at one of the world’s most secretive sovereign wealth funds

We’ve been looking into issues at Kuwait’s secretive sovereign wealth fund for several months now. It was dragged into the public spotlight last month when Saleh al-Ateeqi, the head of its London office, was abruptly fired.

For decades, the Kuwait Investment Authority kept a low profile as it garnered a reputation as one of the oil-rich Gulf’s most powerful and respected sovereign wealth funds. But behind closed doors, the organisation, which has over $700bn in assets under management, is riven by conflict as modernisers, an entrenched old guard and disaffected employees all jockey for influence, according to more than a dozen current and former staff interviewed by the Financial Times.

The fund has not explained its decision to fire Ateeqi, which capped a four-year period in which the KIA became embroiled in a string of legal battles with former staff, internal investigations and rising tensions between the London office and leadership in Kuwait.

Ateeqi’s backers said his firing was politically motivated, blaming a power struggle between those attempting to reform the fund and veterans at the KIA. “It’s chaos there now, with various factions pitted against one another,” said a fund manager who invests on behalf of the KIA.

Changes started to ripple through the traditionally conservative fund from 2017, according to people familiar with the matter, when Bader al-Saad, who had been the dominant figure at the KIA for over a decade, stepped down as managing director. His successor, Farouk Bastaki, and a freshly appointed board wanted to modernise the fund, the people said.

But Ateeqi’s approach stirred resentment within the KIA and led to an outflow of staff from the London office, according to current and former employees. Some of them said Ateeqi, a Wharton graduate who once worked as an adviser to former UK prime minister Tony Blair, had shaken up a sleepy organisation and supported high performers. But others described a turbulent, dysfunctional work environment rife with bullying.

“The culture of the office has drastically changed from what it was. Within six months of arriving, [Ateeqi] started wielding the axe and it hasn’t been the same place since,” said a person who has worked at the KIO, referring to departures of employees. “The culture is awful.”

Read the full investigation, by my colleagues Adrienne Klasa, Andrew England and Simeon Kerr, here.

‘I think we’re in for a volatile second half’

Last week was a busy week for corporate earnings. The varying fortunes of a handful of asset managers were a good illustration of some of the themes shaping the industry.

Resilient results from the likes of Schroders and Amundi illustrate how larger, diversified groups with exposure to faster-growing areas such as private assets, responsible investing and wealth management will probably fare better and have the firepower to continue to invest.

Meanwhile it was a bleaker picture at Janus Henderson and Jupiter, both of which have recently changed their chief executives and are facing additional company-specific headwinds, exacerbating challenging overall market conditions.

Janus Henderson, the result of a merger between asset managers Janus Capital Group and Henderson Group five years ago, said that its assets under management dropped by 17 per cent in the second quarter to $299.7bn, lower than the $331bn the two combined oversaw following the merger. The group lost market share due to poor fund performance.

Meanwhile Jupiter said on Friday that assets under management dropped by a fifth in the first half of the year, to £48.8bn, driven by poor investment performance and £3.6bn in net outflows. Jupiter said it has paused hiring and non-essential investments until markets improve.

In the short term, asset managers are bracing themselves for a volatile second half after this year’s big fall in markets has left them racing to protect their profitability and pivot towards faster-growing areas.

“The economic outlook is incredibly tough,” said Peter Harrison, chief executive of London-listed Schroders, which oversees £773.4bn in assets under management. “There are inflationary pressures that aren’t going to abate quickly and a war in Ukraine which isn’t going to end for a considerable while.”

Economic headwinds should result in markets remaining difficult, he added: “I think we’re in for a volatile second half.”

Longer term, however, asset managers were more optimistic about the future. “The long-term growth trends of the asset management industry have not changed at all, they remain absolutely intact,” said Valérie Baudson, chief executive of Amundi, Europe’s largest asset manager with €1.93tn in assets under management. She pointed to structural themes including funding the retirement of an ageing population, a growing middle class in Asia and the need to finance the energy transition away from fossil fuels to renewables.

Chart of the week

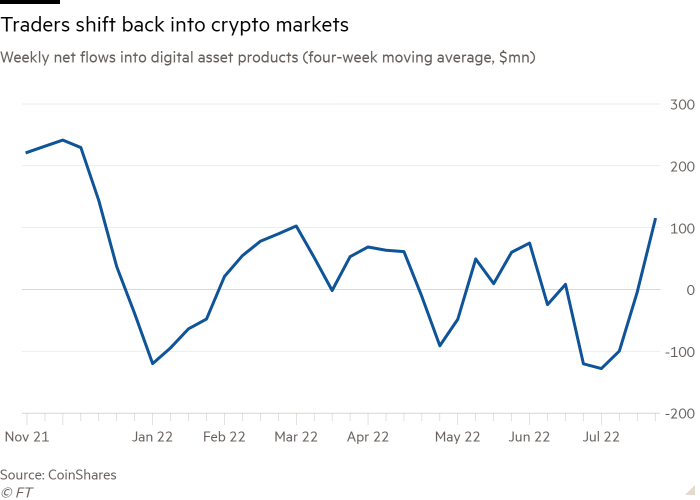

Crypto investors are showing signs of renewed confidence, with digital assets’ market cap rising $280bn in July after a painful sell-off and credit crisis that had scared many players out of the market.

Investment products tracking cryptoassets have pulled in just under $400mn since the start of July, racking up the longest run of sustained weekly net inflows since March, according to data from crypto asset management group Coinshares.

“We’re starting to see some bold investors come in [and] take . . . long positions, and people are not adding to short positions now”, said Coinshares’ head of research James Butterfill.

The early signs of a rebound follow a period of sharp declines for the digital assets industry. Bitcoin, the world’s flagship cryptocurrency, fell by as much as 70 per cent from its all-time high in November, while the size of the digital asset market tipped below $1tn, down from a November high over $3tn.

Want to know more about what’s happening in digital asset markets? Check out the FT’s new Cryptofinance newsletter.

10 unmissable stories this week

Investors were desperate for the slightest sliver of good news from Federal Reserve chair Jay Powell this week, writes markets editor Katie Martin. They heard what they wanted to hear in his comments on the pace of rate rises, and ignored pretty much everything else.

The energy, climate and social spending bill that won critical support in the US Senate last week would raise $14bn by taking aim at “carried interest”, a tax break long cherished by America’s wealthiest private equity and hedge fund managers. Here’s US private capital correspondent Mark Vandevelde on why the reviled tax break proves hard to kill off.

Howard Marks, co-founder and co-chair of Oaktree Capital Management, writes about how investors can stay ahead of the herd. Portfolio shifts should not be based on short-term results as no strategy will make every quarter or year successful.

Over two decades Tiger Global’s punchy bets on the growth of tech firms helped it become one of the world’s most successful hedge fund and private equity firms. This FT Film goes inside how Tiger swung from gains to spectacular losses.

BlackRock’s support for US shareholder proposals on environmental and social issues fell by nearly half in this year’s annual meeting season, as the world’s largest money manager pulled back from ESG.

M&G’s chief investment officer Jack Daniels is retiring from the company after more than two decades. Meagen Burnett, chief operating officer at M&G Investment Management, is also leaving and is set to join Schroders as group deputy chief operating officer.

‘Gumming up the works’: unwanted debt from the buyout boom is stuck at investment banks. Wall Street lenders like Bank of America and Goldman Sachs are stomaching losses on private equity deal-financing offered before a sell-off rattled markets.

The private equity buyout of UK supermarket Morrisons turned into a nightmare for Goldman Sachs: a gripping tale of how the mega-deal turned from dream ticket to a symbol of the excesses of the cheap-money era.

Stablecoin issuer Tether could end up having to pay back an $840mn loan it recovered from Celsius Network as the crypto lender’s bankruptcy tests how insolvency rules apply to digital assets.

Dividends from UK listed companies surged in the second quarter but analysts are worried that mining groups, which are the London market’s biggest payers, have passed the peak of shareholder payouts.

And finally

Previous stories of surrealism have focused on Paris in the 1920s. Surrealism Beyond Borders at Tate Modern reaches across the world over half a century, showing how artists from cities as diverse as Buenos Aires, Cairo, Lisbon, Mexico City, Prague, Seoul and Tokyo have been inspired and united by surrealism.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

Comments are closed, but trackbacks and pingbacks are open.