One scoop to start: the head of the Kuwait Investment Authority’s London office has been fired with immediate effect. Saleh al-Ateeqi’s departure follows a period of turbulence at one of the world’s largest sovereign wealth funds that has been characterised by high staff turnover and legal battles with former employees.

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

Investors cut equity allocations to lowest level since Lehman collapse

There is certainly no shortage of reasons for investors to feel gloomy at the moment: no end in sight to the war in Ukraine, high energy prices, soaring inflation, rising interest rates, lingering Covid . . .

The growing risk that all of this will drag leading economies into recession has spoked large institutional investors, writes Chris Flood in London. As a group, they have chopped their allocations to equities to the lowest level since the collapse of Lehman Brothers in September 2008, according to Bank of America’s widely followed monthly fund manager survey.

Pessimism has reached a “dire level,” says Michael Hartnett, BofA’s chief investment strategist. One indication of this: the survey, of 259 investment managers with combined assets of $722bn, found cash holdings last month had reached a 21-year high. And almost four in five of those polled expected corporate profits to deteriorate than at any point during the coronavirus pandemic or when Lehman collapsed.

Contrarians may see all the gloom and pessimism as a “buy” signal. But the “I’m so bearish that I’m bullish” argument doesn’t wash with Hartnett. He cautions that any bounce for stocks or bonds is unlikely to turn into a sustained rally until it is clear that the Federal Reserve has decided that it has tightened monetary policy sufficiently to control inflation.

Meanwhile Albert Edwards, global strategist at Société Générale, is true to his customarily bearish stance. He thinks that central banks’ role in fuelling rising prices and their misjudgement about the severity of the current increase in inflationary pressures could prevent them from stepping in again to provide support if financial markets continue to weaken. He asks:

“Has the arrogance and hubris of western central bankers now been curtailed? And if so, what will that mean for the future?”

It’s a big question and one that will haunt investors following a prolonged period of central bank largesse. This is unlikely to be repeated while inflation remains a problem in the eyes of policymakers.

Do you think it’s time to buy equities? Email me: harriet.agnew@ft.com

Why young investors aren’t ready to give up on risk

With $1,000 in savings and two US government stimulus checks, Chris Zettler began investing in 2020. First he bought companies he knew, he says, “but then I got bored with it”. He moved on to call options in companies with volatile share prices, riding the price swings, writes Madison Derbyshire in New York. He used a win to buy 100 shares in the meme stock AMC at $30 in May and sold at about $65 in June.

The 35-year-old finance major at the University of Alabama, Birmingham, had a TD Ameritrade account that allowed him to trade on margin and place nearly $8,000 in bets with his original $4,000 of capital. He turned that into $18,000.

Zettler saw his account balance rise to $50,000 before falling to $35,000 when a bet went sideways. He sold $20,000 of shares and paid his college tuition fees: “I got lucky as heck,” Zettler says.

Yet the risk was worth it, he adds. The possibility of making outsized returns outweighed the risk of loss: “If I did it again, would I have done it the responsible way and just sat on that $4,000? Shoot, no . . . You don’t have anything to lose so you might as well shoot your shot.”

Zettler is part of a generation of investors who came of age around the 2008 financial crisis and in its aftermath. Having struggled to accumulate wealth through traditional means over the past decade, many have turned to speculating in the riskier corners of financial markets.

Experts say the growing appetite for speculative assets such as cryptocurrencies, NFTs and “meme stocks” (whose value skyrocketed in early 2021, driven by retail traders and social media hype) is about more than just getting rich quick.

Stagnant wages, rock bottom interest rates, soaring house prices — and now, corrosive inflation — have cut away at the idea that the under-40s can follow the well-trodden path to financial security that their parents took. Younger investors report feeling like the game is rigged and that playing by the old rules is a losing strategy.

Read the full story here on how even amid a meltdown in crypto markets, there are few signs that “generation moonshot” is planning to retreat from the game.

Chart of the week

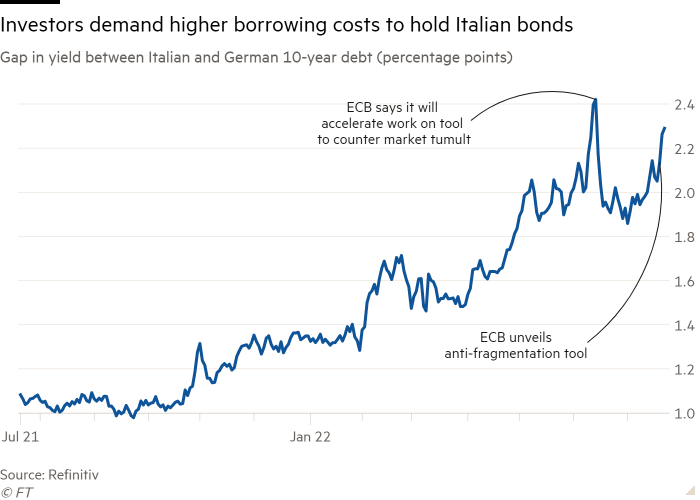

The premium investors demand for holding Italian debt has risen to its highest point since mid-June, as borrowing costs in the heavily indebted economy spiralled after the resignation of prime minister Mario Draghi.

Draghi, the former president of the European Central Bank, resigned on Thursday after rightwing parties in Italy’s parliament withdrew their support for his national unity government, writes Ian Johnston in London.

Meanwhile, the European Central Bank’s decision to raise interest rates by 0.5 percentage points on Thursday — a higher than expected rise and the central bank’s first in more than a decade — has propped up demand for safer government debt, notably 10-year German Bunds.

This has extended the gap in 10-year borrowing costs between Italy and Germany — a key measure of risk — to 2.3 percentage points, an elevated level that some analysts have referred to as within the “danger zone”.

This widening spread reflects concerns over Italy’s political fragility and heavily-indebted economy. It will also drive further concern about fragmentation in the eurozone — when borrowing costs differ between southern and northern European economies — even despite the ECB this week unveiling of a new bond-buying tool, the transmission protection instrument, to prevent debt crises.

Here’s markets editor Katie Martin on how markets are testing the resolve of the ECB.

10 unmissable stories this week

Asset managers have sailed on a rising tide of wealth in recent years. But Lex explains why rising interest rates, stubbornly high inflation and the worst start for stocks in half a century mean fund managers big and small will see a sizeable hit to their earnings this year.

Investors still need to tread warily in emerging markets, writes Mohamed El-Erian, an adviser to Allianz and Gramercy. Historically cheap pricing is not enough given the macro headwinds.

Blackstone Group, the world’s largest alternative asset manager, is warning of a continuing slowdown in economic activity as persistently high inflation forces the Federal Reserve to continue raising interest rates.

Turbulent global markets drove the $440bn California Public Employees’ Retirement System, the largest US public pension plan, to its first annual loss since the global financial crisis in 2009. Meanwhile Toby Nangle, former global head of asset allocation at Columbia Threadneedle Investments, explains the big collateral call facing pension funds in the UK.

The “return of cash” as a strategic asset has delivered a rare bit of good news for investment managers. Rising interest rates are turning the $4.6tn money-market fund sector from a drag on profits into a source of earnings.

Neil Shen’s new $9bn Sequoia China fund will target “politically correct” investments that align with Beijing’s policy agenda, the latest sign of political pressure on investors in China.

“We’ve seen peak mutual fund,” says Peter Harrison, chief executive of Schroders, which unveiled a minority stake in Forteus, an investment manager focused on digital assets. Here’s an op-ed from Harrison on why the crypto crash has important lessons for asset managers.

US quant fund Fort has been hit by losses of between 20 per cent and 40 per cent across its funds this year, in sharp contrast to the strong gains made by other computer-driven hedge funds in 2022’s market turmoil.

Former FT City editor Jonathan Ford reviews ex-Apollo partner Sachin Khajuria’s book Two and Twenty. His verdict? An insider’s account of the controversial investment industry preaches to the converted.

Bill Perkins, one of the hedge fund industry’s most successful energy traders, is expanding into London to tap opportunities from the “crazy” European market in the wake of Russia’s invasion of Ukraine.

And finally

Milton Avery inspired Abstract Expressionists like Mark Rothko and Barnett Newman, and is considered one of North America’s greatest 20th-century colourists. According to The New York Times, “Only Matisse — to whose art he owed much, of course — produced a greater achievement in this respect”. The Royal Academy of Arts is now showing the first comprehensive exhibition of Avery’s work in Europe. It brings together a selection of around 70 paintings from the 1930s — 1960s that are among his most celebrated.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

Comments are closed, but trackbacks and pingbacks are open.