[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Absolute hog of a rally in stocks yesterday, with big techs Google and Amazon leading the way. No particular reason for it, but as discussed below, the market may be set up for a short-term pop. Feeling bullish? Email us: robert.armstrong@ft.com and ethan.wu@ft.com.

Gotta bounce?

Investors dream of catching the moment of capitulation — that brief period when sentiment is so washed out, portfolio positioning is so bearish and so much bad news is baked into prices that a whisper of good news, or even less-bad news, will make risk assets jump. Alas, stock exchanges do not make an announcement on capitulation day, and no set of indicators sends an unambiguous signal that things have become as bad as they can get.

The latest edition of Bank of America’s much-followed institutional investor survey seems to suggest that we are getting a little closer, though. The survey authors note a “dire level of investor pessimism” that suggests stocks and credit could rally.

Here is their chart of the net percentage of investors expecting a strong economy (that is, the per cent expecting a strong economy less the per cent expecting a weaker economy) and the net per cent who are overweight equities:

Growth optimism is at an all-time low and equity positioning is the thinnest since 2008. Unsurprisingly, given recent signals from the bond market, the deep pessimism does not reflect expectations of runaway inflation, but rather that the Federal Reserve will increase short-term rates, halting inflation at a cost to growth:

The survey also shows that a strong majority of investors do not expect long-term rates to rise. Same story: the Fed wins the war, but growth is a casualty. As a result, cash holdings in portfolios are high, risk exposure is low and defensive stocks are in vogue. The asset class investors are most bullish on is cash, and the US dollar in particular.

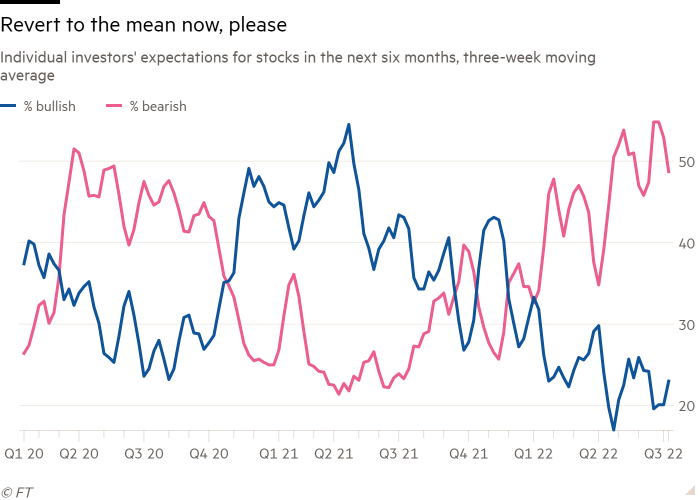

Without being quite as emphatic about it as the BofA team, this does all look a little capitulation-y. On the retail investor side, though, the picture isn’t quite as one-sided. The AAII investor sentiment survey shows that bears are still in control, but bulls have bounced back some in recent weeks:

Maybe, just maybe, the climb up from the bottom has begun (I must admit that chart does give me an animal desire to buy stocks, but I’m suppressing it for now).

Whatever their feelings, though, retail investors are still putting money to work in the stock market. Here, from VandaTrack, is a chart of net retail inflows into US stocks. They are volatile, but are positive and are tracking about where they have been tracking all-year long:

Desire for risk exposure is still there: Cathie Wood’s temple of profitless tech, Ark Innovation fund, has been pulling in cash all year.

Another indication that investors have not quite quit on risk is provided by Marty Fridson of Lehmann Livian Fridson Advisors. He notes that high-yield corporate bond valuations are not particularly beaten down by the standard of past cycles. He points to the distress ratio, or the proportion of bonds that are trading at a yield spread over Treasuries of 1,000 basis points or more. The proportion of bonds trading that wide stood at 10.27 per cent as of last week. Here is what previous cyclical lows have looked like:

We’re just not there yet, in short. And indeed, the point might be generalised to other asset classes. We have had a massive move in interest rates — the 10-year yield is up one and a half percentage points this year. That alone has taken a big bite out of asset valuations. So, for example, much of the terrible returns from high-yield bonds has nothing to do with their risk spreads, but just with the move in Treasuries. The pricing of risk — spread-widening, that is — looks to have some room to run if a recession is on the way. Hence the historically moderate distress ratio. Something similar may be true of equities. Their implied discount rate has risen — but do investors’ expectations for the next few years of cash flows reflect recession yet?

All that said, the fact remains that sentiment is awful, and moments of awful sentiment are generally not bad times to buy. The BofA strategy team (which remains very bearish long-term) outlines the following contrarian trade for the third quarter:

Risk-on if no Lehman [ie, no major market participant blows up], CPI down, Fed pause by Xmas . . . short cash-long stocks, short US$-long eurozone, short defensives-long stocks banks & consumer.

Could such a trade work? Two related factors seem to be particularly important to its success. Oil prices will have to fall (likely because of better than expected developments in the Russia-Ukraine war) or inflation will continue to make trouble. And financial conditions will have to loosen, either because the Fed eases up a bit or for some other reason. On that last point, watch the dollar, the great global tightening agent. It has eased up in the past day or two against the euro:

That’s a cheerful chart!

A short-term bounce wouldn’t be at all surprising here. But the bigger picture still looks pretty grim, and not fully priced in.

One good read

It may not be possible for China to have a banking crisis. The financial system is something of a closed loop and the government are epic can-kickers. But here, Minxin Pei makes the case that it could happen: “If local officials have to hire thugs to attack bank customers trying to get their money back, investors should brace for far worse days ahead for China’s banking sector.”

[ad_2]

Source link