[ad_1]

This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

A “strong love call” from London is how SoftBank founder Masayoshi Son describes the UK’s charm offensive aimed at securing the listing of chip designer Arm. The collapse of Boris Johnson’s government means that courtship has now cooled.

If plans for a London initial public offering come to nothing, it will be a sizeable symbolic blow. Attracting Arm would have demonstrated the UK’s appeal to fast-growing companies. The bigger question the UK should be asking is why Arm is such a rare example of a homegrown tech heavyweight.

The small number of British tech success stories is a longstanding disappointment to policymakers. Countless reports over many decades contrast the UK’s poor record at commercialising breakthroughs with its scientific prowess. This is demonstrated by the high rankings of its universities and its success at winning more science Nobel Prizes than any country other than the US. Failure to capitalise on the first large-scale electronic computer (built to decipher German codes in 1944) is the first of many examples.

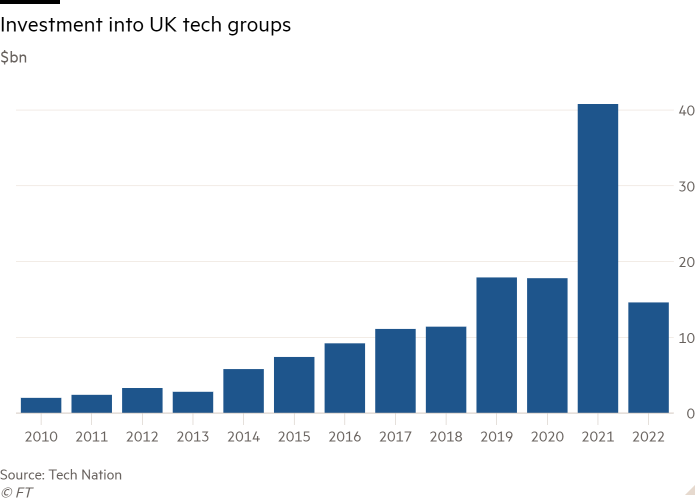

Blame is usually pinned, at least in part, on difficulties faced by start-ups in securing funding. Here, there are grounds for encouragement even if conditions have become tougher in recent months. Funding has poured in, with UK companies attracting $41bn of venture capital last year. US groups such as Bessemer Venture Partners, General Catalyst, Lightspeed Venture Partners and Sequoia Capital have set up offices in the UK. The UK accounts for 30 per cent of Europe’s venture capital funds, more than twice its share of gross domestic product.

Cambridge is the top regional recipient of this cash. Predictable enough, given the term “Cambridge phenomenon” was coined more than four decades ago to describe the city’s tech cluster. Thousands of knowledge-intensive companies have taken root in “Silicon Fen”, although — contrary to common perception — the university is not a major source of spinouts.

Judged by its success at creating sizeable independent companies, however, Silicon Fen is less impressive. David Connell, of the University of Cambridge’s Centre for Business Research, said that when he ran a venture capital fund in the city in the early 2000s there were four profitable Cambridge-based tech companies created in the previous 25 years that employed more than 1,000 people: Arm, Autonomy, CSR and Domino Printing. None remained national champions.

Autonomy was acquired by Hewlett-Packard in 2011, in a deal that led to the biggest civil fraud trial in UK history. In 2014, CSR, the world’s dominant Bluetooth supplier, was bought by US chipmaker Qualcomm for £1.56bn. The following year, British barcode-printer maker Domino Printing was acquired by Japan’s Brother Industries for £1bn. SoftBank bought Arm for £24.3bn a year later.

A few more promising Cambridge-based tech companies have emerged in recent years. They include Aim-listed Abcam, a maker of protein research kits, and cyber security company Darktrace, co-founded — as was Autonomy — by Mike Lynch. Its shares jumped 4 per cent on Tuesday after it lifted its margin guidance for the financial year just ended.

Darktrace’s decision to list on the London market bucked a trend for European companies to list in the US. The share of $1bn-plus European companies opting to list on US exchanges has risen almost 5 times to 26 per cent for those founded after 2000 compared with their predecessors, according to Atomico. US buyers also play a big role in tech acquisitions. In the four years to 2020, North American buyers accounted for 45 per cent of M&A exit value.

Overall, the US accounts for slightly more than half of the exits of $1bn-plus venture capital-backed European companies, through IPOs and acquisitions.

Takeovers can be a good outcome. Many UK innovators struggle to achieve the economies of scale available to companies in larger markets. Yet there are some businesses that could have gone it alone and would have contributed more value to the UK economy had they done so.

Unicorns — venture capital-backed start-ups worth $1bn or more — are hailed as a sign of the UK’s success in nurturing tech businesses. But their high valuations typically reflect investors’ expectations that they will prove attractive to buyers. Companies with important innovations generally have more value to an acquirer than to a long-term financial investor. Takeovers are the norm unless the management retains control.

Venture capital is not an unalloyed blessing. Delaying or minimising the use of venture capital is a hallmark of entrepreneurs who build substantial, independent UK-based businesses, according to Connell. Founders of companies in this category, such as Arm and vacuum cleaner maker Dyson, funded themselves in their early stages through consulting or development contracts for other companies.

“We were profitable at an early stage, so we didn’t have to go out and raise money from the venture capital community who might have been pushing for an early exit,” former Arm chief executive Simon Segars said in 2014. “We were able to call our own shots as a company. That gave us huge freedom to operate.”

Arm’s example is instructive. The lessons it provides might help the UK to keep more of the tech companies it builds.

Enjoy the rest of the week,

Vanessa Houlder

Lex writer

If you would like to receive regular updates whenever we publish Lex, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

[ad_2]

Source link