[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

A string of big rate rises by the Federal Reserve has put pressure on central banks around the world to follow suit to counter soaring inflation and the strong dollar.

A Financial Times analysis found that central banks are now, more than at any other time this century, opting for large rate rises of 50 basis points or more, laying bare the challenges of tackling price pressures and higher US rates.

Rises by the Fed, including its first 75 basis point increase since 1994, and fears over the health of the global economy, have bolstered the US dollar against almost all currencies. As many goods are priced in dollars on international markets, the strong dollar adds to inflationary pressures by raising the cost of imports — creating what analysts have described as a “reverse currency war” between monetary policymakers.

“We’re seeing a rate hike feeding frenzy,” said James Athey, a senior portfolio manager at Abrdn, an investment company. “It’s the reverse of what we saw in the last decade . . . Nowadays the last thing anyone wants is a weak currency.”

Thanks for reading FirstFT Asia. Here is the rest of the day’s news. — Sophia

The cryptocurrency industry is at a critical juncture and the FT is here to guide you through the deepening crisis. Premium subscribers can sign up to a new weekly email written by digital assets correspondent Scott Chipolina and sent every Friday. Sign up here.

Five more stories in the news

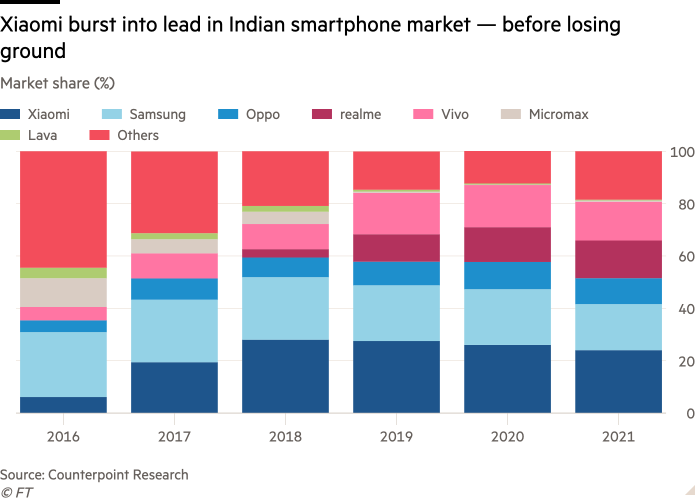

1. India escalates crackdown on Chinese phonemakers A series of legal actions have raised trade tensions between Asia’s two biggest nations. Indian regulators hit Oppo, Vivo and Xiaomi — which together control around 60 per cent of India’s smartphone market — with accusations of tax evasion and unlawful remittances. The move comes as New Delhi seeks to build up its domestic tech sector and reduce dependence on China.

2. China growth hopes rest on troubled local government financing vehicles LGFVs play a vital role in funding infrastructure development across China, and they will need to accelerate construction activity if the country hopes to reach its economic growth target of 5.5 per cent this year. Bigger investors have grown reluctant to back LGFVs, causing them to turn to retail investors directly.

3. Biden’s fist bump belies unease between Saudi Arabia and US Although the US president’s trip to Saudi Arabia included a summit with other Arab leaders, the enduring legacy of his trip may be the images of his fist bump with Crown Prince Mohammed bin Salman, the man who US intelligence concluded authorised the operation that led to the murder of Jamal Khashoggi.

4. Coronavirus sub-variant ‘Centaurus’ spreads across India and parts of Europe The Omicron sub-variant BA.2.75 that is spreading rapidly in India and has been detected in several European countries may be better than other coronavirus strains at overcoming immunity provided by previous infection and vaccines. Nicknamed Centaurus, it appeared to have mutated in a way that could indicate “major immune escape”, the World Health Organization said.

5. BlackRock founder warns of food inflation’s dangerous impact The destruction of arable land during the Ukraine war has dangerous global consequences, BlackRock founder Larry Fink told the Financial Times. Dramatic spikes in oil have distracted investors, but the bigger issue is rising food prices, which will have long-lasting effects.

The day ahead

British Conservatives whittle down list of candidates for prime minister Another vote takes place today to whittle down the pack of Tory MP hopefuls seeking to become the country’s next prime minister. Plus, the UK’s ruling Conservative party will hold a vote of confidence in itself today, which they are expected to win.

Haleon opens on the London Stock Exchange The consumer healthcare companies spin-off from GSK, whose brands will include Sensodyne toothpaste and Advil and Panadol painkillers, is expected to seek a valuation of as much as £45bn. It is scheduled to start trading on the London Stock Exchange today.

Results Bank of America, Charles Schwab, Goldman Sachs, and IBM release their Q2 results today.

Indian presidential election India holds an indirect election of the president by elected members of both houses of parliament, the elected members of the 29 states and the elected members of the Union Territories of Delhi and Puducherry.

What else we’re reading

The sultan, his family and a $15bn dispute over oil in Malaysia The heirs to the Sultanate of Sulu have seized state-owned energy assets in a legal battle 144 years in the making. The sultan’s descendants have been seeking compensation for land that their ancestor leased to a British trading company before the discovery of vast natural resources in Sabah, a Borneo state in Malaysia.

Personal branding makes us cringe, but it works Like networking, a personal brand is something we are told we should be cultivating. But most of us don’t, because we are embarrassed. Viv Groskop suggests breaking down the nebulous term into more tangible components: your professional reputation, and visibility.

Moderna’s Noubar Afeyan on the race to create a Covid vaccine The chair of the US biopharma group discusses his approach to combining science with entrepreneurship, and how Moderna’s pivot to tackle Covid — which required larger and faster clinical trials than any it had done before — transformed it into a $60bn company.

The era of the Great Exasperation arrives for investors Data on employment, inflation, bond yields and more have all shown turbulence this year, and as instability replaces predictable moderation, fund managers struggle to place accurate bets.

Church or cult? Inside the Moonies’ ‘world of delusion’ Tetsuya Yamagami, the man suspected of killing Japan’s former PM Shinzo Abe, is reported to have been seeking revenge against the Unification Church. The connection is the latest controversy for the church, which has built a sprawling multibillion-dollar business empire, with interests ranging from a Brazilian football club to a Californian chinchilla ranch.

Food

When it comes to meat off the barbecue, there’s nothing quite like a succulent, smoky rib. The trick is in learning how to cook it “low and slow.”

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here.

[ad_2]

Source link