[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Good evening

So much for the “roaring Twenties”. We report today on how US retailers have ditched their forecasts of a post-pandemic boom as the economic outlook darkens.

The strong housing market, soaring stock prices and low interest rates of last summer have been replaced by rising rates, a bear market and inflation at a 40-year high, leading to consumer sentiment at its lowest level since first tracked by the University of Michigan in 1952. Markets are increasingly contemplating the possibility of a recession.

The downturn in sentiment masks a “bifurcation” of consumers, with demand for premium products holding up at the same time as budget items, whether it’s pricey charcuterie at one end and Spam at the other, or high-end beauty products and “entry-level” cosmetics.

Squeezed consumer demand is also in evidence at big UK retailers.

Cutbacks in spending on big-ticket items such as technology and furniture at its Argos chain dented quarterly sales at UK supermarket J Sainsbury. There was also evidence of customers trading down on groceries, with rising sales of cheap own-label products and those price-matched with discounter Aldi.

“There’s a lot of pressure in the system at moment, commodity prices are higher, fuel is higher, labour, fertilisers . . . this pressure has been in the system for a while, progressively building up,” said Sainsbury’s chief Simon Roberts.

Rival Tesco, the UK’s biggest supermarket chain, is embroiled in a row with Mars Petcare over the price of catfood in the latest sign of how inflation is hurting relations between retailers and producers. Tesco has also had a spat with Heinz over beans and ketchup, saying that “now more than ever we have a responsibility to ensure customers get the best possible value, and we will not pass on unjustifiable price increases”.

“The pace of reversal in customer tastes in a weakening economy has been head-spinning,” says the FT’s Lex column, analysing the downward path of US homeware chain Bed, Bath and Beyond as it seemingly heads towards bankruptcy, having already disposed of its chief executive after a 25 per cent drop in sales.

The world of ecommerce is also experiencing tough times. TikTok yesterday abandoned plans to expand its live shopping experience in the US and Europe after suffering from technical problems and a lack of traction with consumers. Livestream commerce, where brands and influencers broadcast live and sell products through clickable links, is seen as the future of shopping by social media platforms, and has had considerable success in China.

US online sales have dropped from 17 per cent of total transactions to 14 per cent over the past year, severely denting the ambitions of ecommerce companies such as Shopify, which last year was briefly Canada’s most valuable public company but has since experienced a plunge in its share price of 80 per cent. Similar pressures are affecting UK online retailers: white goods supplier AO World today announced moves to strengthen its finances after its share price halved over the past few months.

Corporate ambitions have also taken a hit from uncertainty in financial markets. Walgreens had to abandon its sale of Boots after failing to receive any adequate bids for the UK pharmacy chain. The company still has some 9,000 stores in the US but owning physical drugstores is not the cash cow it once was, the Lex column noted, as margins on prescription medicines are squeezed by cheaper generics and pressure to cut prices.

Latest news

For up-to-the-minute news updates, visit our live blog

Need to know: the economy

After a turbulent 24 hours at Westminster and a series of ministerial resignations, the UK has a new chancellor of the exchequer: Nadhim Zahawi. The MP for Stratford-upon-Avon has experienced a rapid rise since his arrival in the country with his family as an 11-year old fleeing from Iraq in 1978. Plans to raise corporation tax from 19p to 25p from next April could be in his sights.

Zahawi has a tough task ahead. The Bank of England yesterday said the UK outlook had “deteriorated materially” as it published its semi-annual financial stability update. Prime minister Boris Johnson meanwhile was accused in a parliamentary report of overselling the benefits of post-Brexit trade deals.

Latest for the UK and Europe

The Church of England is selling bonds for the first time despite the current uncertainty in credit markets. The “Cranmer” programme, named after the 15th-century Archbishop of Canterbury, is being pitched as a sustainable investment opportunity.

The Norwegian government intervened to end a strike by oil and gas workers that could have slashed production just as Europe is scrambling to replace Russian output. Gas supplies to the UK were at risk of being cut off by the weekend. European power prices hit the highest sustained level on record.

After months of debate, the European parliament designated gas and nuclear as “sustainable” energy sources. European Commission chief Ursula von der Leyen said the move would hasten the EU transition to clean energy but campaign group Greenpeace described it as “outrageous”.

Global latest

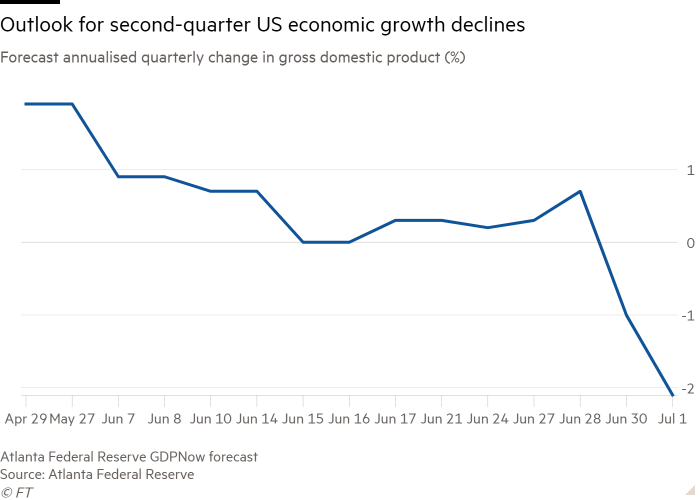

Fears of potential recession gripped markets yesterday as investors fled to haven assets, the euro dropped to its weakest level against the dollar in 20 years and oil prices turned sharply lower on fears that the downturn would hit demand. US president Joe Biden is making a fresh attempt to tackle soaring inflation as dissatisfaction grows among American voters.

China stepped up Covid restrictions after new clusters of infections, raising fears among investors that shutdowns could once again disrupt global supply chains.

Inflation in South Korea hit six per cent in June, the fastest rate since the 1998 Asian financial crisis, upping the pressure on the country’s central bank to raise interest rates by 50 basis points for the first time in its history. Last August, the country became the first big Asian economy to raise interest rates since the start of the pandemic.

Need to know: business

Amazon will share more data with rivals and offer consumers a wider choice of products as part of a deal with EU antitrust authorities. The move comes just ahead of new laws designed to rein in the market power of Big Tech.

The head of European real estate for the Brookfield private equity fund said dealmaking was set to plummet and values fall against the backdrop of rising interest rates and the dimming economic outlook.

The property sector in China meanwhile has taken an even more startling turn: developers said they would accept stocks of garlic — as well as watermelons, wheat and barley — as down payments from farmers on new apartments. The bartering highlights the desperation of a real estate industry hit by the pandemic, central government policies and slowing growth.

Our new Big Read examines parallels between the crypto crash and another seminal moment in tech history: the dotcom boom and bust. Chief economics commentator Martin Wolf is not a fan, arguing cryptocurrencies are objects of speculation rather than stores of value.

The summer of discontent in the UK intensified as Royal Mail managers and train drivers outlined new strike plans. UK holidaymakers can also look forward to further travel chaos as BA cancelled more flights. The airline has also appointed a new operating chief to manage the disruption. Workers at Heathrow are also set to take action.

Strike action was also blamed for fuelling financial problems at Scandinavian Airlines, which has filed for bankruptcy protection. The forecast for European aviation looks gloomy, says the Lex column.

The World of Work

Employees struggling with the cost of living are at higher risk of suffering mental health problems according to new research, with productivity also affected. The link is particularly strong in the US, where healthcare bills are the largest cause of financial hardship.

Swiss bank UBS, which last summer started to allow up to two-thirds of its staff to work from home, is to sublet two floors of its grand London building. It is one of a number of companies offloading “grey space” that is surplus to requirements as a result of changing working practices.

Is hybrid working putting women at a disadvantage for career progression? Listen to the latest edition of our Working It podcast.

Covid cases and vaccinations

Total global cases: 543.4mn

Total doses given: 12.1bn

Get the latest worldwide picture with our vaccine tracker

And finally…

Nostalgia, once considered a medical diagnosis, ain’t what it used to be. Tristram Hunt, director of the Victoria and Albert Museum and former politician, reviews a fascinating new history of how we remember (or misremember) significant events.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link