[ad_1]

UK mortgage rates rose at their fastest pace for a decade in the six months to May according to data from the Bank of England, fuelling expectations that the country’s housing market is cooling after a pandemic-induced boom.

Figures published on Friday showed that the average interest rate on newly drawn mortgages increased by 13 basis points to 1.95 per cent in May. This is 46 basis points above the rate in November, marking the fastest six-month increase since 2012.

The average quoted rate for a two-year fixed-rate mortgage with a 75 per cent loan to value ratio surged to 2.63 per cent in May, from a low of 1.2 per cent eight months earlier — the fastest increase over such a period since records began in 1995.

The rate on existing mortgages also ticked up 2 basis points to 2.07 per cent in May.

The data confirm that mortgage providers are passing on the interest rate rises implemented at the BoE’s last five meetings.

Markets expect the BoE to continue to raise rates from their current 1.25 per cent to 3 per cent by February next year as the central bank confronts the fastest pace of inflation in four decades, suggesting the housing market will soon lose its momentum.

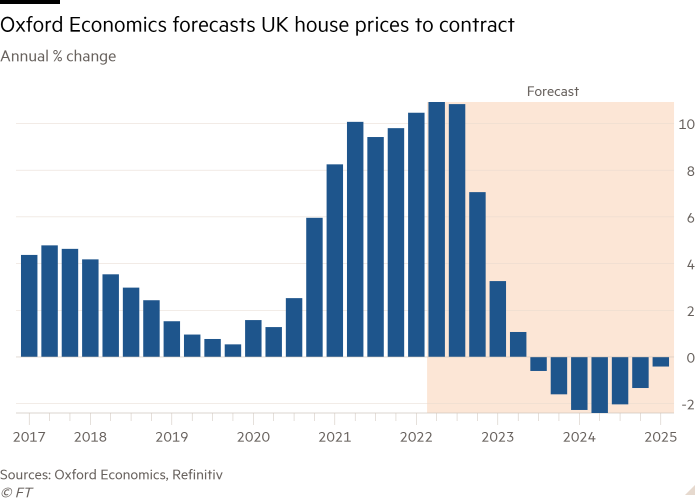

With interest rates increasing and the cost of living soaring, consultancy Oxford Economics predicts that from the end of next year house price growth will drop from its current 10 per cent into negative territory, and will contract through 2024.

Rising mortgage rates coupled with record house prices mean the share of new buyers’ incomes devoted to monthly mortgage repayments “will rocket,” said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Separate data from mortgage provider Nationwide show that payments have already risen relative to pay, hitting 32 per cent in the second quarter of this year, up from 27 per cent in the third quarter of 2020.

Given the intense pressure on households’ disposable incomes from the jump in the cost of essentials, and the current record low level of consumer confidence, “homebuyer numbers surely will dwindle in the second half of this year,” added Tombs.

For now, however, house prices are supported by the UK’s strong labour market, low housing supply and by buyers rushing to secure mortgage deals before rates rise even further.

“With the prospect of higher mortgage rates on the cards, buyers are taking advantage of the last remaining lower rates before the inevitable spike, with those remortgaging desperate to lock into a fixed-term mortgage for as long as possible,” said Tomer Aboody, director of property lender MT Finance.

This is borne out by BoE data, which showed net mortgage borrowing rose to £7.4bn in May, up from £4.2bn in April, and above the £4.3bn 12-month pre-pandemic average to February 2020.

The data also showed that approvals for house purchases ticked up to 66,200 in May from 66,100 in April — only slightly below the pre-pandemic average of 66,700 in the 12 months to February 2020.

“Rates are rising at a rate of knots and people are getting in while they can, and fixing for as long as they can, whether through a house purchase or a remortgage,” said Andrew Montlake, managing director of mortgage broker Coreco.

[ad_2]

Source link