[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. The biggest story in markets at the moment is the fall in Treasury yields. The 10-year has gone from 3.5 per cent to under 3.1 per cent since last Tuesday. The simplest explanation is that recession fears are ascendant, and the market thinks the Federal Reserve will be able to stop tightening (or will be scared into stopping?) at a lower level than previously expected. The futures market is indeed pricing in a lower peak for the fed funds rate. Because the economic data is equivocal, it is hard to know whether this is a jittery overreaction, set for a reversal, or whether we might have seen the peak in long yields. We tend to favour the former, without much confidence.

Send us your thoughts: robert.armstrong@ft.com and ethan.wu@ft.com

What, if anything, comes after 60/40?

A year ago, with core inflation (excluding food and energy) at a mere 4 per cent, we showed you this chart from UBS, comparing rolling 36-month core inflation against 36-month stock/bond correlations:

When core inflation rises above 2.5 per cent and stays there, stock and bond returns correlate. When that happens, the core premise of the 60/40 portfolio — when your stocks falter, your bonds will rise — looks shaky. And so it has turned out. With 36-month core inflation now at 3.1 per cent, the 60/40 portfolio has done historically badly.

This is old news. But it comes at an interesting moment. There is a plausible case that inflation will eventually moderate — and another plausible case that inflation is now structurally higher. If the latter proves true, the 60/40 portfolio can no longer be the default — what you might call the “dumb portfolio” for people who hate thinking about investing, but want to get it broadly right (we mean “dumb” as a compliment here).

If we have entered an era of higher inflation, what comes after 60/40? It’s a huge question.

The standard suggestion is to add in “alts”: something besides stocks, bonds or cash, with performance uncorrelated to one or the other. Commodities are an obvious candidate. They look good as a diversifier, jumping during times of stress, but are less appealing for capital appreciation. Even after the recent commodity surge, the broad trend since the 1970s has been sideways:

There’s also real estate, which we can separate into home ownership and real estate investment trusts. Outside of severe recessions, house prices have only gone up, though at a snail’s pace compared to stocks:

The caveat here is that this is a price comparison. It ignores the rental yield from real estate, if you don’t live in it. Then again, you never call the plumber to fix your stock portfolio, either.

Reits — or rather some Reits — can act as an inflation hedge. Leases that reset annually, as is common for multifamily units, let rents rise with prices. Mark Hackett at Nationwide’s Investment Management Group tells us he likes Reits’ combination of reasonably low volatility and yield generation. One difficulty, though, lies in how diverse Reits are. You have to look at the underlying assets and structure.

Then there is private markets. Even if these were easy for average investors to access — they are not, except indirectly through large pension funds — their procyclicality and high fees cut against their inclusion in the dumb portfolio. Returns from private capital were strong 10 years ago. Now they are crashing to earth. And, as we have argued here several times, just because they are not marked to market does not mean they are truly uncorrelated to public markets.

There are more exotic alts like art or infrastructure available. Write in if you think we’ve missed an important option. It is a high bar to be both accessible to a wide investor base and offer exposure not already captured by stocks and bonds. There isn’t some “well, duh” alternative waiting in the wings. (Wu & Armstrong)

Housing: worse

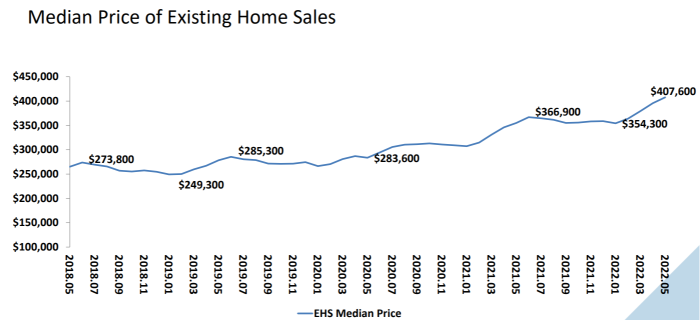

Housing remains the one big area of the economy that is not sending mixed signals. It just looks bad. Existing home sales fell 8.6 per cent in May, a new low for this cycle. Courtesy of the National Association of Realtors:

How bad can things be, you may ask, when prices are rising?

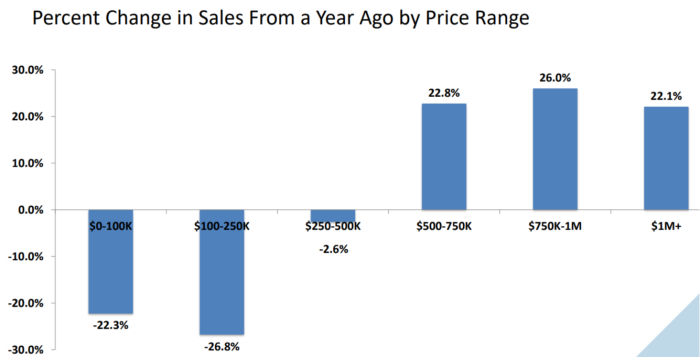

Here is the distribution of unit sales growth by price level:

When lots of expensive homes sell and the bottom falls straight out of the cheap end of the market, median prices will go up. But that is not a picture of a hot market. On the contrary. And remember 30-year fixed mortgage rates are now about 5.8 per cent on average — about half a percentage point higher than in May. And sales data actually lags the market, as May sales will have been agreed weeks or months ago.

Until recently the consensus among pundits (as far as I could make out) was that while home sales volumes were likely to fall, that would be accompanied by slower growth in prices, but not an outright decline. This consensus is eroding. This for example is Matthew Pointon of Capital Economics, writing this week:

At 6 per cent [mortgage rates] the median income household looking to buy the median-priced home today will have to put close to 25 per cent of their income toward mortgage payments, higher than the previous record of 24 per cent seen in the mid-2000s . . . the first-time buyer share [or purchases] has recently dropped to a 13-year low.

Looking ahead, we have revised up our forecast for the 10-year yield, which we now expect will peak earlier at just over 4 per cent in Q1 2023. That means mortgage rates are set to rise to 6.5 per cent . . . we expect lower home demand to lead to a relatively small fall in house prices, with annual growth dropping to 5 per cent year-over-year by mid-2023.

The big homebuilder Lennar reported strong earnings this week, but executive chair Stuart Miller said that:

The weight of a rapid doubling of interest rates over six months, together with accelerated price appreciation, began to drive buyers in many markets to pause and reconsider. We began to see these effects after quarter-end. The Fed’s stated determination to curtail inflation through interest rate increases and quantitative tightening have begun to have the desired effect of slowing sales in some markets and stalling price increases across the country.

Rick Palacios of John Burns Real Estate Consulting pointed out to me that pending sales are “collapsing” in many of the markets he monitors, at the same time as listings rise, leading to a jump in available supply. This is a precursor of price declines. This is visible in the national data. Here is the year-over-year change in the number of house listings nationwide, from Realtor.com:

Palacios also expects national-level declines, with some markets falling 10-15 per cent. He singles out northern California and Seattle as particularly vulnerable markets. New built home prices will probably fall first, as homebuilders are more willing to “meet the market” than owners selling their homes.

For those of us who are not buying or selling homes, the crucial question remains how much a fall in house prices will affect the economy. The crucial channel is wealth effects. We wrote recently that the standard estimate of wealth effects from losses on securities is that for every dollar lost in the market, consumers spend 3-5 cents less. Is it different for houses, which we also live in? (Armstrong)

Just wrong

I compared the distribution yield on the HYG high-yield bond ETF. Then I tried to salvage the logic of this specious comparison. Without going into the details of what I have learned about pull-to-par, I now concede my error. Thanks to several readers for putting me on the true path of bond maths.

One good read

Courage and conscience in Hong Kong.

[ad_2]

Source link