[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

How well did you keep up with the news this week? Take our quiz.

Stocks sold off sharply in the US on Thursday after Switzerland and the UK joined a global rush to raise interest rates, stoking concerns that central banks’ attempts to tame high inflation could push economies across the globe into a downturn.

The S&P 500 stock index slid 3.2 per cent for the day, a move that took the broad gauge to a 6 per cent fall this week. The declines have battered valuations in recent days as pessimism about the global economic outlook has spread, with many investors warning more restrictive monetary policies from central banks could stamp out the recovery.

In a sign of the darkening outlook, almost every stock in the S&P 500 declined on Thursday, with losses pushing the share prices of hundreds of companies down to new 52-week lows. The technology-heavy Nasdaq Composite index tumbled 4.1 per cent.

The S&P had closed the previous session 1.5 per cent higher after the Federal Reserve raised its main interest rate by a historic 0.75 percentage points, tempered by comments from chair Jay Powell saying he expected rises of this magnitude to be relatively uncommon.

More on global inflation:

-

Analysis: The Fed’s full-tilt inflation fight makes a “softish” landing harder to achieve, writes Colby Smith.

-

News in depth: While the past week has revived memories of the eurozone debt crisis, there are big differences between then and now.

-

Opinion: In the fight against inflation, Fed chair Jay Powell is not just waging a battle in the markets, but also with consumers’ minds, writes Gillian Tett.

-

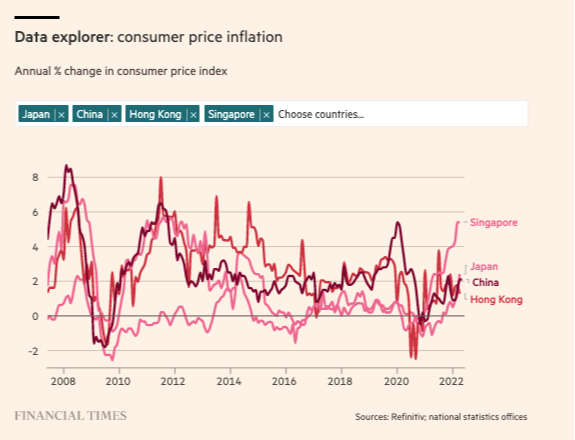

Tracker: See how your country compares on rising prices with our global inflation tracker.

Thanks for reading FirstFT Asia and here is the rest of the day’s news — Emily

Five more stories in the news

1. European leaders back Ukraine’s bid for EU membership The leaders of France, Germany, Italy and Romania pledged on Thursday to back Ukraine’s bid to apply for EU membership after travelling to Kyiv and meeting president Volodymyr Zelenskyy to show support in the face of Russia’s invasion. For more on the latest news on how the war is impacting business and the economy, sign up to our Disrupted Times newsletter.

2. Trump was told overturning election was illegal Donald Trump pressured his vice-president Mike Pence to overturn the 2020 election despite having been told repeatedly that doing so would be illegal, a Congressional committee has heard. Members of the bipartisan panel investigating the attack on the US Congress were told that Pence made clear his opposition to the former president’s plan, including in a heated telephone call on the morning of January 6.

3. Musk tells Twitter staffers his plan for company’s future Elon Musk warned Twitter staffers its business needed to “get healthy” and undergo a “rationalisation of headcount” as he addressed the social media platform’s employees directly for the first time since launching his $44bn takeover bid.

4. China to set up centralised iron ore buyer China is moving to consolidate the country’s iron ore imports through a new centrally controlled group by the end of this year, as Xi Jinping’s administration seeks to increase Beijing’s pricing power over the industry — and particularly to counter Australia’s dominance.

5. Reliance targets diesel exports using cheap Russian crude Indian refiners including Mukesh Ambani’s Reliance Industries are using cheap Russian crude to try to boost diesel exports, including to destinations such as the EU with sanctions on Russian oil.

-

More energy news: The US is urging European capitals to seek ways of easing the impact of their ban on insuring Russian oil cargoes, arguing the measure could cause global crude prices to soar.

The days ahead

Japan interest rate decision The Bank of Japan Monetary Policy Committee will announce its interest rate decision today. Governor Haruhiko Kuroda is expected to remain one of the lone doves amid an increasingly hawkish outlook globally. (Bloomberg)

Solomon Islands PM hosts Australian foreign minister Prime Minister Manasseh Sogavare will meet Australia’s Penny Wong to discuss concerns over the nation’s security agreement with China. (Reuters)

European officials expected to issue recommendation on Ukraine The European Commission is expected to recommend today that Ukraine should be granted EU candidate status, a first step towards membership.

Sunday elections Colombia will hold its second round of voting in its presidential election on Sunday. In France, which is set to hold its second round of voting in its parliamentary election, the contest has been dominated by three individuals. What does this mean for the country’s stability?

What else we’re reading

‘Let it rot’: China’s tech workers struggle to find jobs Over the past year, China’s once overworked but well-compensated tech workers have seen an erosion of office perks, job cuts, headcount freezes and stalling or falling pay. Trouble at smaller, unprofitable companies gradually expanded to highly profitable groups including social media group Tencent and ecommerce leader Alibaba.

Sales slow down in Sydney’s suburbia-on-sea Harder bargains are becoming more common in Sydney as home prices fall. The median sale price for a home dropped 1.5 per cent between January and May, after increasing 25.5 per cent in the previous 12 months, according to the index of CoreLogic, a property data provider. Rising interest rates are an important element of Sydney’s slowdown.

-

Related reads: New Zealand’s housing price boom cools as rate rises bite, while US home mortgage rates jumped by the most since 1987. Sign up here to receive our House & Home newsletter.

Why we trust fraudsters From Enron to Wirecard, elaborate scams can remain undetected long after the warning signs appear. Left behind in the ashes, however, is a much larger question that haunts all victims of such financial fraud: how on earth did they get away with it for so long?

Chinese courts flex intellectual property muscle across borders Since 2020, companies in the world’s second-biggest economy have been outpacing their American rivals in the number of new patents they secure each year. There are also signs that Chinese companies are turning the tables on foreign counterparts in aggressive IP litigation — a move that appears to have been backed by the country’s courts.

Inside ‘gentle parenting’ Today’s parents largely believe that physical punishment such as spanking does little to change a child’s bad behaviour and should be avoided, in part because toddlers struggle to control their impulses as their prefrontal cortexes are not fully developed. Here’s why the movement is stressing some parents out.

Thanks to readers who took our poll yesterday. Forty-six per cent of respondents said President Joe Biden was right to visit Saudi Arabia.

Travel

Japan’s long-awaited lifting of the ban on foreign tourists coincides with the launch of striking new works — and a new hotel — on Naoshima Island.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here.

[ad_2]

Source link