[ad_1]

Middesk, a platform designed to automate business verification and underwriting decisions, today announced that it raised $57 million in a Series B round co-led by Insight Partners and Canapi Ventures with participation from Sequoia, Accel, and Gaingels. Co-founder and CEO Kyle Mack said that the new capital will enable Middesk to triple its headcount to 120 employees by 2023 and further develop products in the identity management space.

“When people hear ‘identity,’ they think of ‘identity verification,’ but identity means something different based on who is asking or interested,” Mack told TechCrunch in an email interview. “For a bank, it means simplifying the process of opening commercial bank accounts. For a lender, it means accelerating the process for businesses to access capital. For the government, it means ensuring businesses are registered and paying their taxes appropriately.”

Mack co-launched Middesk in 2019 with Kurt Ruppel to address what he describes as the “downstream effects and resulting challenges of onboarding new business customers.” Mack previously worked at Checkr, where he managed and built the solution consulting team. Ruppel was a senior software engineer at Zendesk before joining Checkr, where he worked with Mack as an engineering manager.

“When entrepreneurs start a business, they’ll need a bank account and credit card within weeks of forming the company. Within months, they’ll need access to working capital and insurance, payments, and payroll providers to grow the business. We take for granted how easy it is for a person to access a financial product made possible through strong infrastructure products. Businesses don’t have this,” Mack said.

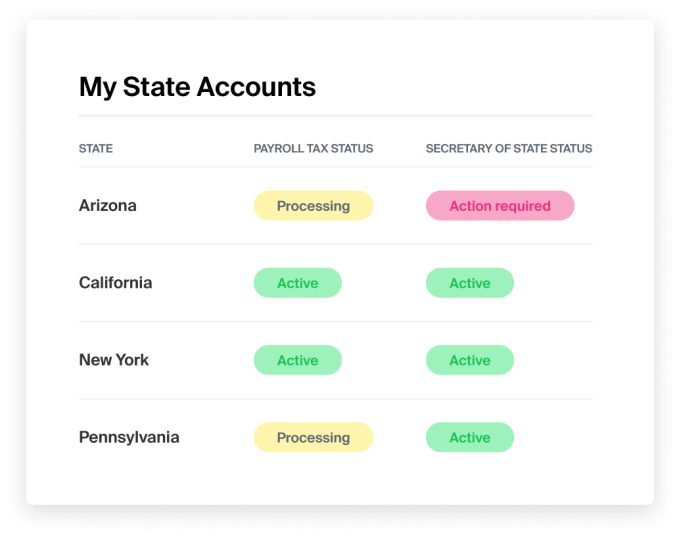

Companies can see their compliance status from Middesk’s dashboard.

Middesk’s “identity-as-a-service” APIs can be used by banks, insurers, credit card companies, lenders, payment firms, payroll companies, and other service providers to automate onboarding in regulated industries, specifically for business customers. Middesk provides data on businesses in the U.S. and notifies service providers of changes to its customer base, enabling them to make decisions during and after onboarding.

According to Mack, Middesk allows service providers to form a picture of their customers and offer products they might need to establish, operate, and maintain their businesses. It also helps companies manage their business by setting up payroll tax accounts, registering with the U.S. Secretary of State, and managing government communications.

“Middesk applies machine learning techniques to … identify and enrich businesses across a broad spectrum,” Mack explained. “With its technology and infrastructure, we have the ability to provide a lens into a wide range of business — across a long tail — and the opportunity to expand both the breadth and depth of the information we supply. For example, our customers require industry classification as a critical input in their business onboarding and loan underwriting process today. Banks need to identify businesses operating in high-risk and restricted industries for compliance purposes, and lenders use industry classification as an input to disqualify loan applicants from specific industries early on in the funnel, calculate a risk score for loan decisions, and understand the extent to which they have diversified their portfolio.”

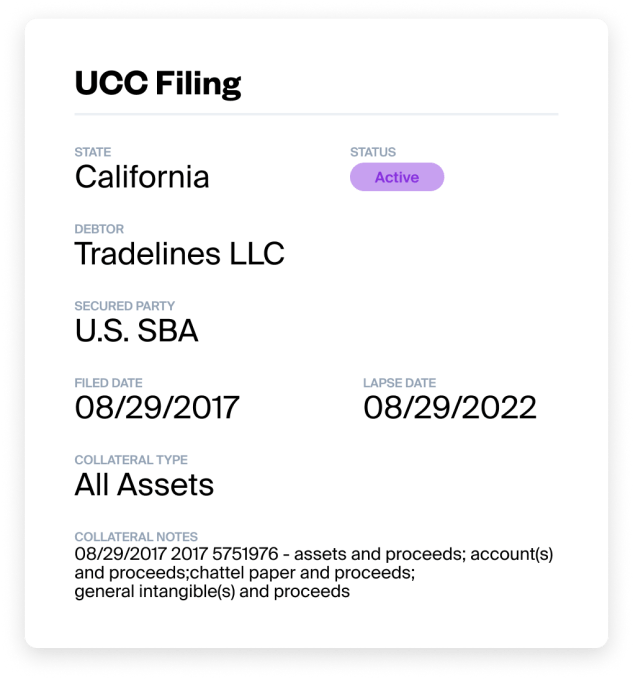

Middesk recently launched a solution for underwriters that provides the ability to search and file liens (i.e., legal claims against property). Beyond this, the platform added account transfers for its payroll tax registration product, allowing customers to transfer their existing state registrations over to Middesk to manage for multi-state compliance.

“Middesk means something different to each decision-maker,” Mack said. “For the product manager, the key pain point is the number of manual follow-ups required from internal teams or the customer. Middesk can help by improving funnel conversion, delivering a stellar customer experience, and managing compliance and risk requirements … For the operations leader, the key pain point is that supporting growth and reducing risk are often in contention with one another. Middesk can help by meeting internal service-level agreements, managing the capacity of the team, and ensuring consistency and accuracy of the output.”

A liens from Middesk.

Middesk, which has raised a total of $77 million in venture capital, competes with business data providers such as Dun, Bradstreet, and LexisNexis. But the company has managed to grow its customer base to 350 brands to date, including heavy hitters like Plaid, Affirm, Bluevine, Pipe, and Novo.

“Without access to reliable data, newly formed and small businesses deal with unnecessary friction to access products that are critical to growing their business. And with the recent market downturn, we expect businesses to be even more risk-averse. Unfortunately, this results in a disproportionate amount of new and small businesses being unable to access critical products and services like bank accounts, working capital, and corporate credit when they need it,” Mack said. “Middesk’s goal is to build the infrastructure to enable instant identity-related decisions between all businesses and counterparties.”

[ad_2]

Source link