[ad_1]

In 2020 Cambridge university announced that it would strip its £3.5bn endowment fund of all fossil fuel investments by 2030. Shedding its near-£100mn of exposure to the energy sector was necessary to align its investment strategy with climate science which showed the need to cut carbon emissions to net zero to avoid catastrophe, it explained. By divesting, said vice-chancellor Stephen Toope, Cambridge was “responding comprehensively to a pressing environmental and moral need for action”.

Activists had campaigned for years for Cambridge to make such a move, even disrupting the Oxford-Cambridge boat race. Only two years previously, however, the university had ruled out divesting from oil and gas stocks.

The university made clear how difficult the decision to divest fossil fuel assets had been when it disclosed its decision in 2020. A lengthy accompanying report which explored the arguments noted that there was agreement over the urgent need to cut emissions. It added, however, that there had been “intense debate” over whether full divestment was the best way or if Cambridge should instead try to change companies’ behaviour as an engaged shareholder.

The university is not alone in puzzling over which strategy will prove more effective. It is a question asked by numerous asset owners, investment managers, climate activists and others. Both strategies come with trade-offs and evidence of their effects is elusive.

Those that favour divestment at scale argue that this creates the moral opprobrium needed to prompt policymakers to introduce tougher regulation. The divestment movement also unites people around action on climate change, says Richard Brooks, climate finance director at Stand.earth, a Canadian campaign group.

“It allows people to make a connection with the target — being oil and gas and coal companies — and that was a way to bring people into working on climate change issues,” he says. “What we’ve seen is an explosion of climate advocacy that came out of the fossil fuel divestment movement.”

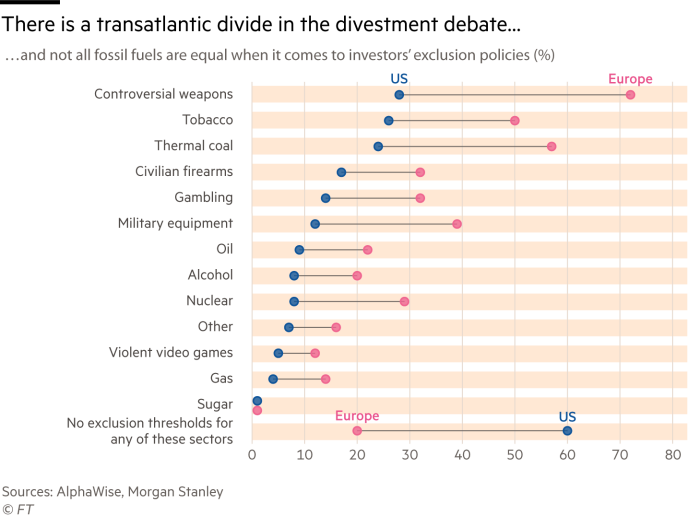

Divestment campaigns are not new. Supporters point to the effect of the boycott by western companies of apartheid-era South Africa, as well as the bans many large investors have on holding stocks in tobacco, guns or gambling. Some, though, question whether shunning a company will change behaviour.

“Divestment, to date, probably has reduced about zero tonnes of emissions,” Bill Gates, the philanthropist, told the Financial Times in 2019. Activists had not deprived those companies of capital, he said. He argued that it would be better to invest in technologies to slow emissions or to help people adapt to the effects of climate change.

Other critics also point out that investors who sell shares in fossil fuel companies lose the ability to influence those groups.

“When you choose exit, you don’t have any voice in the future,” says Luigi Zingales, an entrepreneurship and finance professor at the University of Chicago Booth School of Business who is co-author of Exit vs Voice, a study published in 2020.

Anne Simpson agrees. “We must keep our eyes on the prize, which is the real economy,” says the global head of sustainability at Franklin Templeton, the asset manager. “The question is are you trying to transform the economy or are you trying to come up smelling of roses in your own portfolio?”

In the Exit vs Voice study, Zingales and co-authors Eleonora Broccardo and Oliver Hart argue that exit is less effective than voice in influencing a company since divesting may depress the stock’s price. “That very action creates an incentive for people who don’t care [about social or environmental concerns] to buy on pure return,” says Zingales.

Moral Money Forum

When we asked FT Moral Money readers which strategy they thought was the most effective, one put the same point more bluntly: Divestment “merely moves the problem elsewhere”. Most readers, in fact, said engagement was the best approach. “Engagement all the way,” wrote one, while another said engagement was “the only way to deal with this”.

Some, though, saw value in divestment. “Divestment (or the threat of it) has a key part to play in achieving the Paris goals,” one responded. Another wrote: “Divestment has the potential to remove the social licence to operate from industries or sectors which are at risk of becoming socially unacceptable.”

Some want to move away from a dualistic debate. More can be achieved, they say, by looking at which strategy to use and when, by combining approaches and tailoring strategies to different asset classes, sectors and types of investments.

ShareAction, which campaigns for responsible investment, is among those to call for a nuanced approach. “It has been a hot debate for about a decade but it has not advanced very far,” says Catherine Howarth, its chief executive. “There are still endless conferences where the panel discussion is ‘Engagement versus divestment — which works?’ It is such a false dichotomy.”

Making an exit

On March 1, a group of campaigners met at an online party to mark a milestone. Supporters of the fossil fuel divestment movement celebrated the fact that more than 1,500 institutions with assets that total $40tn had committed to divestment of fossil fuel stocks. This was a sharp rise from $15tn a year earlier.

At present, the movement is focused on the producers of oil, coal and gas, rather than on the industries that use them. “The fossil fuel sector is the largest source of greenhouse gas emissions and that is the sector we need to transform,” says Brooks of Stand.earth.

What made the March milestone possible, said US climate campaigner Bill McKibben at the time of the announcement, was that “hundreds of thousands of people around the world have joined in, finding a way to make a real difference in the climate fight on their campus, in their church or through their pension fund”.

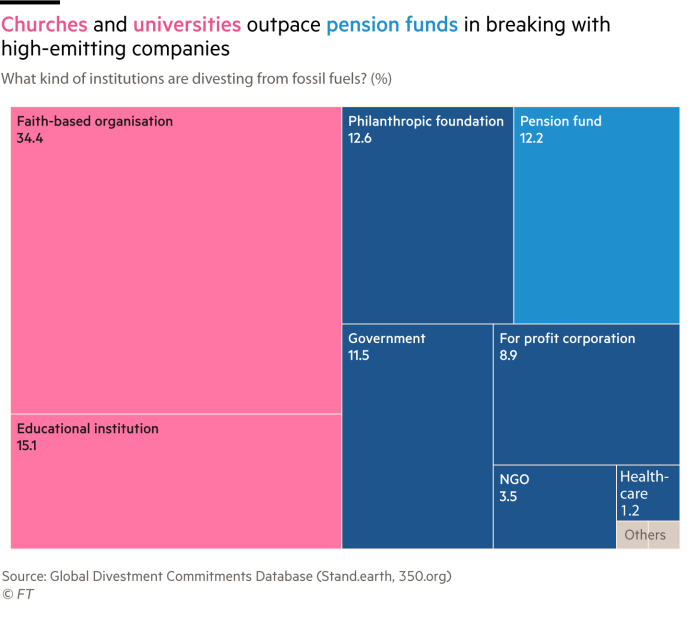

His comment is an indication of the types of institutions that have embraced divestment. By far the largest group is faith-based organisations, which represent more than 35 per cent of the total, according to a database of divestment commitments maintained by Stand.earth in partnership with 350.org. Next are educational institutions (15 per cent), philanthropic foundations (12.5 per cent) and pension funds (12 per cent).

Among notable names that have announced full or partial divestment plans are two funds that manage the wealth of the descendants of John D Rockefeller — the Standard Oil baron — Harvard and Oxford universities, the Church of England, the $16bn Ford Foundation and Norway’s $1tn-plus sovereign wealth fund.

Environmental or moral concerns aside, some investors have found sound economic reasons to exit fossil fuel. The risks of remaining invested include being stuck with stranded assets — those that are of low or no value or are hard to sell.

Scottish Widows, the UK pension fund, cited this concern in March when it announced a strategy of environmental, social and governance divestment. This includes not investing in any company that derives more than 10 per cent of its revenue from tobacco or 5 per cent from thermal coal and tar sands. Pressure from investors, regulators and consumers could, it said, turn such operations into stranded assets.

When it comes to energy and natural resources, Oxford university’s stranded assets programme points out that stocks in these sectors are exposed to risks ranging from climate change to potential litigation, as well as the introduction of carbon pricing and greater competition as clean technologies become cheaper.

It is increasingly possible to design investment strategies that address these risks. For example East Sussex Pension Fund, with Osmosis Investment Management as its adviser, has addressed climate risks in its passive holdings with a portfolio that excludes fossil fuels.

Evidence of the pain that divestment can cause investors is mixed. Long-term declines in the oil, gas and coal sectors have meant that divestment has not always dented returns. In its most recent report, the Divest Invest network compared the S&P 500 index with and without the inclusion of fossil fuel companies. Between 2012 and 2021, it found, the latter outperformed the former.

Increases in energy prices after Russia’s invasion of Ukraine have led to rallies in many energy stocks, however, which has changed the calculation in the short term at least.

Some funds have said that divesting from controversial sectors has cost them over time. After the Norwegian oil fund shunned tobacco, for example, it estimated that the hit to its returns was equivalent to missed profits of $1.94bn between 2006 and 2015. Calpers, the California pension fund, calculated last year that it had missed out on $3.7bn in gains from tobacco stocks since 2001.

Some believe that divestment can increase risk to a portfolio by reducing diversification. “This makes it harder to achieve the returns we need to pay benefits to the teachers of California,” says Aeisha Mastagni, a portfolio manager at the California State Teachers’ Retirement System, which opposes a bill the California senate passed in May that, if passed by the assembly, would prevent it from owning shares in fossil fuel producers.

The fossil fuel divestment movement, however, is driven more by politics than economics, inspired by campaigns such as the one that focused on ending apartheid in South Africa. Rather than take down any one corporation or raise the cost of capital for targeted companies, the idea is to stigmatise them, putting pressure on policymakers to introduce restrictive legislation, says Brett Fleishman, head of finance campaigning at 350.org.

“We never thought a bunch of institutions divesting would hurt Exxon’s bottom line,” he says. “We wanted to make it popular for politicians to do the right thing by institutions making powerful statements by divesting from fossil fuels.”

A few proponents of divestment have moved into the political arena. Brooks points to the election of Chloe Maxmin, a Democratic senator, who co-founded Divest Harvard. In 2020 she unseated a Republican in Maine with a promise to introduce a green new deal. “She led the push to get the state pensions fund to divest from fossil fuels,” he says. “So we have legislators who cut their teeth on the divestment movement and [who] are now part of government.”

Zingales acknowledges that divestment can raise the political stakes. “The divestment campaign is much more effective in creating awareness than an engagement campaign,” he says. “But the irony is that we are where we are because at the political level we’re not doing very well.”

The rules of engagement

Despite the apparent momentum behind divestment, Larry Fink, chief executive of BlackRock, decided this year to make a vocal case for engagement. The head of the world’s largest asset manager used his annual letter to argue that “divesting from entire sectors — or simply passing carbon-intensive assets from public markets to private markets — will not get the world to net zero.”

BlackRock had not adopted a blanket policy to divest from oil and gas companies, he said, because some were transforming their businesses to be less carbon intensive and needed to be encouraged. “Driving capital towards these phoenixes” would be essential to achieving a net zero world, Fink said.

As his comment indicates, there is concern that pressure from investors for companies to offload carbon-intensive assets can lead to those assets being snapped up by private owners such as hedge funds, which face less environmental scrutiny. This may make divestment less effective, particularly given the growth in private capital.

Those who believe that engagement is better than divestment also diverge when they decide how best to use the tools investors have at their disposal. For some, engagement is ineffective unless investors also wield a stick.

“If we don’t see companies stepping up to the plate to change their business, we’re going to make investment decisions . . . that could lead to divesting,” says Carol Geremia, president of MFS, an active manager based in Boston. “We do have timeframes that we’re explicit around.”

Abrdn, the UK asset manager, has also set targets and timeframes for its portfolio companies which relate to their progress towards achieving net zero emissions. If these are not met, Abrdn says, it will consider offloading the stock.

“The divestment approach is very much a last step but at the same time we want to show that we’re serious,” says Fionna Ross, a senior analyst in ESG at Abrdn. “If these things are not achieved, we will ultimately divest from that company.”

For others divestment is not an option. “The question is not whether your heart is in the right place but whether you will have any impact on the problem you are trying to solve,” says Simpson. “That’s where the divestment case on equities is found wanting.”

What she and others argue is that until the entire corporate sector has met its emissions goals, engagement with companies remains critical. “Risks associated with climate change cannot be divested away,” says Mastagni. “We need a more holistic approach.”

This begs the question as to what other sticks investors can use. One option is to use their votes at annual meetings to replace managers or members of the board of directors.

“Directors care deeply about the vote they receive. That definitely does send a message,” says Mastagni. “So you’ll see an increase from Calstrs in terms of the number of directors that we’re not supporting.”

She says the fund’s engagement begins with behind-the-scenes discussions asking companies first to disclose their emissions levels and then to take action to reduce them. “We can do that privately or we can do that more publicly,” she says.

A change in the make-up of the board of directors was the goal of Engine No. 1, a US investment firm that campaigned to push ExxonMobil to move to a lower-carbon model. It won three board seats after a battle in which it said the oil company’s focus on fossil fuels put it at “existential risk”.

In 2021 Exxon said it planned no “huge shifts in strategy” after losing the shareholder vote, but Chris James, founder of Engine No. 1, said this was not what happened. “After losing the board fight, of course management doesn’t want to say that changes were a result of the outside pressure,” he says.

James describes the changes at Exxon as “dramatic”. “They have gone from talking about net zero pledges as beauty contests to actually making net zero pledges,” he says. “Before the campaign, there wasn’t a business strategy where carbon was anything other than a byproduct of their oil and gas activities. Today managing carbon is one of the three pillars of their business.”

Beyond influencing individual companies, many investors see engagement as being most effective if it is part of a broader movement. It is for this reason that in recent years several investor coalitions have been formed. These include the Net Zero Asset Managers initiative, Europe’s Institutional Investors Group on Climate Change, and Climate Action 100+, a group representing 700 investors with more than $68tn in assets. CA100+ pushes companies to cut emissions, strengthen governance and improve climate-related financial disclosures.

However, while Engine No. 1’s Exxon campaign was hailed as a significant victory by the sustainability community, the results of collaborative engagements appear to be mixed. In the second round of its net zero company benchmark assessments, CA100+ found that just 17 per cent of its focus companies had set medium-term targets. The same percentage had quantifiable strategies in place to reach their net zero goals.

“That body has been in place for several years now and to have a record like that points to the difficulty with relying on an engagement-only strategy, particularly with fossil fuel companies,” says Brooks.

Some point out that engagement is not for the faint-hearted. “You have to do it right, it takes a long time. You have to be sophisticated about it and you need to have a portfolio manager in the discussion,” says Bob Eccles, a professor at Oxford university’s Saïd Business School and an expert on corporate sustainability.

“We are in the foothills of a very long climb,” says Simpson, who is a member of the CA100+ global steering committee.

Others take a more pessimistic view. “The focus on shareholder returns still takes priority,” wrote one FT Moral Money reader. “Unless this changes, engagement just prolongs conversations.”

A third way

As investors become more interested in using their money to put the global economy on to a more sustainable, equitable footing, some say they should not be bound by a binary choice between divestment and engagement, but should apply different strategies to different asset classes.

For example, while private equity was once known as an industry where corporate raiders used a slash-and-burn approach to costs, its value creation model — based on improving the performance of portfolio companies away from the short-term pressures of public markets — is well suited to shareholder engagement, Eccles argues. “Private equity is a place where you can take assets and clean them up,” he says.

While seeing tangible results from divestment and engagement requires time, effort and often collective action, there is one asset class that enables investors to wield an immediate lever for change: debt.

For bond investors, the stick is the denial of funds at a critical moment, since most companies need to raise fresh debt every year. Investors can deny a company funds by refusing to refinance or roll over corporate debt unless certain environmental or social conditions are met, such as accelerating the transition to renewable energy or achieving a workforce gender balance.

Andreas Hoepner of University College Dublin compares this to a homeowner looking to refinance their property who finds that the bank insists on home insulation as a condition of a fresh loan. “You would insulate your house because you need someone to refinance it,” says Hoepner, a professor of operational risk, banking and finance.

Asset owners have begun to understand the power they wield through bond investments. In 2020, for example, Lothian Pension Fund launched an approach it called “engage your equities, deny your debt”. This included a refusal to supply new funding — whether through new bond issuance or new equity issuance — to companies whose strategies were not aligned with the Paris Agreement treaty on climate change.

Recognising asset owners’ appetite for using debt as a tool of influence, companies have issued bonds whose contracts tie them to sustainability goals. Green bonds, for example, have funds ringfenced for environmentally friendly activities, such as the development of renewable energy technologies. Meanwhile, SDG- or sustainability-linked bonds are general purpose bonds with contracts that impose financial penalties if the company fails to meet social or environmental targets in a set time.

The advantage for companies is that the terms of the bonds make them more attractive to sustainability-focused investors. “I’ve heard CFOs saying that this actually brought down their coupon, or that the coupon was the same but they could pick their investors — both of which are a significant advantage for the business,” says Hoepner.

Beyond the binary debate

Whether they favour divestment, engagement, denial of funds or a mixture of strategies, investors must be prepared to accept that their actions may not yield tangible results, at least in the short term.

This is particularly true for the divestment movement since it can be hard to disentangle the effect of an advocacy campaign from other forces that might have pushed companies to change behaviour or governments to introduce new policies.

“It is something that we struggle with as an organisation,” says Fleishman at 350.org. “It’s very hard for us to say whether the momentum we have today was due to the divestment movement.”

Moreover, with asset owners seeking to achieve different forms of social or environmental impact through different asset classes and sectors, investment professionals need to arm themselves with new knowledge and to create a more joined-up approach.

ShareAction’s Howarth sees more work ahead for many institutional investors. “Half the time there is a flat contradiction between what’s going on in the equity teams and what’s happening in the bond teams,” she says.

Influencing different sectors can also mean taking different approaches. While Brooks is a proponent of divestment from companies whose business is the production and transportation of fossil fuels, he believes engagement can work for companies in other sectors. “There’s a better record of moving through engagement when [fossil fuels] is not their core business,” he says.

One FT Moral Money reader argued that divestment could be effective but only in industries such as petrochemicals, plastics, chemicals and pharmaceuticals, which are “slow to adopt readily available alternative technologies that have proven themselves to be better for human health and the environment”.

While proponents of both divestment and engagement often hold strong views, the choice between one and the other is starting to give way to more nuanced strategies that use both — and add the threat of denial of funding to the mix.

Determining how best to use investment funds to address climate change will remain a highly complex business. But while the “need for action” drove Cambridge towards divestment, others looking to respond may now have options that go beyond a binary choice between divesting and engaging.

[ad_2]

Source link