[ad_1]

What does the chart show?

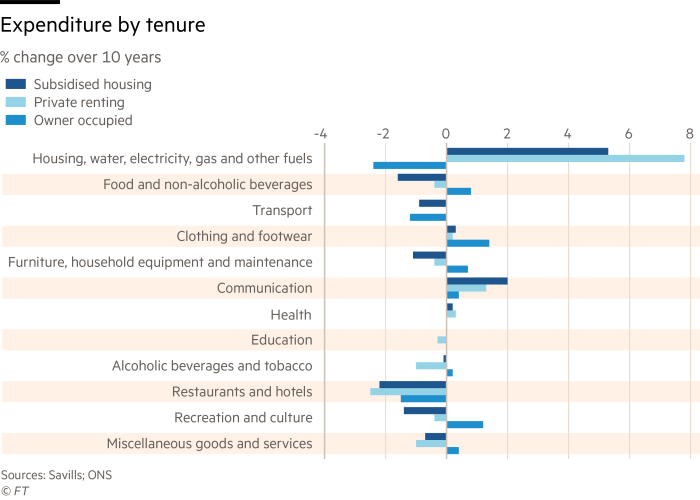

It reveals the extent to which renters in the UK are more exposed to rises in the basic costs of living than owner-occupiers — with or without a mortgage.

The gap between the two has steadily opened up in recent years, according to an analysis of data from the Office for National Statistics by estate agent Savills.

The proportion of private renters’ expenditure taken up by housing and utility costs has jumped from 28 per cent in 2005 to 42 per cent last year. For owner-occupiers, however, housing and utility costs have fallen slightly as a proportion of their overall expenditure from 20 to 19 per cent.

Lucian Cook, director of residential research at Savills, said the figures suggested owner-occupiers have more leeway than renters to reduce their discretionary spending to cope with the current pressures of high inflation and rising energy bills.

This is partly because mortgage interest rates have been low in recent years, but also latterly the effect of high inflation on debt. “Rents continue to go up, but the value of a mortgage is deflating over time,” he said.

Is the gap likely to widen?

It is. The data run only until 2021, but inflation has soared this year, with the consumer price index hitting 9 per cent in the 12 months to April 2022, compared with 1.5 per cent in the year to April 2021.

The ONS also produces an index incorporating housing costs, known as CPIH, which went up from 1.6 per cent in April 2021 to 7.8 per cent in April 2022.

Rents have been rising this year while mortgage costs, though also going up, are still relatively modest in historic terms. Tenants hoping to find ways to cut their core housing cost are set for disappointment in the current climate, as the demand for rented homes is intense.

In its latest rental tracker covering the first three months of 2022, property website Rightmove said: “Tenants are faced with the most competitive rental market ever recorded by Rightmove, with more than triple the number of prospective tenants as there are rental properties available.”

Mortgaged property owners are also likely to see their housing costs rise as interest rates go up, but around three-quarters are insulated from such rises in the short term by holding fixed-rate mortgage deals.

Rents can’t keep rising forever, surely?

At some point, landlords seeking higher rents will hit the ceiling of affordability among tenants. Kate Faulkner, founder of Property Checklists, a website and advice provider, said fluctuations in wages at a local level remain a reliable guide to the course of rents. Last year, earnings overall were rising fast, but this year have been outpaced by inflation. “Rent growth will stop in its tracks,” she predicts.

Cook said pressure on private renters who were less able to cut back on their discretionary spending would eventually act as a brake on growth in rents, but not until the private rented sector had overcome the acute shortage of available rental stock. “Some of the macroeconomic pressures are playing second fiddle to supply-demand dynamics within those markets,” he said.

Eventually, this imbalance would resolve itself, but he added there was another reason to think this may take time: the continued pressure on landlords from regulatory and tax changes, which would cause some to reconsider their participation in the sector.

These include government proposals to abolish “no-fault” Section 21 evictions; the loss of full tax relief on mortgage interest payments for individual landlords; the prospect of a landlord register; and the need to ensure properties meet energy efficiency rules expected to apply from 2025.

“Unless something changes, we will continue to have a fundamentally undersupplied private rented sector,” he said.

[ad_2]

Source link