[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Saudi Arabia has indicated that it is prepared to raise oil production should Russia’s output fall substantially under the weight of western sanctions, according to five people familiar with the discussions.

The kingdom has resisted calls from the White House to accelerate production despite oil prices trading near $120 a barrel, the highest level in a decade, arguing that it fears the energy crunch could get worse this year and that it needs to reserve spare production capacity.

But alarms about outright supply shortages have risen after the EU launched another round of sanctions against Moscow, including a ban on importing seaborne cargoes of Russian oil into the bloc.

The EU has also agreed a deal with the UK to bar the insurance of ships carrying Russian oil, a move analysts said was likely to severely curtail Moscow’s ability to redirect oil to other regions.

“Saudi Arabia is aware of the risks and that it is not in their interests to lose control of oil prices” — a person briefed on the kingdom’s thinking

How can we improve the newsletter? Share your feedback with us at firstft@ft.com. Thanks for reading FirstFT Europe/Africa — Jennifer

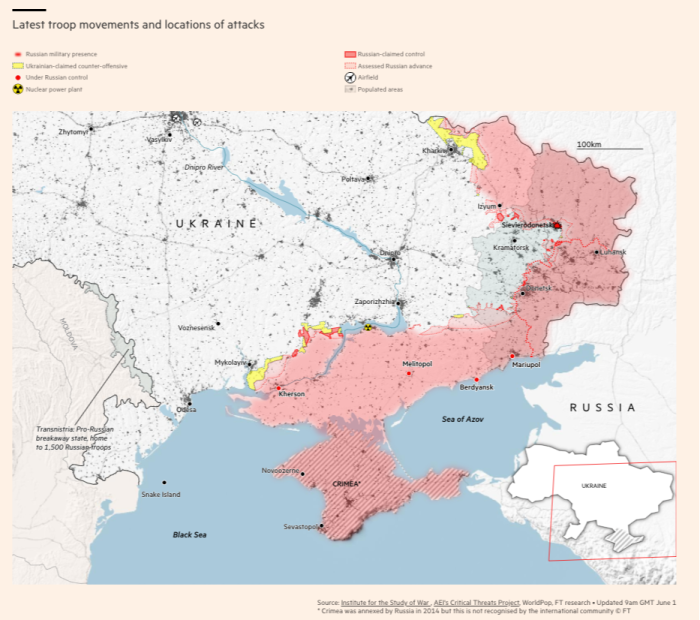

The latest from the war in Ukraine:

Five more stories in the news

1. JPMorgan chief warns of economic ‘hurricane’ Jamie Dimon struck a gloomy tone on the global economic outlook, warning investors yesterday to prepare for an economic “hurricane” and oil prices as high as $175 a barrel as the war in Ukraine and policy tightening by the Federal Reserve roil markets.

2. It’s Facebook official: Sandberg steps down from Meta Sheryl Sandberg is stepping down as the chief operating officer of Facebook’s parent company after 14 years, a major shake-up in which chief executive Mark Zuckerberg will lose one of his closest lieutenants.

3. Amundi: parts of private equity market resemble ‘Ponzi schemes’ Europe’s largest asset manager warned that parts of the industry would face a reckoning in the coming years. “You know you can sell [assets] to another private equity firm for 20 or 30 times earnings. That’s why you can talk about a Ponzi,” said chief investment officer Vincent Mortier.

4. Hedge funds turn bearish on stocks Top-performing managers have become increasingly pessimistic about the outlook for global equities, even though markets have already sold off sharply this year, with high-growth technology shares a particular area of concern. “Life is going to be much more difficult for investors”, warned Crispin Odey, founder of London-based Odey Asset Management.

5. Women take record proportion of Queen’s Jubilee honours A record proportion of people honoured for their contribution to public life went to women this year, among them Arlene Foster, the former Northern Ireland premier, ahead of Queen Elizabeth’s platinum jubilee celebrations.

-

Reign supreme in retirement: Many women born in the decade of the Queen’s coronation are working for much longer than they had planned. Here’s how to ensure you’re getting what you’re owed from the state pension.

The day ahead

Trooping the Colour military parade Celebrations will honour the Queen’s official 96th birthday. Today and tomorrow are public holidays in the UK.

Opec+ meeting The oil producers group meets today and is widely expected to stick with its plan of raising production by about 400,000 barrels a month, a target that has been in place since last year.

Economic data EU producer price index figures and US factory orders data for April are published.

Festa della Repubblica Italy will commemorate the founding of its modern state with fireworks and parades on National Republic day.

Corporate earnings Canadian athleisure brand Lululemon Athletica publishes first-quarter results while US food processing company Hormel Food reports second-quarter results.

What else we’re reading and listening to

The global nursing crisis In 2020, the World Health Organization estimated there was a global shortage of 5.9mn nurses — almost one-quarter of the current workforce of almost 28mn. Covid-19 has made things worse, with many suffering burnout and mental health challenges as they struggled to deal with the chaos of successive waves of the virus.

Copenhagen’s fine dining faces reckoning over toxic workplaces In restaurants, two stories are being told. The first is in the dining room, a perfectly choreographed show of luxury. And then there is the story that you are never supposed to hear, of what happens on the other side. In Copenhagen, some are trying to make us listen.

“We found out that we have actually been victims of kidnapping from life, because the life we had been offered is not a life” — a chef from Ukraine

Who wants to work for airlines any more? Services at a standstill, the threat of strikes and complaints about pay not at pace with inflation. Unless aviation employers improve conditions, a “summer of discontent” threatens to turn into a winter one, writes Cat Rutter Pooley.

Global rate gaps loom large for investors Central banks in the US and Europe are searching for a sweet spot in monetary policy, raising rates enough to dent inflation but not to push economies into brutal recessions. In Asia, central bankers are in a very different place, writes Claire Jones.

Tether’s path to the spotlight This episode of the Behind the Money podcast starts with a real-life fire that sends a business up in smoke. With the help of Financial Times reporters, we dig into the professional histories of the executives who sit atop two of crypto’s most important businesses: stablecoin issuer Tether and exchange Bitfinex.

Fashion

The newly named HTSI rounds up the best of summer style for men, modelled naturally on the beach.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here.

[ad_2]

Source link