[ad_1]

After an exceptional 2021, this year was never going to be an easy ride for investors. With the world’s largest economy, the US, moving towards monetary normalisation, choppier market conditions were only to be expected. Add to this a brutal mix of snarled supply chains, rising inflationary pressures, Russia’s war in Ukraine and mounting fears about possible recessionary slowdown, and it’s made for a humbling experience even for seasoned investors.

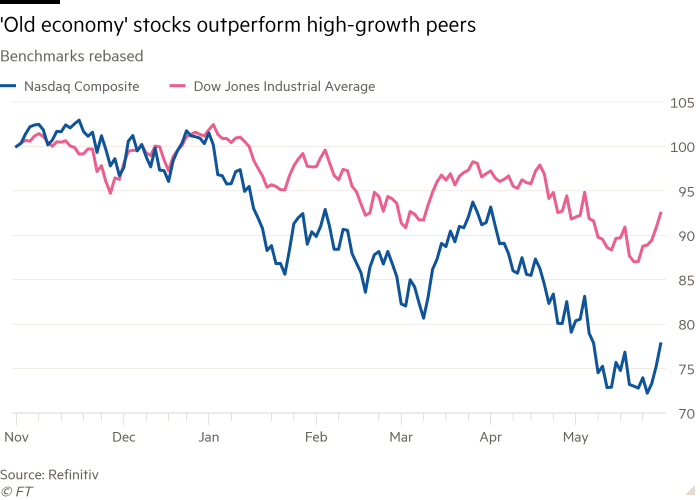

Tech and other growth-oriented companies have sold off in dramatic fashion, while “old economy” companies, such as the oil majors and mining stocks, are striding ahead. The UK, for years a pariah stock market, has suddenly become a safe place to see out the storm, while the US (never bet against Uncle Sam) has come off the boil.

The technology-heavy Nasdaq index, seen as a bellwether for growth investors, has fallen nearly 30 per cent from its high in November last year, and 20 per cent in the short time since the end of March. Compare that to a considerably more modest decline of around 10 per cent by the old economy stocks of the Dow Jones Industrial Average.

There are many ways of illustrating the travails of tech stocks so far in 2022. One is to look at the performance of the £10.84bn investment trust behemoth, Scottish Mortgage, a retail investor favourite and top seller on most fund platforms.

Is the savage fall in SMT’s share price a golden opportunity to buy it at a bargain price? Or is the reliance on a handful of racy technology names — with positions on MRNA vaccine technology (Moderna), gene sequencing (Illumina) and electric cars (Tesla) — a reason to pause?

Many technology companies saw a huge acceleration of growth during the pandemic, and investors do need to adjust to a deceleration and in some cases a reversal. Markets arguably over-extrapolated long-term growth from a short-term phenomenon, which pushed valuations too high.

With much of their growth still in the future, these tech darlings are worth less in today’s money when their present value is calculated using higher interest rates. In current conditions, jam tomorrow is much less attractive than jam today.

The counterargument to this is that many of the tech fallers are still highly profitable and cash-generative businesses, delivering sustainable profits growth.

In spite of the precipitous decline in its share price, Scottish Mortgage is less troubled by downside risk than some of its peers, believing that fund managers’ time is better spent finding the next Amazon or Tesla, which can grow to many times their current size. The idea is that the outsized gains it makes on these companies will more than compensate for a stock or two where ambitions remain unfulfilled.

For long that approach has served it well. And, in its favour, it is inconceivable that technological change will become less important in the years that lie ahead. The electric vehicle revolution, the desire to automate, shortages of water, energy and decent housing around the globe and strategies to tackle climate change all call for more technological innovation.

However, my colleague, Jeremy Podger, manager of the Fidelity Global Special Situations Fund (in which I’ve invested a slice of my husband’s Sipp savings), makes an equally pertinent point, which is simply that tech is not the only answer. “There will be many new opportunities in tech over the coming years but equally important will be how non-tech companies internalise technology and use it to their competitive advantage.”

As for the growth versus value debate and the so-called “market regime change”, it’s worth noting that growth stocks are still more expensive (against expected near term earnings) than they were five years ago and value stocks are still cheaper than they were. Many growth fund managers have felt the pain this year, but that doesn’t mean we’ll see a shift in their investment process.

You could, as Podger suggests, scoop up some good growth stocks caught up in the market rout, while keeping an eye on the many value stocks that look attractive. “It is one of those times when it appears to be best to start to look for outstanding opportunities in both growth and value camps, rather than trying to hide in the middle ground,” he says.

Others argue that the real story playing out in markets is not about value versus growth, but rather between cyclicals and defensives. Though there is some overlap, it is not a perfect fit — and that will be the decider this year.

“Rather than trying to catch the bottom in growth stocks, or justify increasing valuations . . . investors might do well to look closely at profitability,” says Alexandra Jackson, manager of the Rathbone UK Opportunities Fund. Finding a defensive factor can help protect against the inevitable shocks that appear at this point in the cycle (the late stage, but not the end, in case you were wondering).

High-quality names typically lead in periods after activity shocks. This is when stock picking, rather than having to buy an entire index or sector, really comes into its own. Active managers can weight their investments towards the best-quality opportunities and pick them up when they are most attractively priced. A passive fund is compelled to buy the bad along with the good and the expensive alongside the cheap.

This is true throughout the market cycle but never more so than when markets are nervous and volatile. At such times, good active managers have a huge competitive advantage. The current environment calls for balance, rather than one-way bets — a blend of reopening and pandemic winners, procyclical and defensive stocks, reflation and resilient businesses.

So how do investors sift through the stock market wreckage from here? The answer is as simple as it is complex: stock by stock. War, inflation and the threat of recession are making investors nervous, while the market is trying to position for the risk that central banks get it wrong. It’s the job of the active stock picker to find the right blend of quality names with enough of a fluffy valuation to help cushion the landing, however soft or bumpy it might be.

Maike Currie is head of personal finance and markets content at Fidelity International. Maike.currie@fil.com, Twitter @MaikeCurrie; Instagram @MaikeCurrie. An immediate family member holds the Fidelity Global Special Situations Fund.

[ad_2]

Source link