[ad_1]

The writer is president of Queens’ College, Cambridge, and an adviser to Allianz and Gramercy

At a conference of investment professionals I recently attended, several private equity funds argued with considerable vigour that this year’s large losses in public markets would drive even more investors their way.

They were confident that their asset class would avoid the reckoning that stocks and bonds have been exposed to this year because they were structurally immunised against disruptive changes in the investment landscape.

I fear that this may prove to be too much bravado and misplaced self-confidence. Both the real economy and the financial system have entered a phase that is uncertain and destabilising for private as well as public market investors.

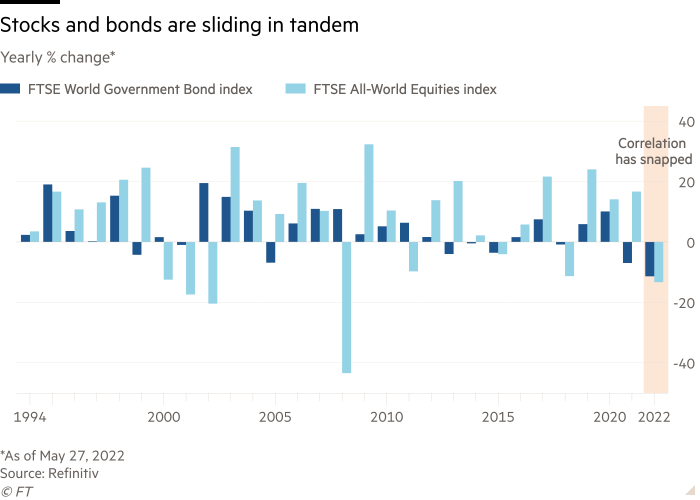

As noted recently in the Financial Times by Katie Martin, “adherents to the classic portfolio split — 60 per cent stocks and 40 per cent bonds — have not had it so bad in half a century”. Both equities, usually dubbed as risk assets, and the “risk free” alternatives of government bonds have experienced large losses this year.

In the traditional correlation between such assets, if stocks sold off, government bonds rose. That correlation has broken down as all these assets (understandably) suffered from worries about higher interest rates and tightening financial conditions.

While the last couple of weeks have seen some reversion to the more traditional correlation, that is not without its own problems. The reason is growing worries about global growth and corporate earnings. They point to further volatility for equities which constitute the largest part of most public market portfolios.

In contrast to this year’s brutal sell-off in stocks and bonds, private equity valuations have remained robust. As often pointed out by their marketers, the conventionally longer holding period reduces the disruptive influence of speculative money looking to get out quickly. As does the fact that private equity investments are usually focused on single assets as opposed to indices, limiting the scope for contagion.

Such factors fuel expectations of an acceleration of what already has been a considerable multiyear increase in the strategic allocation of investment flows, and not just from public pension funds, foundations, endowments and sovereign wealth institutions. Private equity fans also expect the asset class to get a boost from ongoing efforts to make private equity more accessible for retail money.

Such optimism about the robustness of the asset class may, however, be excessive. Private equity valuations are updated much less regularly than for public investments. Indeed, historically, revaluations have tended to lag behind public markets by a minimum of six to nine months. Moreover, several of the factors that have recently undermined the public markets are also worrisome for private equity.

Higher interest rates and tightening financial conditions will complicate the refinancing of leveraged take-private transactions. They make the paths back into the public markets less secure and the exit valuation less certain. They also curtail new investors’ enthusiasm for buying private equity stakes in the secondary market, putting pressure both on prices and volumes.

The worsening global economic outlook is also a problem. Downturns rob companies of actual and prospective revenues, leading to faster burning of cash reserves, increased debt burdens relative to equity and capital erosion.

There are two additional risks that are specific to private equity in the period ahead. First, that one of its often-cited structural strengths — that of illiquidity that damps unfavourable price volatility — turns into a weakness; and second, that financial regulators and supervisors pay a lot more attention to conduct in private markets.

Private equity is just as likely to experience a shift in operating paradigm this year as the public markets have been undergoing — from a seller’s to a buyer’s market. Indeed, both are in the process of exiting from a world of massive and predictable central bank liquidity injections that over-facilitated a seemingly endless flow of money into a smaller set of investment opportunities. What lies ahead is a world in which the cost of money will be higher and financial flows more selective as they become less ample.

With time, genuinely attractive value will be restored to private and public markets. The process of doing so, however, is likely to be as bumpy.

[ad_2]

Source link