[ad_1]

This article is an on-site version of Martin Sandbu’s Free Lunch newsletter. Sign up here to get the newsletter sent straight to your inbox every Thursday

Times of big global upheaval may not be good for the world, but the dirty secret of journalism is that regular opinion writers find them professionally quite rewarding. Books, however, are a different matter. The economic shocks have been rolling in so fast that the slow process of book publishing leaves years of painstaking work hostage to fortune. I finished my last book, The Economics of Belonging, in the early months of 2020, just too soon to discuss a pandemic that in weeks turned the global economy upside down.

The paperback edition, which came out in the US on Tuesday, gave me a chance to think about what has changed (though after I sent off the new preface, Russia attacked Ukraine, leaving the book outdated again). For me, the most “intriguing” thing about the pandemic is that some of the policies I advocated in the book suddenly fell massively into favour. They include strong macroeconomic stimulus for a “high-pressure economy”, policies helping to rebalance power in the labour market and the digital economy (and, of course, the combination of the two, where high demand pressure improves the bargaining power of workers), and easier conditions for leaving bad jobs to look for better ones. The US government’s “Bidenomics”, in particular, is a great test case.

In the book, I argued we had had far too few of these things in the past. The cost, I wrote, had been poor growth and productivity performance, and also rising unfairness because these outcomes disproportionately hurt those on lower wages and on the margins of the labour market. Among other things, I concluded it was crucial to be much less timid about macroeconomic demand stimulus.

This week, these arguments have been supplemented by new research from the Bank for International Settlements. Here are three key findings. First, on average, recessions increase inequality. Second, increases in inequality are sticky, and it does not quickly come back down by itself. This is called “inequality hysteresis” in the jargon. (The analogy is with the “hysteresis” where output lost in a downturn is gone forever as post-recession economies rarely return to their pre-recession path). And third, higher inequality blunts the normal macroeconomic policy tools used to fight inflations. Together, these findings imply there are several equilibrium paths that the economy could end up on: some where recessions are rarer or shallower, inequality is lower and output and productivity are higher; and some where recessions are more frequent or deeper, inequality is higher and output and productivity are lower. Which an economy follows depends in part on how much firepower policymakers are willing to use to keep economies growing, with particular concern for those at the bottom.

This is the background from which I have approached the great post-pandemic inflation debate. As I wrote very early on, a bout of inflation would be a welcome sign that we had got demand policies right. And I have argued that the subsequent increases were, in any case, due to, yes, transitory supply shocks. The fact that we have had one unforeseen supply shock after another — which nobody disputes — is not a reason to think each of them is not transitory.

But suppose it is true, as most people now seem to think, that record-high inflation is the price we are paying for a high-pressure demand policy, how well is that policy delivering for the price? Let us look at the US, which is clearly the economy that has taken most seriously the need for high-pressure demand if not in so many words.

Take productivity first. Increasing at an annual average rate of 1.1 per cent since end-2019, output per hour worked has performed reasonably well — better than in the immediate pre-pandemic years but still disappointing compared with the faster labour productivity growth of the more distant past. Note, however, that output in the US economy is greater today than projected before the pandemic — and you should pause to acknowledge what an extraordinary feat that is. At the same time, fewer people are in work than three years ago, and many fewer than would have been expected on the preceding trend. Put together, this means productivity is significantly higher than projected before the pandemic: output per hour has grown unexpectedly fast.

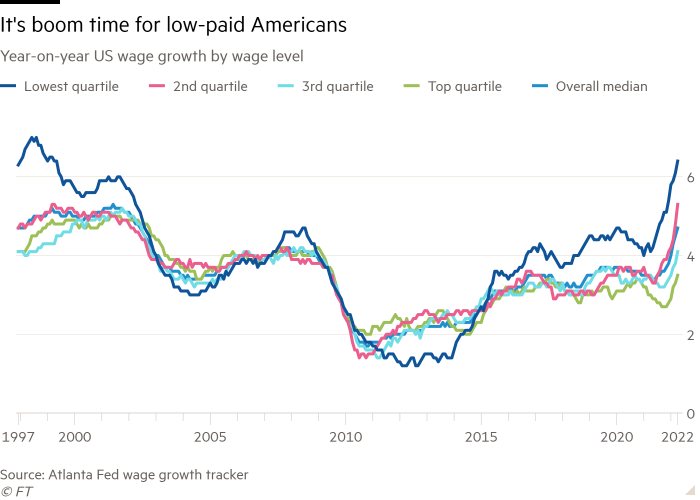

What about inequality? The great Atlanta Fed wage growth tracker usefully breaks down wage growth by wage level. As its chart (reproduced below) shows, wages are growing much faster among the poorest paid than among the highest paid, and this gap has been increasing fast — in fact, it is the highest on record. Caveat: these should not be seen as entirely real-time measures (they are 12-month moving averages of year-over-year wage changes for the same individuals). But the pattern shows convincingly that wages have become less unequal in the pandemic, that the most recent wage growth has been particularly strong at the low end and, therefore, that it is likely that the poorest have seen real wage increases even as the highest paid have seen real wage cuts. (Another caveat: the very richest are not captured; data shortcomings mean the tracker excludes those earning more than $150,000 a year.)

So far, then, the economics of belonging thesis is holding up quite well. Better wages at the bottom and higher productivity than expected are a pretty good reward for a rise in inflation — at least if inflation does indeed come down reasonably soon in the absence of new negative shocks to global supply. With US profits soaring as a share of real value added (see chart), there is little sign of unsustainable wage demands forcing companies to fuel price inflation. For more on this sort of argument, read Adam Tooze’s latest write-up on the debate over wage pressures on companies’ pricing. And remember that inflation was unexpectedly low in the previous decade, so the current increase just helps to bring price levels in line with what the Federal Reserve encouraged people to plan on when making long-term lending and borrowing decisions.

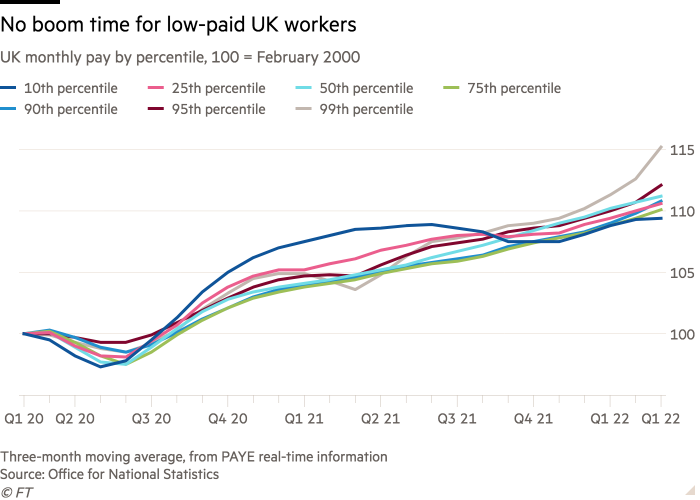

The contrast with other countries is instructive. In the UK, output has not held up as well as in the US. And the distribution of wages has behaved quite differently. As the chart below shows, in the second half of 2020 the lowest earners did best. But since then, the highest earners have caught up and then some, with the two years showing a clear widening of inequality.

Inflation rates, meanwhile, are comparable between the two countries. What accounts for the difference in the output and inequality developments that has come with this inflation? The likely answer is precisely the much punchier stimulus and more consciously redistributive policy choices in the US compared with the UK. We should not write off Bidenomics yet, nor accept the new narrative that all a high-pressure economy brings is immiserising inflation.

Other readables

-

A new paper contributes to the literature showing how financial crises can spawn political extremism. The study shows that greater exposure to foreign-currency loans in Hungary, which led to greater financial distress as the exchange rate moves, results in greater support for the populist far right.

-

News in the world of universal basic income: US cities are experimenting with a UBI for artists, and a group of Polish municipalities plans a two-year UBI pilot for 5,000 people. In the UK, a new report by the organisation Compass calculates that a UBI amounting to £11,000 for a family of four could be funded by removing tax-free allowances, increasing tax rates by 3 percentage points and charging everyone the same national insurance rate.

-

The German soul-searching on how much to support Ukraine is fascinating. Jürgen Habermas, the greatest living German theorist of democracy, has weighed in on the side of caution. Adam Tooze puts the contribution in context. And Paul Mason argues convincingly why those on the left must reject Habermas.

Numbers news

-

UK consumer price inflation hit the highest rate in more than 40 years because of the recent jump in energy prices. It puts the country near the top of the inflation table among OECD economies.

![Chart of annual percentage change in consumer prices in April 2022 in the UK compared with selected countries]()

-

The cognitive impairment caused by severe Covid-19 is comparable to the decline that takes place between the ages of 50 and 70, according to new research.

The first chart has been amended since original publication to correct the quartile labels.

[ad_2]

Source link