[ad_1]

After more than a day of grilling by officials from the US Securities and Exchange Commission in May last year, Stephen Bond-Nelson went to the bathroom and cut short his testimony.

The fund manager had just been presented with changes he had made to investor documents that were intended to make funds he helped run for Allianz, Europe’s largest insurer and one of the world’s top asset managers, appear less risky than they were.

This week, authorities announced that Bond-Nelson and his former colleague Trevor Taylor had pleaded guilty to fraud as part of a $6bn settlement Allianz agreed with US authorities over a scandal exposed during the pandemic-linked market turmoil of early 2020 — leaving investors with billions of dollars worth of losses.

The US arm of Allianz Global Investors and its fund managers “materially misled investors about the significant downside risks” of the so-called Structured Alpha funds from as early as January 2016, according to the SEC.

Gregoire Tournant, the former lead manager of the funds that amassed $11bn at their peak and were marketed as being able to withstand a market crash, has been indicted but has yet to submit a plea. He has vowed to defend himself in court.

With its US investment unit pleading guilty to fraud and banned from providing some local services for a decade, the Munich-based insurer has been rocked by the episode at Allianz Global Investors, an asset management business that provided just 2 per cent of the group’s €149bn in revenue last year.

For Wall Street prosecutors who have vowed to get tougher on white collar crime, it has also provided a significant corporate scalp.

The seriousness of the case makes it “readily understandable why the US government pursued such an aggressive and punitive outcome”, said Jacob Frenkel, partner at law firm Dickinson Wright.

As Allianz attempts to put the damaging episode behind it, legal filings from the SEC and the Department of Justice show that an opportunity to spot the conduct was missed five years ago and highlight the influence that incentive structures had on the trio running the funds.

Following the testimony from Bond-Nelson, after which he and Taylor began to co-operate with the authorities, Allianz launched an intensive investigation of its own that amounted to almost 17,000 hours of legal and expert time “combing through every single email and communication”, according to people familiar with the matter.

While Tournant allegedly portrayed Allianz — which also owns bond giant Pimco — in one conversation as a “master cop”, telling an investor in 2014 that he had “behind me one of the largest and most conservative insurance companies in the world monitoring every position that I take”, the investigation from the DoJ pointed to “significant gaps and weaknesses” in the funds’ controls.

A 2017 internal audit by Allianz’s US investment unit of the structured-products group, which ran the funds, highlighted inaccuracies in materials presented to investors.

“Although that audit identified red flags that, if pursued, might have led to identification of at least certain aspects of the fraudulent scheme, no meaningful follow-up was conducted,” the DoJ said. In fact, it was conducted by specialists in the structured-products group itself, “whose compensation was directly tied to the quarterly performance of the funds”, fillings say.

Incentive structures, that included performance fees and led to more than $110mn in bonuses being handed to the three men between 2016 and 2020, were highlighted by the regulators.

In an email, Tournant told colleagues that a recalculation he had requested from accounting colleagues, based on understated targets, was “[w]orth about 900K to our Comp pool,” according to the SEC.

“It’s hard to believe that such [bonuses] didn’t trigger some kind of audit by Allianz about how the team generated such returns,” said Jérôme Legras, head of research at investment company Axiom. “It sounds like some executives still believe money grows on trees.”

Tournant surrendered to authorities in Denver, Colorado, earlier this week. His lawyers said investor losses in 2020 were not “the result of any crime”.

A lawyer representing Bond-Nelson declined to comment and a lawyer for Taylor did not respond to a request for comment.

Although the funds invested across equity, debt and derivatives, regulators highlighted the sometimes crude attempts to mispresent the funds.

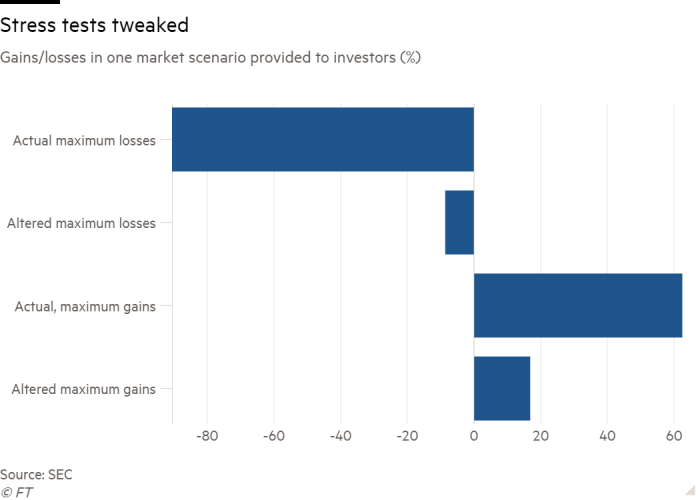

In the output from one fund stress test, Tournant removed a digit, the SEC alleged, so projected losses of -42.1505489755747 per cent were transformed into -4.1505489755747 per cent.

According to authorities, the fund managers “smoothed” performance data to reduce the magnitude of gains and losses and altered documents detailing the funds’ hedging strategies to make the options they had bought appear “closer to the money”, or worth more in a market downturn.

The hedges that the funds did have were not enough to stop them running aground in the brutal market sell-off in March 2020, when governments across the world shut their economies to stem the spread of coronavirus.

Allianz, whose promised $5bn compensation to investors led to a significant reduction in the fine, said this week’s settlements had “fully” resolved the episode. The investment unit is putting in place additional controls on what is communicated to investors, as part of a continuing governance overhaul, according to a person familiar with the matter.

The Allianz settlement comes as authorities have pledged to take a tougher approach to corporate malfeasance than during Donald Trump’s presidency, which critics deemed too lax.

That has included heightened scrutiny of businesses violating deferred prosecution agreements — where companies can postpone criminal charges in exchange for remedies and penalties — and demanding that co-operating companies identify more individuals involved in misconduct if they are to receive leniency.

At a press conference on Tuesday, Damian Williams, US attorney for the Southern District of New York, hailed the settlement as “one of the most significant corporate prosecutions in history”.

[ad_2]

Source link