In the investment management business, Performance Dispersion refers to the size of the gap between the best and the worst asset managers within a peer group. There’s an equally, if not more challenging variant of Performance Dispersion at work in the wealth management business. It exists across the range of investment and other solutions that are available to wealth advisors and their clients. The gaps between the best and the worst solutions in a given category are often sizable and hard to see. This means that wealth advisors can differentiate their practices by being discerning shoppers on behalf of their clients.

We take a look in this article at how sizable Performance Dispersion gaps can be across the solution spectrum. Our assessment underscores the importance of identifying the right resources, expertise and service providers that can help wealth advisors be on the right side and avoid the wrong side of these gaps.

Performance Dispersion Where You Wouldn’t Expect It

We begin with what most people would understandably regard as the simplest of all investment solutions – cash and near-cash investments. You probably wouldn’t blame someone for thinking that Performance Dispersion can’t occur much in such a simple asset class. And yet, such overly simplistic assumptions can overlook very different choices and results.

We consider three different investors in March 2020 with three strikingly different, real-world cash investing outcomes:

One investor had $50 million deposited at a major bank earning only .05% per annum and only $500,000 of FDIC protection;

Another investor was earning .50% per annum on up to $100 million in FDIC-insured deposits;

And a third investor bought overnight and weekly A-rated, tax exempt debt obligations yielding 4% per annum.

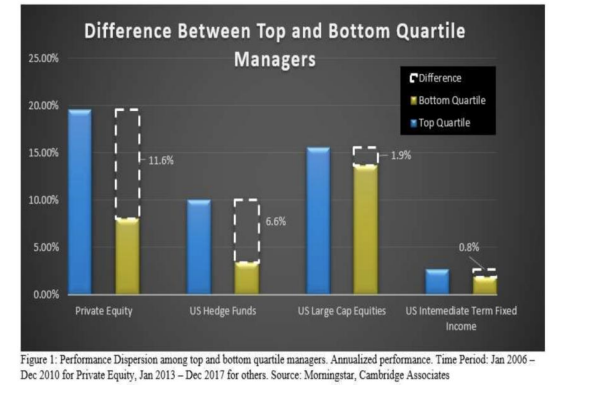

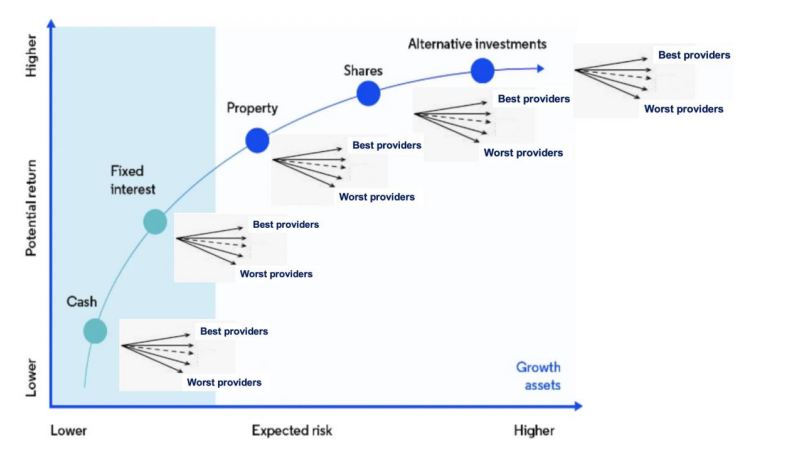

The dispersion of outcomes we can see even in simple asset classes, such as cash and near-cash, also can be found to significant, varying degrees in other asset classes and strategies:

And when we consider that different wealth advisors often have different ways of accessing these solutions, Performance Dispersion has more potential to grow than shrink because the method of access can magnify or mitigate the Performance Dispersion experienced by clients. A good solution can turn into a lousy one if it’s utilized through a poor method of access. For more evidence and some examples, see “A Surprising Key to Unlock Value for Advisory Clients.”

Viewed this way, it’s not surprising that we can observe big differences in what different wealth advisors are able to achieve for their clients across asset classes:

The takeaway: Performance Dispersion is real. It’s not limited to just asset managers. It extends to virtually all investment and financial products that are available to wealth advisors and their clients. It’s made better or worse by the particular method of access. The evaluation of solutions and solution providers should include an assessment of where they rank on the Performance Dispersion spectrum with respect to the competencies that matter most to wealth advisors and their clients.

Wealth advisors can turn this challenge into a differentiator by tapping into techniques that bring Performance Dispersion to the surface and by cultivating a network of peers, providers and experts that have the experiences and mindset to keep them informed and on the right side of Performance Dispersion gaps. As with most things in life, choosing skillful providers and partners with well-aligned motivations is a key to success.

Steve Bodurtha teaches the Investment Planning course in Columbia University’s Master’s in Wealth Management program. He has had a long career in investments, markets and wealth management, and is the Founder and CEO of Flexbridge Partners LLC.

Comments are closed, but trackbacks and pingbacks are open.