[ad_1]

Registered investment advisors have seen their corner of the wealth management industry truly come into its own over the past decade, as more advisors left brokerage firms to start their own fiduciary practices or join established RIAs—bringing with them thousands of clients and billions of dollars in assets under management.

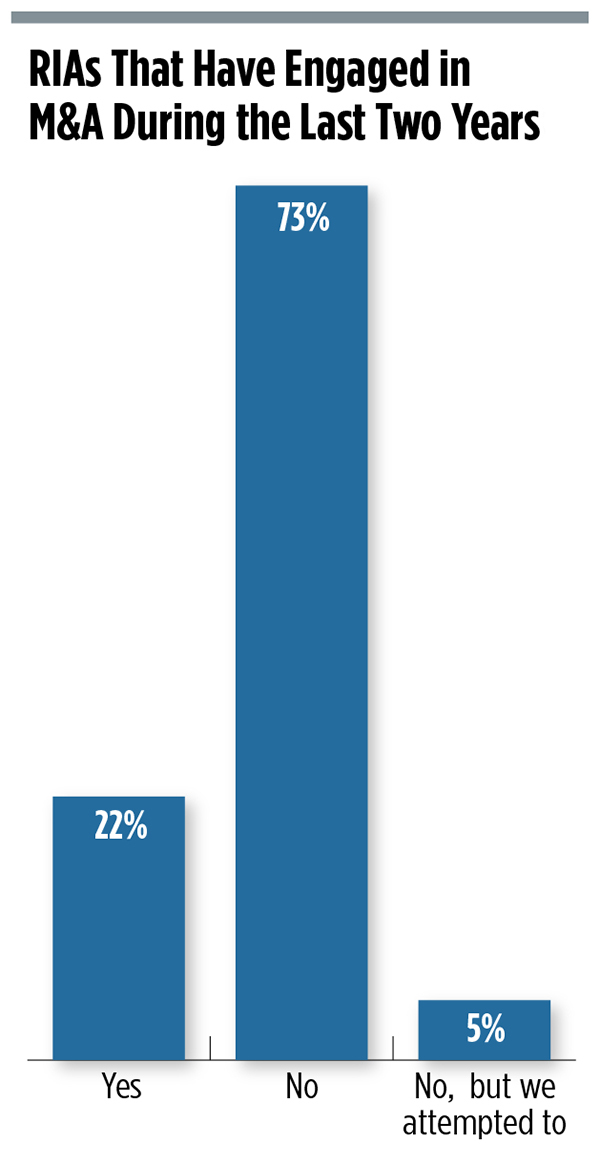

This movement has led not only to an increasing number of RIAs but also to the significant growth of many established firms. M&A activity among the proliferating RIAs has been shattering records for several years now, with a few firms leading the charge and some completing more than 15 transactions in a single year.

And, according to the professionals, there’s no end in sight.

And, according to the professionals, there’s no end in sight.

The inaugural RIA Edge Study of these growth trends, completed earlier this year, sheds light on some of the numbers behind the industry’s rampant growth, the drivers that are motivating that growth and how it is being achieved—both inorganically and organically. RIA Edge and Wealth Management IQ, with support from Thrivent Financial, collected the data through an industry-wide survey that included 419 responding firms and created the first of a series of reports highlighting the activity, anticipation and aims of three (overlapping) segments within the RIA space.

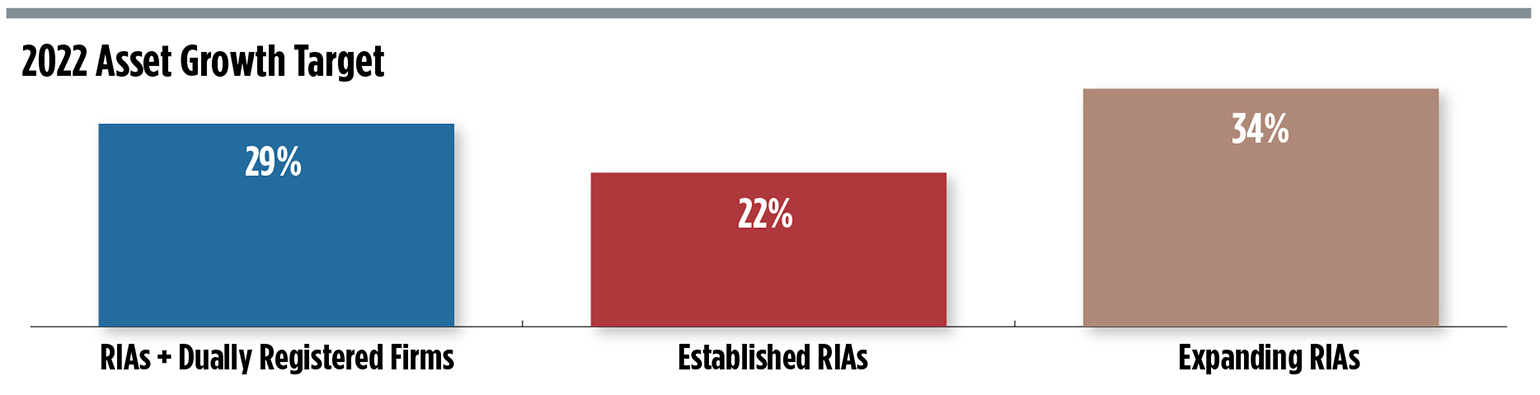

What they found is that continued growth is forecast across the industry, with 94% of all RIAs expecting to see growth of more than 10% in 2022. With a median anticipated growth rate of 29% across all RIAs and dually registered firms, established RIAs (classified here as those with at least $250 million AUM) expect to see assets increase by 22%, and expanding RIAs (those that have seen at least 50% growth since 2016) are anticipating 34% year-over-year growth.

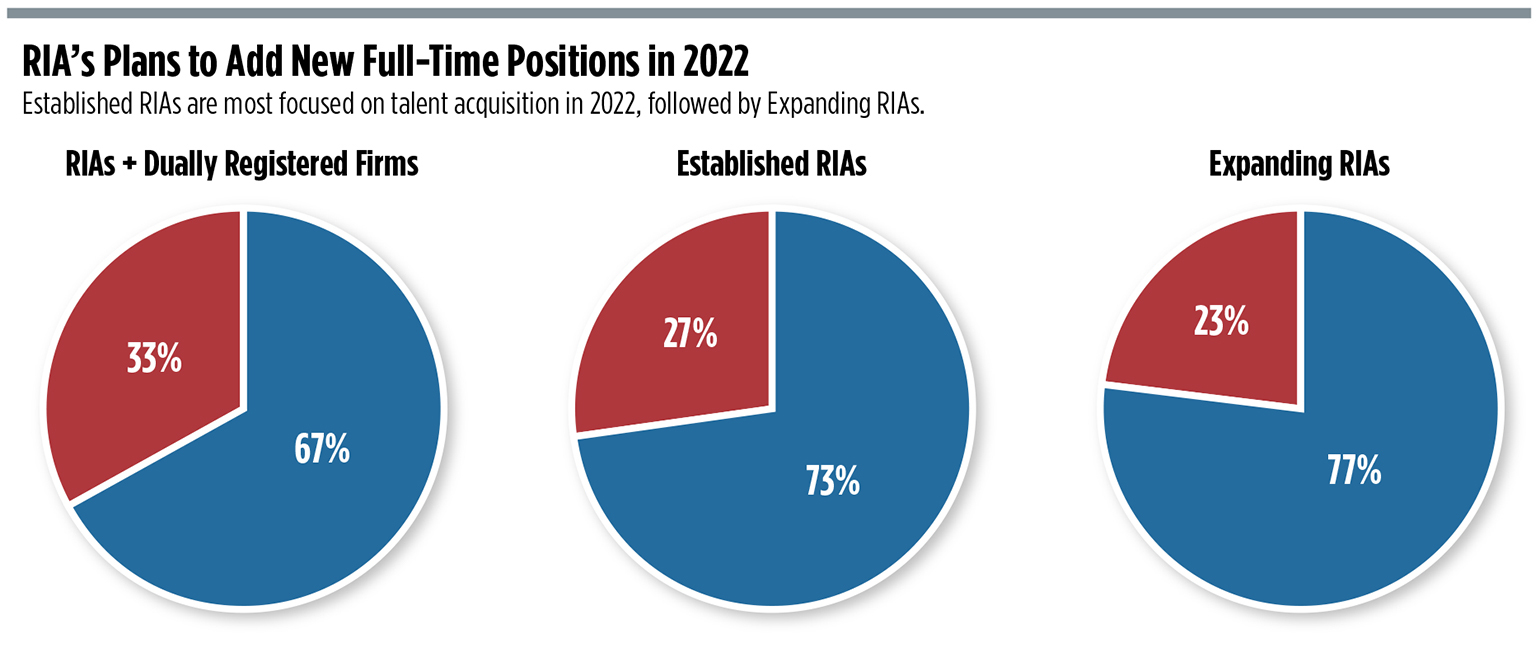

These double-digit growth rates are expected to be achieved through the addition of talent and human capital, as well as continuing M&A activity and investments in traditional organic growth strategies.

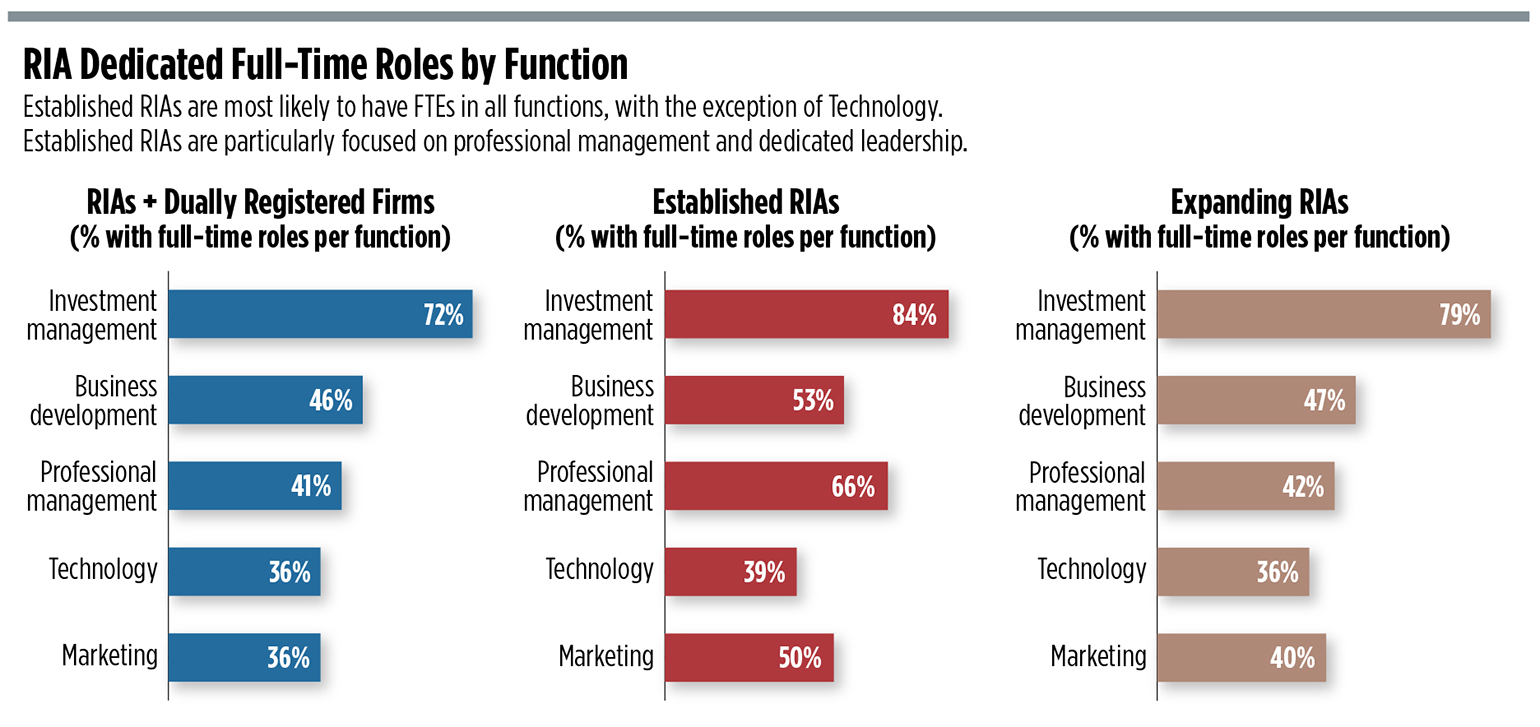

Talent acquisition and retention is a clear overarching priority for all RIAs in 2022 and beyond—with 51% of all RIAs and dually registered firms planning to add new full-time positions this year. This focus is particularly strong among established RIAs, 84% of which are planning to add new full-time employees. Junior advisors, paraplanners and operations/administrative roles emerged as the most desired additions. Lead advisory positions weren’t far behind, with 44% of established RIAs and 33% of all RIAs looking to add someone in this role.

“Lead advisors have been among the most difficult to recruit in recent years due to their short supply and the compensation levels they can now command,” according to the report. “Larger RIAs tend to have an advantage in attracting this talent, due to their more extensive resources and ability to offer competitive compensation packages. It is still expected to be an intense battle for lead advisors in 2022, a factor that is playing an increased role in large RIAs’ M&A strategies.”

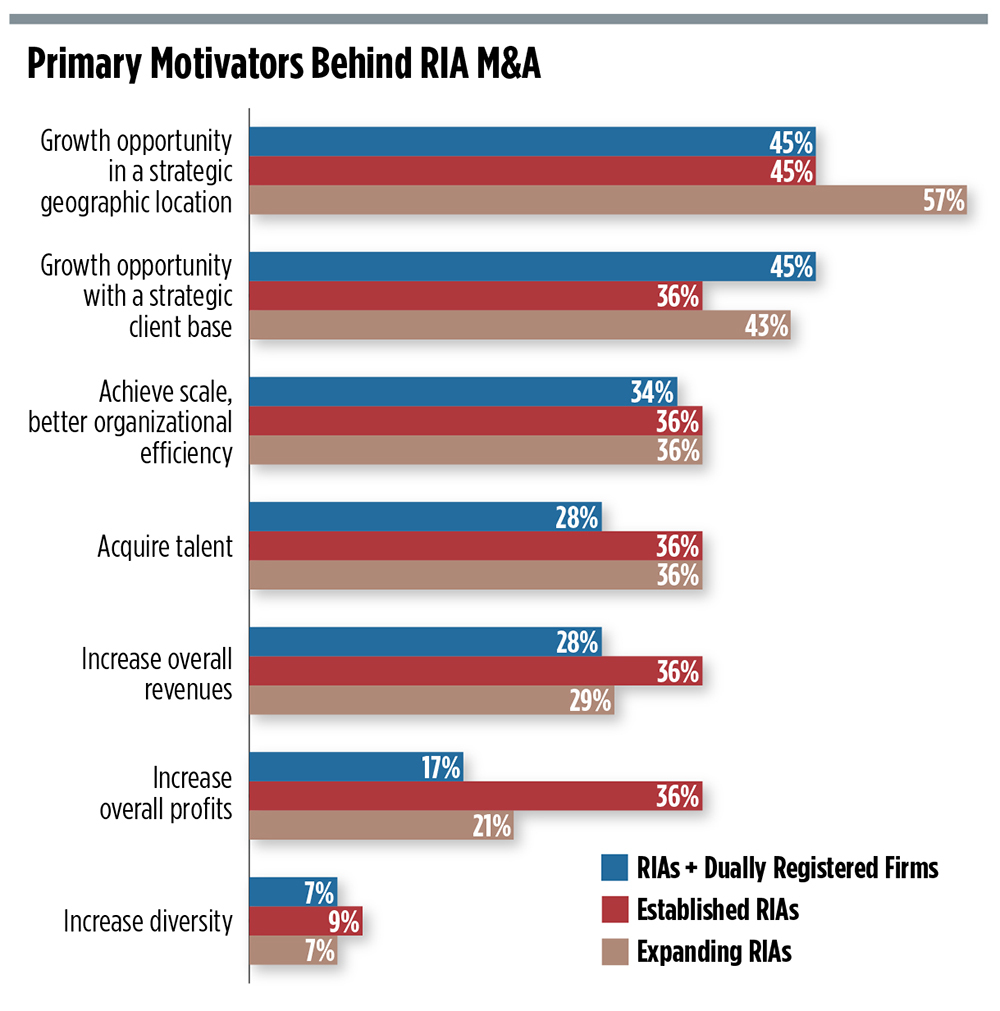

While talent acquisition is a major factor in the motivation behind much of the surging M&A activity—tying with the desire to achieve scale and better organizational efficiency among established and expanding RIAs—it was found to be significantly less important than the pursuit of geographic and client growth opportunities. Also motivating M&A was a desire to increase overall revenue, profit and diversity.

Forty-five percent of all RIAs said they anticipate making some kind of acquisition in 2022, be it another firm or a team of breakaway advisors.

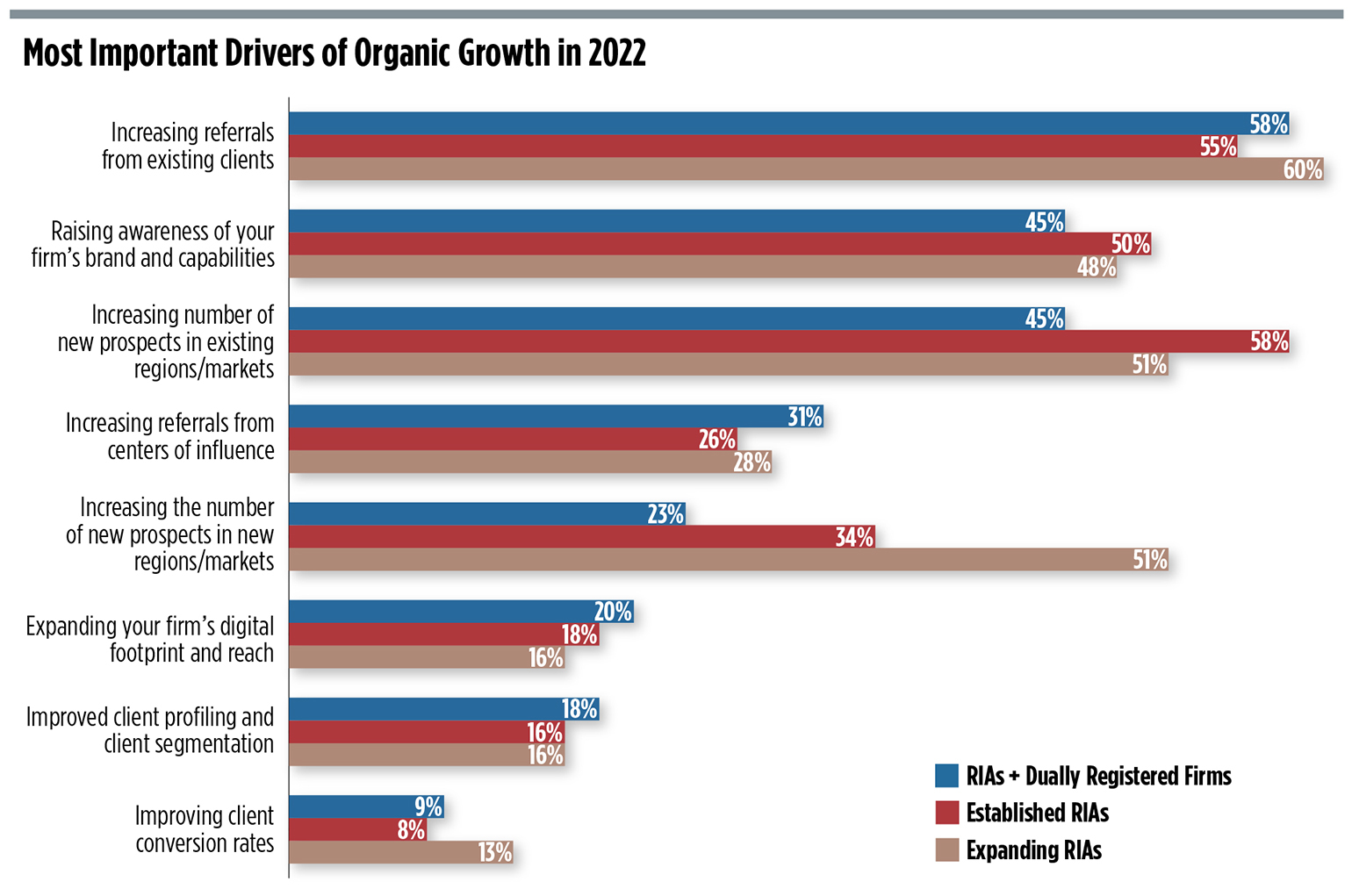

Even with the breathtaking results being achieved through M&A, the average RIA believes that one-third of its overall growth in 2022 will come from organic growth activities—and expanding RIAs said that roughly half of their growth will be generated organically.

Organic growth is expected to be achieved primarily through referrals and brand awareness, followed by increasing the number of new prospects in existing markets using marketing activities that will focus on social media and networking events, both virtual and in person.

Contributions to publications such as this one, paid advertising, podcasts, direct mailing and traditional media will also be used to drive organic growth in new and existing markets.

The embrace of marketing and brand awareness represents a shift for many RIAs, according to the report, many of which have relied on one-to-one client acquisition tactics rather than broader “one-to-many” marketing strategies.

In the second quarter of this year, an update to the RIA Edge Study will explore marketing and organic growth in greater detail.

[ad_2]

Source link