Lenin, the Russian revolutionary leader, is said to have remarked that the best way to destroy the capitalist system was to debauch the currency.

The Bank of England currently forecasts that inflation in the UK will soon top 10 per cent. This falls short of outright currency debasement. Yet we live in an economy where the capitalists are no longer a tiny group of rentiers and rich business moguls but ordinary people with savings tied up in pension schemes.

With the general price level rising at the fastest rate since the 1970s there is a serious threat to UK retirement incomes.

Behind Lenin’s aphorism is an important political truth, namely that inflation brings about a transfer of wealth from creditors to debtors that is unsanctioned by democratic or legal process.

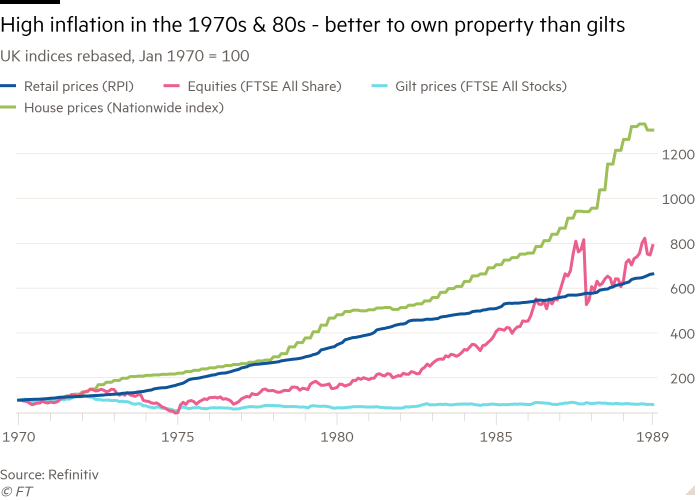

Because inflation is a monetary phenomenon, the big winners in investment terms tend to be owners of assets that act as a residual sink for the excess money created by central banks. Real assets such as property are an obvious example. So, too, are energy companies and commodities including gold.

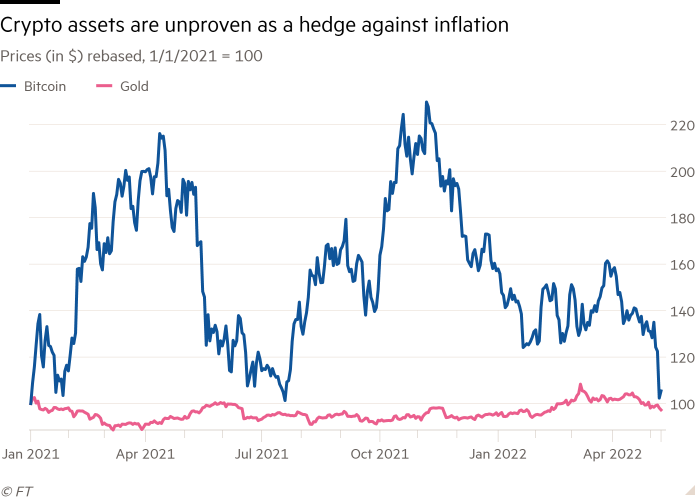

Some argue that crypto assets fall into the same category. Certainly they have been boosted by ultra-loose monetary policy since the 2007-09 financial crisis. But, as I argued here in a piece on the respective investment merits of bitcoin and gold in April, the record of crypto as an inflation hedge is unproven and bitcoin’s performance in recent months has been disastrous in terms of providing a haven against spiralling prices.

The big losers from inflation are fixed-interest investments such as gilts — a core holding in British pension funds. The capital value and income stream shrink in real terms and tend to underperform equities when price levels are rising fast.

Debtors who have borrowed on fixed-price contracts enjoy a windfall, notably the government. And since much property is financed by fixed-interest debt, property investors can experience a double win as the value of the asset goes up while the real value of the related debt goes down.

For savers and pensioners, this underlines the importance of avoiding bonds, and shifting to real assets and value equities which tend to outperform in inflationary times.

Where possible, it makes sense to fix mortgage rates for longer while nominal interest rates are still at historically low levels and real interest rates will remain negative in the short to medium term.

The losers from inflation are people on any kind of fixed income — such as annuities — and householders who rent rather than own.

No perfect answers

But there are no perfect investment antidotes to inflation and even property is not a foolproof protection, as experience in the late 1970s demonstrated. In my book That’s the Way the Money Goes, published in 1982, I chronicled how many large pension funds incurred huge losses in real estate. The ICI and Unilever pension funds, for example, took devastating hits from their investment in speculative property development in continental Europe, undertaken in both cases in joint ventures with dodgy entrepreneurs who had been severely criticised by Department of Trade inspectors.

Back then, pension funds were minimally regulated and not required to reveal their finances. Fund managers were panicking as the retail price index reached a year-on-year peak of 26.9 per cent in 1975 and doing inadequate due diligence in their search for havens against the inflationary storm.

Today, there is greater transparency and funds are so heavily regulated that the risk of such accidents is lower. But management matters. Property does not lift all boats during periods of high inflation.

Note that there were no index-linked gilts in the 1970s. Yet today, paradoxically, index-linked securities fail to provide any protection against current 7 per cent inflation in the short run.

This is because they are driven by relative real yields rather than inflation per se. That is, when the yield on nominal gilts rises closer to the rate of inflation the negative real yield falls. So the negative yield on index-linked bonds has to shrink to remain competitive, causing the price to fall. The longer the maturity, the greater potential for loss. Earlier this week the price of the 2068 index linked gilt was down more than 44 per cent since late November — an astonishing plunge.

Investment returns in the first quarter of this year, when investors came to distrust the central banks’ claim that inflation was transitory, confirm this broad picture around winners and losers.

According to consultants LCP, fixed-interest gilts delivered a return of minus 12.3 per cent, while index-linked showed minus 6.4 per cent. Overseas equities delivered minus 2.5 per cent, trading under the shadow of rising interest rates and the war in Ukraine. UK equities were positive at 0.5 per cent, no doubt reflecting the energy, commodity and financial services bias of the UK stock market, while commercial property led the field with a positive return of 4.6 per cent.

Some protection in defined benefit funds

The impact of inflation on pension scheme members varies according to the nature of the scheme and members’ individual circumstances. Defined benefit schemes, managing £1.9tn of assets at the start of the decade, provide good protection for those still in work because the pension promise is in most schemes related to final pay.

For defined benefit scheme members their fund’s investment performance is thus of no great importance — unless, that is, the fund is in deficit and the employer is at risk of bankruptcy. If the sponsoring company becomes insolvent and the scheme does not have sufficient assets to meet its pension commitments the official Pension Protection Fund will provide a safety net. But for many the compensation provided by the PPF will fall short of the level they expected.

Once retirement is reached there is a hierarchy of pension winners and losers. The biggest winners are civil servants and public sector workers whose defined benefit pensions are fully indexed. Where the retail price index is the yardstick they are arguably on a gravy train because the RPI is based on an outdated arithmetic formula (called the Carli index) which official statisticians claim results in systematic overstatement of inflation.

Where trust deeds permit, pension schemes are now required to change the indexation benchmark to the more realistic consumer price index. But there is a residue of pension scheme members for whom the RPI will continue to deliver an unwarranted bonus, creating inequality within many funds. A further complication is that neither index may be representative of a given individual’s spending patterns.

Very few private sector defined benefit schemes offer complete indexation of benefits. They usually incorporate an inflation cap, typically up to 5 per cent, so pensioners are dependent on trustees paying discretionary increases to shore up their living standards in a high inflation environment. The ability of trustees to do this is constrained by the high proportion of assets devoted to liability matching which involves pairing the timing of pension outflows with bond cash flows around the same dates.

The Office for National Statistics estimates that at the end of 2019 nearly 70 per cent of direct investments in private sector schemes were in long- term debt securities of which three-quarters was in gilts. This means that the return-seeking portion of these portfolios, out of which discretionary pension increases can be paid, is limited. That could be a serious impediment to such increases if inflation were to go much higher.

Defined contribution plans at the mercy of markets

With defined contribution (DC) or money purchase plans, investment returns are crucial to the level of pension that scheme members receive. The latest pension survey by the ONS noted that there are now 22.4mn people in DC schemes compared with 18.3mn in DB.

This reflects the closure to new members of countless private sector DB schemes as employers baulked at the cost supporting them. They have thereby shifted the risk of pensions funding to the employees, although they continue to pay contributions into DC schemes.

Because this switch from DB to DC is relatively recent, gross assets of DC schemes were only £146bn at the end of 2019. So 94 per cent of the total gross assets in occupational pensions in the UK are still held in DB schemes.

Most DC money is in pooled funds. While members are offered a menu of investments from which to choose, the majority go for a default lifecycle option. For most of an employee’s career this will involve a bias towards growth assets such as equities. Much of this will be in passive funds that match market indices. So for the purpose of beating inflation, scheme members have a binary dependence on market movements and the skills of active asset managers. Then, as retirement approaches, the portfolio is rebalanced towards so-called safe assets such as nominal and index-linked gilts.

For those in the period between de-risking and retirement this ineptly and misleadingly named de-risking process is a formula for value destruction at a time of rising inflation because interest rates rise and bond prices fall. As mentioned earlier, the scope for capital loss in index-linked gilts is considerable.

Of course, scheme members who are about to make the shift away from a growth bias today will have the benefit of cheaper bond market valuations after the recent inflation-induced falls in gilt prices. Yet there is a strong likelihood of further falls if gilt market yields revert to anything remotely near historical norms.

Rather than taking cash or converting their pension pot into an annuity most scheme members taking the default option will end up with a drawdown arrangement where they can take money out of their fund at times of their own choosing to suit their retirement needs. The asset allocation at retirement will usually consist of a mix of equities and bonds.

The big worry then is whether stagflation — a combination of inflation with low growth — will play havoc with the portfolio because low growth is bad for equities while inflation is bad for bonds. The benefit of portfolio diversification may therefore be lost.

Central bank policy switch raises big questions

Today’s DC scheme members are substantially at the mercy of policy driven markets. After years in which asset prices have been artificially inflated by the asset buying programmes of the central banks — quantitative easing — central bankers have changed gear. In the past fortnight the US Federal Reserve and the Bank of England have raised interest rates while the European Central Bank is widely expected to raise rates in July. All three are expected to shrink their balance sheets, withdrawing their buying power from the bond markets.

Signals from the Fed weigh heavily on global markets including the UK. According to former New York Federal Reserve president Bill Dudley the Fed wants a weaker stock market and higher bond yields to help tighten financial conditions in the face of soaring inflation.

The move to quantitative tightening will raise a big question as to what level of yields will be needed to attract non-central bank buyers to fund high government spending after the pandemic.

Another question is how far inflation expectations have become entrenched or “de-anchored” in the jargon. The big lesson from the 1970s was that if central banks do not act fast to curb surging inflation and expectations become unmoored it takes a bigger recession to cure the inflationary disease. Today’s high inflation numbers suggest that they have left remedial action very late. Engineering a soft landing will be an intricate and dangerous balancing act.

Misery for annuity holders

That brings us to the bottom category in the hierarchy of pensions winners and losers. This concerns DC scheme members who have converted their pension pot into fixed annuities over the past dozen years. In effect, they have been stiffed twice over by the central banks. First, because quantitative easing led to overblown bond market prices and thus dismally low yields from which to pay annuities. Second, by going slow in their assault on inflation the central banks have further undermined the real value of already low annuity incomes.

Fortunately, the number of DC annuitants will be very low because so many scheme members have taken the default lifecycle drawdown option. But that will not mitigate the misery of those who, not unreasonably, sought a secure and predictable retirement income.

However, the scope for accidents among those who have gone the drawdown route is now very high because of the uncertainties created by soaring inflation. Working out the need for cash in retirement is a challenge in non-inflationary times. Now it is even tougher, with the additional worry that a shortage of care home workers could mean that the cost of late life care will rise much faster than consumer price inflation.

With the cost of living crisis raging, workers’ pension contributions will be harder to keep up. Former pensions minister Sir Steve Webb points out that there is a real risk that cost of living pressures may lead workers aged 55 and over to take advantage of “pension freedoms” legislation to raid their pension pot before they reach retirement age. In a letter to The Times, he says that with a growing number of workers getting no inflation protection from their workplace pension, the role of the state pension will become even more important. So will the need for next year’s state pension increase to properly compensate for inflation.

Inflation reallocates risk

To return to Lenin, capitalism is not at risk from today’s inflationary pressures. But the hierarchy of pensions winners and losers demonstrates the random and arbitrary way in which risk is being reallocated within society.

With so many DC scheme members putting too little into their pension pots to secure a half decent retirement income even before this burst of inflation occurred, a looming retirement poverty problem will now be exacerbated. That underlines the imperative need to bring inflation back under control.

Comments are closed, but trackbacks and pingbacks are open.