[ad_1]

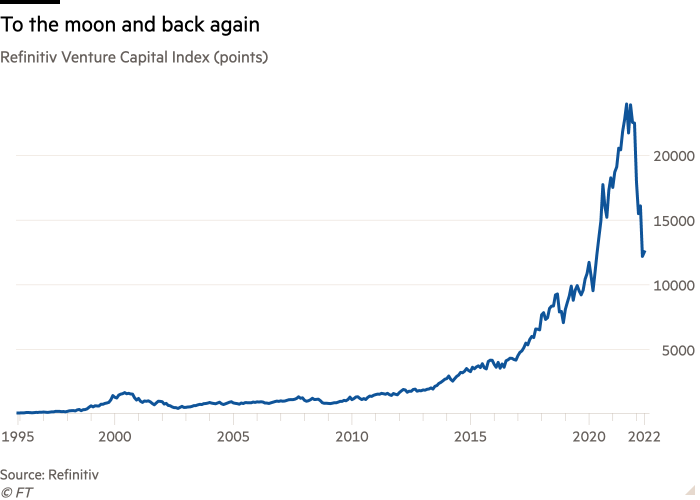

Back in the halcyon days of . . . early 2021, it looked like venture capital was the hottest game in town.

Hedge funds were piling in. Even private equity firms were getting involved in early-stage company investing. Investors loved the combination of fat returns and the lack of volatility in private markets. But the VC cycle now looks like it has hit a sudden stop.

Refinitiv’s venture capital index, which uses the performance of individual VC portfolios and listed stocks to mimic the performance of the broader industry, tanked another 24.2 per cent in April, taking its 2022 loss to a comically bad 45.8 per cent (NB, the Nasdaq is “only” down 19.7 per cent YTD).

That is comfortably its worst monthly performance since worst of the dotcom bust two decades ago.

Of course, a lot of venture capital funds are unlikely to be marking down their books to anywhere near these levels. Some may just be doing better than others (performance persistence is higher in VC than in any other investment industry), but the advantage of private market accounting and negotiated and infrequent funding rounds means that valuations and returns can be massaged a little.

There might even be a bit of schadenfreude at the pain suffered by Tiger Global lately, which many venture capitalists saw as an annoyingly uppity interloper-dilettante in Silicon Valley.

But the reality is that the bottom has dropped out of tech stock valuations lately — both public and private — and anyone who is not marking down their positions heavily might actually unnerve investors more than assuage them.

If markets steady themselves then that may be forgiven and even applauded. After all, the artificial lack of volatility from illiquidity is a private capital feature not a bug for most investors.

But the danger is that we are on the cusp of what Abraham Thomas earlier this year described as a “Minsky Moment in Venture Capital”, where bad performance reverses investor inflows and both start feeding on each other.

His Substack from February is worth reading to understand how the velocity of funding rounds might produce something like a VC Minsky moment, despite the absence of leverage and liquidity mismatches. Here’s his simple diagram illustrating the twin-flywheel trend in recent years.

Thomas stresses that the acceleration of the venture capital cycle — with funding rounds being bigger and faster than in the past — might not alter the fundamental power-law dynamic that rules the industry. Perhaps the recent boom has been entirely rational.

But his conclusion seems pretty on the money.

If my hypothesis about time is true, this could be dangerous. If compressed timelines are the driver of Minsky inflows into venture, then anything that delays funding cycles could precipitate a painful reversal. First some start-ups delay fund-raising because they need to grow into their valuations; then the VCs who invested in those start-ups have to delay their own fund-raising with LPs because they don’t have the requisite markups; then the LPs reconsider their (hitherto ever-increasing) allocations to venture because the latest returns are uninspiring; and before you know it, there’s an exodus from the asset class. Minsky giveth, and Minsky taketh away.

[ad_2]

Source link