[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

The global economy will suffer a hit to growth and higher inflation this year as a result of Russia’s invasion of Ukraine, the IMF said on Tuesday.

In its World Economic Outlook, the fund said prospects had “worsened significantly” with countries closest to the war likely to be hardest hit. But it warned that risks had intensified everywhere, raising the chances of even lower growth and more rapid price rises, and upending the fund’s view that there would be a stronger recovery from the pandemic this year.

The IMF’s forecasts showed global growth of gross domestic product this year of 3.6 per cent, down 0.8 percentage points since the fund’s January projections and 1.3 percentage points lower compared with six months ago. In 2021, global growth was estimated at 6.1 per cent, the fund said.

In a simulation exercise, the IMF warned an immediate oil and gas embargo against Russia would raise inflation further, hit European and emerging economies hard and require even higher interest rates, including in the US.

-

Latest news: Russian forces are using “powerful anti-bunker bombs” to shell the Azovstal steel plant in Mariupol, where civilians are sheltering underground.

-

Military developments: Russia said it had begun a new phase of its invasion of Ukraine as officials in the eastern region of Donbas urged civilians to flee.

-

Markets: The UK plans to strip Russia’s stock exchange of a status that allows investors to claim tax relief on trades.

-

Energy: Can the EU give up Russian gas? The FT’s data visualisation team looks at the feasibility of the bloc’s plan to wean itself off Russian energy imports.

Thanks for reading FirstFT Asia. Here’s the rest of today’s news — Emily.

Five more stories in the news

1. Netflix sheds subscribers for the first time in a decade Netflix shares fell more than 20 per cent after it warned its decade-long run of subscriber growth had ended in the first quarter and admitted that it is becoming “harder to grow membership” in many markets.

2. Buyout groups won’t write equity cheque for Musk’s Twitter bid Elon Musk’s $43bn bid to take Twitter private is struggling to draw interest from several large institutions with the financial firepower to pull off such a large leveraged buyout in part owing to concerns over whether the social media group can become more profitable.

3. Yen’s slides to fresh 20-year low The Japanese currency hit a new 20-year low yesterday as it slid for the 13th straight day, ratcheting up the stakes for the Bank of Japan on whether to maintain its ultra-loose monetary policy stance.

4. China unveils new economic support measures China’s central bank unveiled 23 measures to support the economy after official data highlighted the worsening impact of a wave of lockdowns on consumer activity. The measures encouraged financial institutions to support local government infrastructure projects, the country’s struggling property sector, and provide financial services to industries hit by the pandemic.

5. EV battery maker signs $9bn Indonesia supply deal A group led by South Korea’s LG Energy Solution, the world’s second-biggest EV battery maker, will invest $9bn in Indonesia to build a mines-to-manufacturing electric vehicle supply chain, as battery makers look to reduce their reliance on Chinese suppliers and mitigate commodity price rises.

The day ahead

Johnson to fly to India UK prime minister Boris Johnson is scheduled to fly to India on a trade and diplomatic mission, leaving behind a Westminster swirling with criticism of his conduct and a vote looming on whether he deliberately misled the House of Commons in the partygate scandal.

Morrison-Albanese debate Australian prime minister Scott Morrison will face Labor leader Anthony Albanese in their first televised debate ahead of the May 21 election. Use this video to catch up on what’s on the ballot. (7 News, Guardian)

Macron-Le Pen debate Polls now show Macron’s lead over Le Pen widening slightly to 54 per cent to 46 per cent ahead of a televised debate on Wednesday. Analysts predict that the debate will be crucial in swaying undecided voters or those who may abstain.

Our latest newsletter, Inside Politics, launched today. Join us every weekday morning for insider analysis of the latest political news, plus polls and a dose of culture — all written by our new columnist Stephen Bush.

What else we’re reading

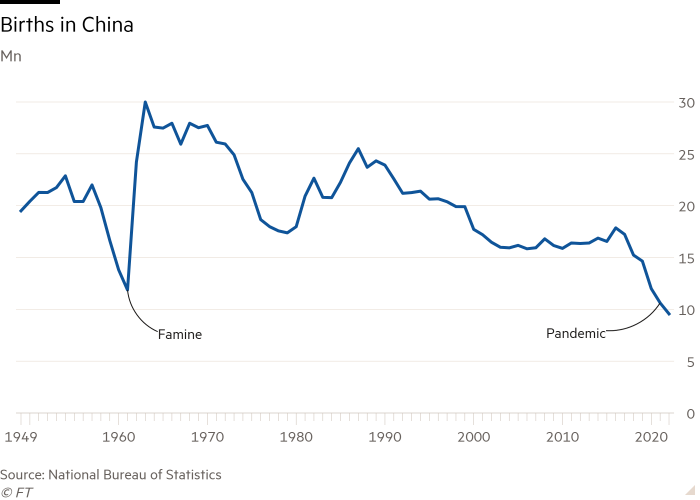

Pandemic accelerates fall in China’s birth rate Before the pandemic, China was already the centre of the global baby bust, but the fall in birth rates has accelerated in the two years since the virus struck. Just 10.6mn babies were born in China last year, the lowest number recorded since the Communist party took power in 1949.

Musk’s bid will change Twitter even if it fails Elon Musk’s interest in Twitter has focused global attention on the company in a way that makes it hard for executives to claim nothing can be improved. The way the business is run and the experience of its users are both up for grabs, writes Elaine Moore.

A culinary tour of Hong Kong with chef Simon Rogan The British superchef shares his highlights of the Hong Kong food scene, from mooncakes to Michelin stardom — via the best fried chicken in town and creative odes to classic Cantonese cooking.

Interview: Korean Air urges government to ease Covid restrictions Walter Cho, Korean Air’s chief executive, has urged South Korean authorities to lift pandemic restrictions on air passengers. In an interview with the FT he warned the country was opening “too slowly” to beat regional rivals in the race to capture pent-up demand.

Should I spend, save or invest my bonus? The squeeze on living standards and turbulent world markets mean it’s even more important to use your bonus wisely. In this episode of Money Clinic, Claer Barrett discusses comments from FT readers who bravely bared their financial souls to tell us whether they intended to spend, save or invest their bonus.

What would you do with a bonus? Tell us in our latest poll.

Your feedback

Thanks to readers who responded to last week’s prompt asking whether you support Lawrence Wong as Singapore’s next leader. Here’s what one reader in the city-state had to say:

When I heard the appointment of Lawrence Wong, the first impression was one of relief — relief in that a good choice has been made. As a resident of Singapore for over 15 years, I have valued the safety, quality of life and the sensible and stable leadership the country offers. The past two years have been as difficult for us as for others globally but we have had a sense of being ‘looked after’ and ‘led with care’. Wong is the face of the Covid Multi-Ministry Taskforce responsible for steering us through the pandemic and alongside the others in the team, has done a remarkable job. — FirstFT Asia reader in Singapore

Recommended newsletters for you

Inside Politics — Join us for analysis of the latest political news, plus polls and a dose of culture — by new columnist Stephen Bush. Sign up here

Working It — Discover what’s shaking up the world of work with Work & Careers editor Isabel Berwick. Sign up here

Disrupted Times — Your essential FT newsletter about the changes in business and the economy between Covid and conflict. Sign up here

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here

[ad_2]

Source link