[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

China’s economy grew faster than expected in the first quarter but official data revealed a contraction in consumer activity as lockdown measures to counter the spread of Covid-19 weighed on the country’s outlook.

China’s gross domestic product rose 4.8 per cent compared with the same period a year earlier, after expanding 4 per cent in the final three months of 2021. On a quarter-on-quarter basis, GDP grew 1.3 per cent.

Retail sales, a gauge of consumer spending, fell 3.5 per cent in March — its first contraction since July 2020 — as authorities hardened restrictions to counter the country’s worst coronavirus outbreak in more than two years.

The data will add to pressure on the government of Chinese president Xi Jinping, which has reaffirmed its commitment to a zero-Covid policy despite mounting costs and disruptions in the biggest cities. Infections across China rose in April and Shanghai, its main financial hub, has remained largely sealed off.

-

The lockdown effect: The lockdown in Shanghai began in late March, meaning its full impact will not be recorded in the first quarter report, which did take into account less severe lockdowns in the manufacturing hubs Shenzhen and Jilin.

-

Wealthy seek to leave: Chinese immigration consultants say inquiries from wealthy individuals trying to leave have surged following the lockdown of Shanghai, underscoring frustration with Beijing’s zero-Covid strategy.

What do you think of Beijing’s zero-Covid strategy? Share your thoughts with me at firstft@ft.com. Thanks for reading FirstFT Asia. — Emily

The latest from the war in Ukraine

Five more stories in the news

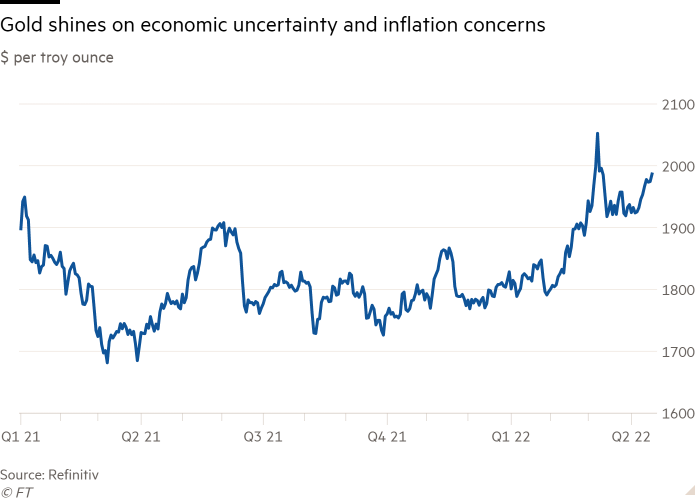

1. Gold rises to highest level in a month Gold prices climbed and US stocks slipped on Monday as worries over a weakening global economy were heightened by signs that coronavirus lockdowns had clouded the outlook for growth in China.

2. Whisky on the table as Johnson heads to New Delhi Leading Scotch maker Chivas Brothers says it aims to double exports to India if New Delhi eliminates whisky tariffs, a top UK demand in bilateral trade talks ahead of prime minister Boris Johnson’s visit to India this week.

3. Sri Lanka’s president appoints new leaders President Gotabaya Rajapaksa appointed 17 cabinet members yesterday as protests over alleged economic mismanagement continue to roil the nation. Rajapaska chose younger leaders to appease the public, but his 76-year-old brother, Mahinda Rajapaksa, will remain prime minister. (Straits Times)

4. Marine Le Pen rejects reports of EU funds misuse French far-right presidential challenger Marine Le Pen has dismissed allegations that she misappropriated tens of thousands of EU funds as “dirty tricks”, less than a week away from a tight election race against Emmanuel Macron.

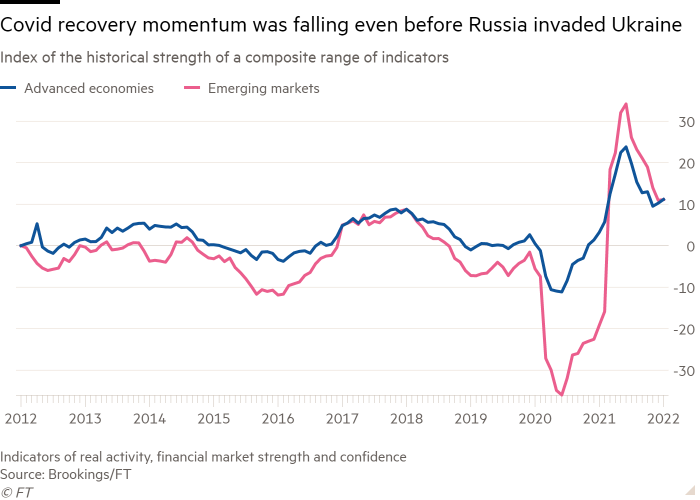

5. UK braced for prolonged period of stagflation The risk of a prolonged period of low growth in gross domestic product coupled to high inflation in the UK has increased after consumer prices surged more than expected while economic growth slowed to a crawl.

Coronavirus digest

-

A US judge has halted the Biden administration’s mask requirement for public transport passengers.

-

China’s zero-Covid policy has taught the world that it is no longer possible, if it ever was, to combat the virus with suppression alone. Ways to live with the virus must be found, our editorial board writes.

-

The number of births in advanced economies has largely rebounded to pre-pandemic levels, an FT analysis shows — a recovery partly due to stimulus policies.

The day ahead

Indonesia central bank meeting Policymakers at Bank Indonesia will meet and make their interest rate decision.

Johnson faces UK parliament A defiant Boris Johnson will face MPs for the first time since being fined over the “partygate” affair, with allies privately criticising the Metropolitan Police’s handling of the issue. The UK prime minister will apologise to MPs but will insist that he was not aware he was breaking his own Covid-19 lockdown rules.

IMF World Economic Outlook With inflation hitting a fresh 40-year high in the US and a 30-year high in the UK this week, the IMF said its forecasts set to be released today would also show rapid price increases would be more persistent than it previously thought.

Join us for the FT’s Crypto and Digital Assets summit on April 26-27. Register today to be part of a critical conversation with the world’s global financial and corporate elite, as they carve out the path ahead for bridging traditional finance and the crypto leaders of tomorrow.

What else we’re reading

US-China Tech Race: Shock and Awe In the latest episode of this Tech Tonic season about US-China tech rivalry, the FT’s US-China correspondent Demetri Sevastopulo tells the inside story of his scoop on China’s secret hypersonic weapon test and how it changed geopolitics.

Asian Americans take safety into their own hands after violent attacks Since the pandemic, anti-Asian hate in the US has escalated. Amanda Chu speaks to Asian Americans in New York City, where the police department estimates that hate crimes against them jumped more than 360 per cent in 2021.

OK, boomer: generations aren’t real. Class is. Desperate individuals — like marketing professionals or opinion columnists who have passed their deadline — love to talk about “generations” because they are neat ways to sell someone something they might not otherwise buy, writes Stephen Bush. For more from Stephen, sign up here for our latest newsletter, Inside Politics.

India’s biggest-ever merger The proposed $40bn merger between India’s biggest private sector bank and mortgage provider has been driven by tighter regulation of the country’s shadow banking sector, Deepak Parekh, chair of HDFC Bank and Housing Development Financing Corporation, told the FT.

Donald Trump and the Republicans’ midterm dilemma The Republican Senate primary in Pennsylvania next month is becoming a pivotal event in this year’s midterm elections and could determine which party controls the upper chamber of Congress. US president Joe Biden defeated Donald Trump in 2020 in the state, but only by a razor-thin margin.

Fashion

Hard luxury drives the retail market because watches and jewellery tend to retain, or even increase, their value. Historically, clothing has been a poor investment, losing about 90 per cent of its value at the point of purchase. But a boom in online retail and changing attitudes towards pre-owned have given rise to vast online marketplaces for second-hand goods.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here

[ad_2]

Source link