[ad_1]

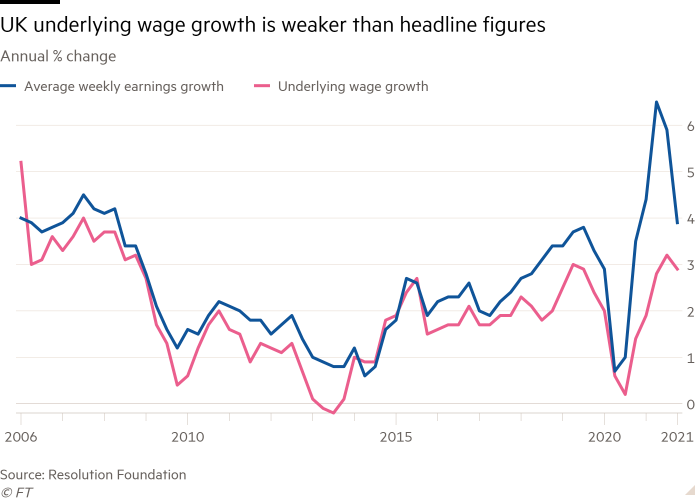

Underlying wage growth in the UK is weaker than headline official statistics show because pay increases have been boosted by the end of the furlough scheme, according to a think-tank.

The Resolution Foundation says pay rises are similar to pre-pandemic levels despite soaring prices, reducing the need for the Bank of England to increase interest rates to curb inflationary pressures.

In January, nominal pay excluding bonuses grew by an annual rate of 4.1 per cent compared with an average of 2 per cent in the decade prior to the pandemic, according to data from the Office for National Statistics.

But the Resolution Foundation’s analysis, published on Saturday, shows the official figures were boosted by the end of the furlough scheme in September.

Furloughed workers received 80 per cent or less of their usual pay, thereby boosting growth rates as they returned to full pay.

After adjusting for the furlough schemes and for factors such as the rise in the number of low-paid workers as hospitality and retail reopened, underlying wage growth averaged only 2.7 per cent in 2021, the same as in 2019, before the pandemic.

This is despite inflation now running at a 30-year high, suggesting that workers are taking the hit from rising consumer prices. The think-tank calculated that for the last quarter of 2021 about 1 percentage point of the wage growth was due to furloughed workers moving back on to their full pay.

Nye Cominetti, senior economist at the Resolution Foundation, said that headline figures “give a misleading impression of pay growth. Given the tightness of the labour market, pay growth is best seen as normal rather than exceptional, once the impact of the end of the furlough scheme is taken into account,” he added.

The ONS is well aware of the issues and warned that “interpreting average earnings data is difficult at the moment”. The effects of the furlough scheme are waning as the number of furloughed workers decreased last year, but they will last until the autumn because growth this year is calculated comparing it with 2021.

This “matters hugely”, argued Cominetti because the pace of wage growth is a key factor for the Bank of England when setting monetary policy, particularly at present when the country faces exceptional price pressures.

The concern for policymakers is that high inflation expectations and a tight labour market are prompting a wage spiral that could result in a more prolonged period of high inflation.

The UK labour market is indeed short of workers. The unemployment rate is close to record lows, the unemployment-to-vacancies ratio is the lowest on record, and workers are moving jobs voluntarily at record-high rates.

However, the findings of the Resolution Foundation show that underlying wage growth is not faster than when the labour market was in similar conditions in 2019, despite much higher price pressures.

Similar modelling by the Bank of England, but based on the private sector only, showed higher underlying wage growth than the Resolution Foundation. However, in both analyses “there is no evidence yet of accelerating pay growth to match fast-rising prices”, the think-tank noted.

The Resolution Foundation also estimated that nominal wages would grow by an average of 5 per cent in 2022.

This means that “with inflation set to reach 8 per cent in the coming months, most workers’ earnings will fall in real terms — even with a 6.6 per cent rise in the minimum wage — further squeezing living standards in the months ahead”, said Cominetti.

[ad_2]

Source link