[ad_1]

Three steps to get approved for a home loan

If you’re wondering how to get approved for a home loan, you’re in the right place. This guide walks you through the approval process step-by-step, including:

- Getting preapproved by a lender

- Completing a full application

- Securing final approval

Here’s what you need to know at each stage of the process.

In this article (Skip to…)

1. Get preapproved by a lender

Mortgage preapproval is the very first stage of the home buying process. It’s basically a trial run that will tell you how likely you are to get approved for a mortgage and how much you’re qualified to borrow.

When it comes to house hunting, your preapproval letter is very important. It:

- Tells you how much you can afford to pay for your next home. So, you only look at homes you can afford and won’t be disappointed if you find your perfect place and it turns out to be too costly for you

- Makes sellers and agents take you seriously. Most sellers will only consider an offer from a preapproved buyer, especially in a competitive market

You can also get prequalified if you want a quick estimate of your home buying budget. The process is typically faster and easier than a preapproval. But getting prequalified won’t give you the power to make an offer on a house like a preapproval will.

How to get preapproved

Getting a preapproval is itself a three-step process:

- Pick a lender: We can put you in touch with some or you might choose your existing bank or a recommendation from a friend or family member. At this point, you’re not making a commitment and will have a chance to comparison shop later

- Complete a preapproval application: This might take only 10-20 minutes online. If your lender thinks you might be better suited to a different type of mortgage, it might suggest you consider that

- Document your identity, income, and assets: Most lenders now allow you to upload your documents online for a quick preapproval decision

Provided you meet basic home loan requirements, you’ll then receive your preapproval letter. Nowadays, some lenders can provide those in hours or minutes. You can show this letter to real estate agents and sellers as proof that you’re a viable buyer.

For more details on each step, read How to get a mortgage preapproval.

Can you get preapproved more than once?

Preapproval letters have expiration dates. And you may need to renew yours several times during the house-hunting process. Don’t worry; lenders are used to that. But always keep your letter current. The last thing you want to do is find your perfect home, make an offer, and then discover your letter’s expired.

Note that these letters are tied to the applicable mortgage rate at the time they were issued. If rates generally have risen since then, you may be able to borrow less. If they’ve fallen, you may be in line for a bigger mortgage. Call your lender to stay up to date.

2. Complete a full application

Getting preapproved means your lender is willing, in principle, to lend to you up to a certain amount of money. But after signing a home purchase agreement, you’ll need to complete a full application for a mortgage on the property you’re buying.

This is the moment when you should comparison shop for the best mortgage lender and rates. In other words, you should apply to several lenders to find which offers you the lowest mortgage rate and best overall deal. Seriously, by shopping around, you could save thousands in just a few years.

If you stick with the lender that preapproved you, you’ll likely have to resubmit all or most of the documents you provided earlier just to be sure it has the latest information.

And, of course, if you switch lenders, you’ll need to provide the whole lot.

If you want your application approved quickly, gather all the documents you’ll need in advance. And scan them if you’ll be uploading them or emailing them. Or make copies if you’ll be mailing them or dropping them off at a branch. The faster you send them in, the sooner your mortgage can be approved.

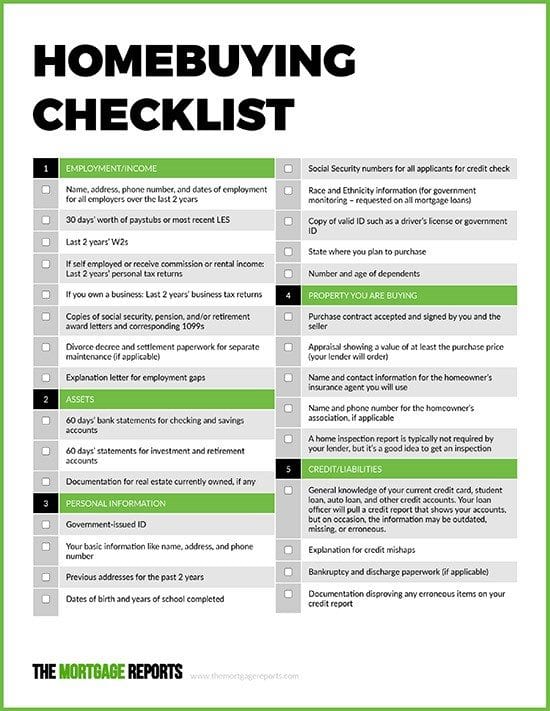

Here’s a checklist of everything you’ll need to get approved for a home loan.

3. Get final approval from the underwriter

“Underwriting” is the final stage of the mortgage approval process. During underwriting, the lender does a thorough review of your credit, income, assets, debts, and your future home. A specialist underwriter combs through the paperwork, checking for red flags and hidden risks.

During this stage of the mortgage process, be as patient and responsive to the underwriter’s queries as possible. The sooner you resolve issues, the more quickly you can be cleared to proceed to closing.

Many applications sail through with few if any queries. But the more complicated your application is, the more issues your underwriter is likely to raise. This tends to be the case with applicants who are self-employed, rely a lot on tips and bonuses, or who have a troubled employment history.

Requirements to get approved for a home loan

Bottom line, a mortgage lender wants to know you can afford the monthly payments on your new home and that you’re a responsible borrower who consistently pays their bills on time. To that end, the underwriter will look carefully at four criteria:

- Credit score and credit history: You generally need a score of 580-620 or higher and a clean credit history (no missed payments, foreclosures, bankruptcies, etc.)

- Down payment: Expect to need at least 3% down, though a bigger down payment can make it easier to qualify

- Existing monthly debts: Your debt load, including your new housing costs*, needs to be manageable. This includes things like auto loans, student loans, childcare/alimony, and minimum credit card payments

- Employment and income history: Your lender will want to see at least a two-year history of stable income and employment

*Your housing costs include monthly mortgage payments (principal and interest), property taxes, and homeowners’ insurance, plus any mortgage insurance and/or homeowners’ association dues.

Of course, your underwriter will be interested in other things, such as any assets you have. But those four will be their main focus.

Sometimes, being strong in one of those four can make up for weakness in another. For example, having an unusually large down payment can earn you a bit of leeway over your credit score or existing debts. But many mortgage programs have set rules over these that the lender can’t bend.

For more information, see: Basic requirements to buy a house.

How to get approved for a home loan: FAQ

Prepare all the documents you’ll need before you apply and be responsive to queries. Choose a lender with an end-to-end digital mortgage process if you want the speediest approval or preapproval.

The main barriers to mortgage approval are too low of a credit score, too small of a down payment, too high of a debt-to-income ratio, or an unreliable employment history.

You’ll need to bring a variety of financial documents to the bank for a home loan, including past years’ W2s or 1099s, tax returns, pay stubs, and bank statements. The lender will also pull your credit and verify your employment status. Most lenders have digital application portals nowadays where you can upload these documents digitally instead of bringing physical copies to a brick-and-mortar office.

FHA loans have the lowest score thresholds: 580 with a 3.5 percent down payment or 500 with a 10 percent down payment. But you may be better off with a loan from Fannie Mae or Freddie Mac and their minimum score is 620.

There’s a hard credit check during the preapproval process, but this typically dings your credit score by only five points or less. And don’t worry about comparison shopping. “Within a 45-day window, multiple credit checks from mortgage lenders are recorded on your credit report as a single inquiry,” says the Consumer Financial Protection Bureau (CFPB).

Technically, no. However, sellers and real estate agents are unlikely to take you seriously if you can’t show a current preapproval letter. If you’re making an offer on a home, the seller and their agent want to know you’re a serious buyer with financing lined up who can afford the property.

Get approved for a home loan

If you’re getting serious about house hunting, it’s time to start the home loan approval process. You’ll want to be preapproved before you make an offer on a home, and then apply for full approval once you have a purchase agreement in place.

Ready to get started?

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

[ad_2]

Source link