[ad_1]

This article is an on-site version of our Trade Secrets newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday

Hello. I have an interview running in the FT news pages with Ngozi Okonjo-Iweala, who has clocked up just over a year as World Trade Organization director-general and, let’s face it, hasn’t exactly been presented with a sea of calm to navigate. In the interview she ranges over the vaccine patent waiver deal, on which subject she made an impassioned plea for WTO member governments to remember the value of compromise, the difficulties of containing geopolitical tension over the Ukraine war in the WTO and the likelihood that supply chain crunches will continue for longer than she’d expected. But her primary concern is the looming global food crisis.

In today’s main piece I’m going to look at how food-importing countries cope with spiralling prices, apart from trying to persuade their trading partners not to put on export bans. Charted Waters this week focuses on a Dutch think-tank’s assessment of the UK’s post-Brexit trade performance.

As usual, if you have any thoughts on the newsletter, or trade more generally, I want to hear them at alan.beattie@ft.com.

Get in touch. Email me at alan.beattie@ft.com

Building up buffers

It’s been nearly 15 years since the last major global food crisis began in 2007 and, as Okonjo-Iweala says in today’s FT interview, it’s not altogether clear we’ve learned a lot. On go the export bans and up go food and energy prices, with not much sign of international co-operation to stop the spiral. The EU is making a good show of trying to increase production in the short term and opposing export restrictions, but that’s relatively easy to say if you’re not likely to suffer food shortages anyway.

It’s a bit harder if you’re, say, Egypt, a densely-populated country with limited farmland and irrigation and which imports more than half its staple food of wheat. Egypt called in the IMF last week to help it with the inevitable balance of payments problems caused when an irreplaceable import suddenly shoots up in price. They’ll no doubt get the money: it’s pretty much what the IMF is for. But if high food prices persist, Egypt will have to start regarding the issue as more than a short-term liquidity problem and do some serious long-term adjustment.

Africa is in particular difficulties here because of its reliance on imported food in general and wheat from Russia and Ukraine in particular. Okonjo-Iweala notes that 35 African countries are dependent on wheat and 22 on fertiliser from the Black Sea region. Apart from aid — while she was at the World Bank, Okonjo-Iweala helped create an agricultural and food security fund as a response to the 2007-08 food crisis — the seemingly logical solution is for countries to hold enough buffer stocks to get through a crisis and, often relatedly, aim for more agricultural self-sufficiency. (Okonjo-Iweala also suggested Africans eat more food that can be grown locally, like maize or cassava, and less of the imported wheat that’s a legacy of colonialism, but I’m not sure whether her recommendation of “yams for breakfast” is official WTO policy.)

At this point we enter a highly contentious subject in development and trade: whether it’s sensible to regard self-sufficiency and/or large buffer stocks as the route to food security. This has, to understate quantities considerably, created a modicum of academic and political debate.

Development economists still recall the arguments that raged after a famine in Malawi in 2002 in which several hundred people at least died. Some development campaigners attempted to blame the IMF for telling the government to sell off its reserve grain stocks in the years before the famine. The IMF countered that the problem was that officials sold off far more than the experts (more than just the fund) had recommended.

Reserve stocks aren’t free insurance. It’s costly to store grain and keep it safe from mould and rats. And as seems to have happened in Malawi, it’s also an invitation for corrupt officials to sell the stocks off and pocket the money when prices rise.

It’s also often not really what’s needed. A global food crisis like the one we’re heading into is unusual. Most food shortages are localised, with produce available to be bought quite close by. (Relatedly, most shocks to production and bad harvests are also quite local, meaning that self-sufficiency creates its own risks.)

It’s generally more efficient to have a crisis fund to purchase food quickly when needed rather than maintain expensive permanent stocks. It’s certainly more efficient than relying on painfully slow in-kind food aid to chug across the Atlantic from the US, which is the way America dumps its agricultural surpluses abroad in the guise of charity.

And here we stumble into the fraught subject of “public stockholding”, a policy argument which has dragged on for years in the WTO. The issue is that India and some other developing countries want the right to buy up big reserves of food for safety buffers. Rich economies like the US (not averse to a bit of subsidising themselves), claim this is an excuse for shelling out trade-distorting government handouts by in effect setting a minimum price above market levels for domestic producers.

As it happens, India is currently one of the countries with some wheat surpluses to export. (Look forward to a chorus of “told you so” from Delhi.) But if it starts to sell off its public holdings, it will count as trade-distorting subsidy and might breach WTO agreements.

There’s a difficult balancing act here. Encouraging production and de facto subsidising exports might be what you need in a crisis. But dumping food abroad reduces the importing countries’ ability to produce for themselves. It’s hard to concentrate on the long term when the short term is so pressing, but it’s going to improve food security over time if countries do. If you’re a net importer of food, right now you’re likely to be grateful for any produce from anywhere, no matter how funded. But locking countries into a pattern of dependency is exactly how they became vulnerable in the first place.

Charted waters

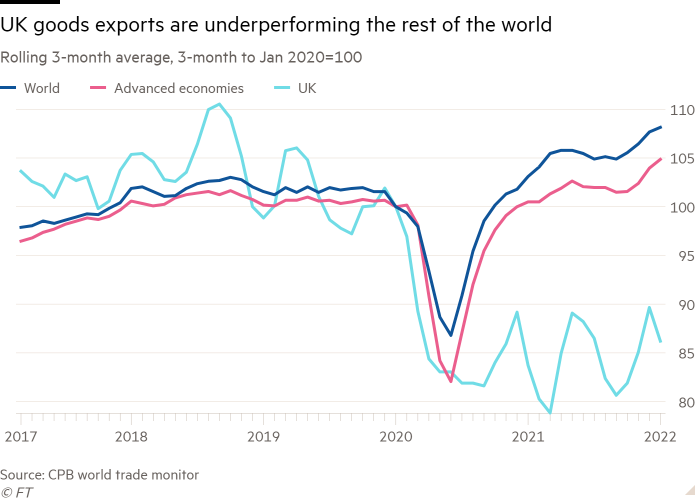

The Brexit debate is back — will it ever go away? — following a global trade report by Dutch think-tank the Netherlands Bureau for Economic Policy Analysis, known as the CPB.

The analysis, which incorporated data from the UK’s Office for National Statistics, found that the UK was the only country in the study where goods exports remained below the 2010 average.

Leaving the EU was pinned as a factor, but other issues are afoot. A couple of days before the CPB analysis was published, the UK’s Office for Budget Responsibility warned that UK trade “lagged behind the domestic economic recovery” and had “missed out on much of the recovery in global trade . . . suggesting that Brexit may have been a factor”.

This means that the UK had become a less trade-intensive economy, which the OBR forecast would remove 4 per cent of the country’s productivity over the next 15 years. Whether or not the UK should have left the EU, what is undeniable is that it now needs more trade.

Trade links

Big investors are betting that the Ukraine war will prompt a wave of companies onshoring production.

Adam Posen of the Peterson Institute argues in Foreign Policy magazine that the Ukraine war will further corrode globalisation, already suffering from populist politicians and tension between China and the west.

Russia’s software, media and online services links with the EU and US are degrading even where there are no formal sanctions, say researchers at the think-tank Bruegel.

Germany announced plans to wean itself rapidly off Russian oil and gas and the US said it would step up LNG exports to Europe.

[ad_2]

Source link