[ad_1]

Rishi Sunak’s Spring Statement offered minimal help for households, hospitals, schools, the military and other public services squeezed by a surge in inflation. The UK chancellor instead concentrated his fiscal firepower on building a war chest for pre-election giveaways.

The decision revealed Sunak’s political choices. Unexpected price rises bring in a huge windfall of extra tax revenues by stealth and he chose to return just a little to the public in the most eye-catching ways possible.

Households, public services, graduates and companies are the losers with the chancellor hoping he will gain a big political pay-off from a tax cut which will not offset the higher taxes paid. Highlighting the dividend he wants to achieve, Sunak said: “For the first time in 16 years the basic rate of income tax will be cut.”

The maths behind the smoke and mirrors of the speech is relatively simple and relates to the effects of high inflation on household living standards and the public finances.

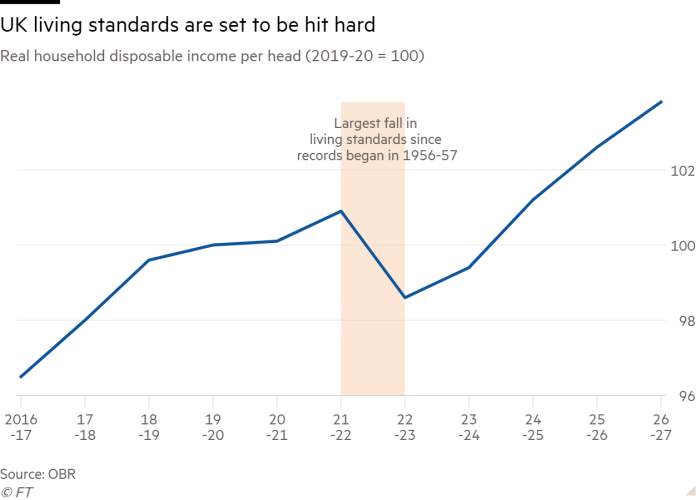

With the Office for Budget Responsibility expecting inflation to peak at around 9 per cent towards the end of the year — the highest rate for more than 40 years — and household incomes not following suit, living standards are set to be hit hard. The fiscal watchdog predicted that real household disposable incomes per person will fall 2.2 per cent in the 2022-23 financial year, which it estimates to be “the largest fall in a single financial year since [official] records began in 1956-57”.

While this hit to incomes lowers the real growth of the economy, higher inflation raises the value of all goods and services produced, which brings in copious amounts of extra taxation.

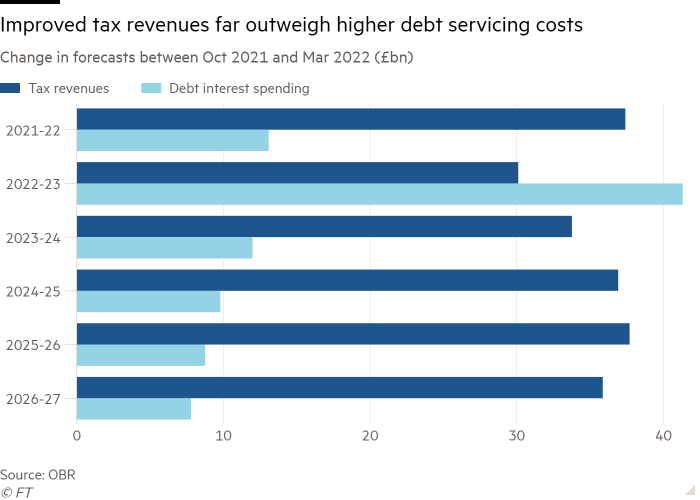

The OBR calculated that the additional tax receipts resulting from higher inflation provide a windfall of roughly £35bn a year to the chancellor, with only some of that having to be spent on higher costs of servicing debt and higher pensions and benefits.

Apart from a one-off bad year of 2022-23 when debt interest costs rise sharply on government debt linked to inflation rates, the OBR reckoned Sunak will gain at least £20bn more a year from higher tax revenues than he is forced to spend on debt servicing and benefit uprating.

The rest is a choice. In the first year, he has gained a £50bn windfall, which has been banked. For future years, he has decided to give back to the public paying the taxes a net amount of a few billion of his £20bn windfall each year.

This giveaway is at its highest in 2024-25, the year of the next scheduled general election, but is still only £3.6bn net.

Sunak made it sound as if the giveaways were much larger than that but, once again, smoke and mirrors were at work.

Cutting 5p off fuel duty on a litre of petrol and diesel, he said would cost more than £5bn this year, but the documents show a costing of only £2.4bn. The difference arises because the chancellor calculated the saving from a notional world of cutting the duty from a notional level as if it had been raised on Wednesday in line with inflation and then cut by more than 10p.

The rise in the threshold for paying national insurance, costing £6bn a year, is more than paid for by the extra tax raised from freezing income tax thresholds for four years at a time of much higher than expected inflation.

The £6bn a year cost of cutting 1p from the basic rate of income tax is more than paid for by the additional money that graduates will have to pay to service their student loans over their working lives.

Public services and public sector workers get nothing to compensate them for higher inflation. Services will simply get worse as schools, hospitals, the police all have to pay more for everything, especially energy, but will not get more money to fund it.

This was a Spring Statement of stealthy tax increases, stealthy real public spending cuts and very headline public tax cuts. Or, as Torsten Bell, chief executive of the Resolution Foundation think-tank, summarised it on Twitter: “This package only makes sense if your only test for policy choices was can you prove you’re a tax cutter [and] you’ve already announced a rise in National Insurance.”

[ad_2]

Source link