[ad_1]

Poppy Lyons is one of thousands of teenagers in the UK to have just turned 18 and received the proceeds of her Child Trust Fund. Her parents opted for a stocks and shares account and topped it up regularly, building it into an impressive £29,000 nest egg.

Living with her parents in Ramsey, Cambridgeshire, she has offers to study biomedical sciences at Cardiff and Plymouth universities. “I received the money when I turned 18 knowing nothing about investing, but I want to make it work to eventually go towards a deposit on a property and provide some security in the future,” she says.

So what should she do now? The money currently sits in cash, losing purchasing power as the UK’s consumer prices index hit an annual 5.5 per cent in January. She wants to tuck it away where it can grow, but her long-term homebuying aspirations mean she might need it within the next 10 years or so.

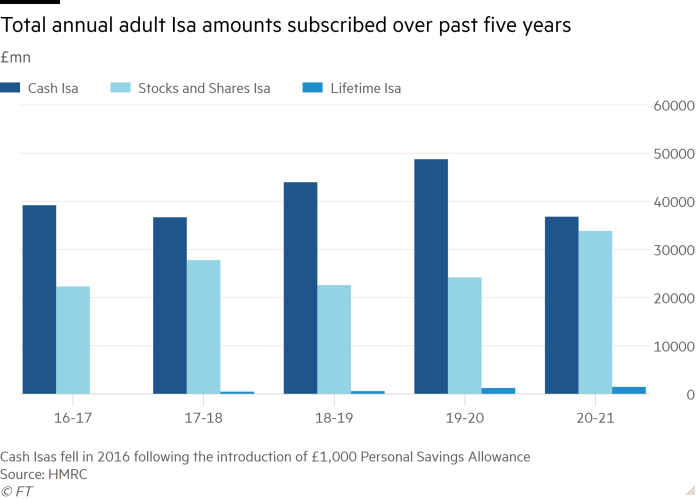

Isas have expanded to offer savers and investors a plethora of tax-friendly choices since 1999, when stocks and shares Isas and cash Isas were introduced. Junior Isas arrived in 2011 to replace Child Trust Funds and currently allow investment of up to £9,000 a year for children and grandchildren. Innovative Finance Isas came along in 2016 to encourage peer-to-peer lending, and Lifetime Isas arrived a year later, offering generous government top-ups.

The question of where to put Isa money — up to an annual £20,000 per adult — is not just for those, like Lyons, who are opening one for the first time. Russia’s invasion of Ukraine has jangled nerves on global stock markets that were already frayed by fears of high inflation and by worries about the high valuations of tech stocks.

“There will likely be a bit more inflation and a bit less growth as a consequence,” says Rob Morgan, chief analyst at Charles Stanley.

For UK households, the tax burden is set to rise as the government looks to shore up the public finances in the wake of the pandemic. As the deadline for investing in the 2021-22 tax year approaches, FT Money looks at some of the key choices facing those looking to make the most of their tax-efficient Isa options at a time of market uncertainty.

Where to invest

Investors have experienced a wild ride over the past two years, since the Covid-19 pandemic initially caused a huge sell-off in stock markets. The FTSE 100 index, for instance, plummeted 30 per cent in the early weeks of the pandemic before recovering its losses by early February this year. Since then, however, fears over Ukraine have sparked more selling, with a 7 per cent drop in the index since February 10.

In the short term, there is no guaranteed way for existing Isa holders and first-time investors like Lyons to protect their investments, says Laith Khalaf, head of investment analysis at AJ Bell. “You have to play a long game, and over the next 10 years, I think the best chance of beating inflation is still the stock market.”

He suggests moving £20,000 into a stocks and shares Isa in the current tax year — the maximum amount adults can pay in one year — and the remainder in the new tax year from April 6.

History suggests staying invested and ignoring stock market volatility remains the best course of action, says Morgan. “The stock market has a 10 per cent-plus sell-off about every 1.5 years, so the volatility we are seeing is fairly normal,” he says. “It’s worth noting that throughout stock market history the biggest rises often come very quickly after the biggest falls, so there is usually no merit in trying to time the market.”

The question for novice Isa subscribers is where to place their money. Some experts suggest a global equity tracker fund is the best way to get core equity exposure. “The simpler the strategy the better: a single fund is better than several,” says Robin Powell, co-author of Invest Your Way to Financial Freedom.

However, AJ Bell’s Khalaf points out that over two-thirds of a global equity tracker will be invested in the US “which feels like quite a lot of risk to be invested in one country”. He suggests looking also at investing in a UK or European index tracker such as iShares Core MSCI Europe UCITS ETF.

He offers another tip: consider dripping the money into the markets over the course of six months. While the magic of compounding means investing earlier maximises returns, the short-term outlook for the stock market is “very uncertain” and the impact of paying in a lump sum before a steep market sell off can be “pretty nasty”.

For equities with the best chance of beating inflation, Morgan suggests investors look for companies with “pricing power”, which can pass on cost increases to customers, such as luxury goods makers. “Liontrust Special Situations is one fund that prioritises competitive advantages and pricing power in its selection process,” he says.

It’s also worth considering areas that will benefit from higher inflation. Banks are a potential beneficiary of higher interest rates as they can earn more on their lending. Inflation caused by rising commodity prices might also be countered in a portfolio via some exposure to mining and energy companies.

However, investors should remember that some inflation expectations have already been baked into markets. Future share price movements will be determined by how reality reflects these assumptions.

Paul Derrien, investment director at Canaccord Genuity Wealth Management, thinks there is now value in so-called “growth” stocks — those expected to outpace the market average — which have fallen out of favour amid fears of higher interest rates. He says “sectors such as technology and healthcare have suffered large falls which is creating good long-term opportunities”.

Khalaf suggests investing in a broad tracker fund as the core of your portfolio and then adding tilts of what you think will do well on top of that.

Research by Bowmore Wealth Group found that the number of millennial and Gen Z taxpayers declaring annual income over £150,000 in the UK has risen by 28 per cent over the past year to 50,000 individuals. Even if you don’t have thousands of pounds to put into your Isa, the sooner you start investing the better, to reap the benefits of compounding.

“The power of tax-free compounding is a marvel to behold. If markets have a wobble and you have spare cash, that can be a great time to top up with whatever you can afford,” says Henry Cobbe, head of research at Elston Consulting.

Lifetime Isa?

Younger investors also face another choice: whether to open a Lifetime Isa. On the face of it, it seems a no-brainer, as they can put up to £4,000 into a Lisa every year and receive a 25 per cent top-up from the government. The money can be used towards a deposit for a first home, or accessed when they reach the age of 60.

But Lifetime Isa holders wanting to use the funds to buy a home face other conditions. It may not be used to buy a property worth more than £450,000 — a limit that has not increased since it was introduced in April 2017. Since then, the average UK house price has risen by 24 per cent, according to the Halifax House Price Index, to £278,123, rising in London to £530,469.

If holders do not meet the conditions — and decide to take out the money before the age of 60 — they pay a 25 per cent penalty to lay their hands on it. The charge takes back the government subsidy and a proportion of the individual’s savings too. For example, if £1,000 is saved, it receives a £250 top up. If £1,250 is then withdrawn, the 25 per cent charge would cost £312.50 — resulting in a 6.25 per cent loss.

Yet for many buying a home or saving for retirement, the Lifetime Isa can still make sense. “It is a trade off between accessibility and tax efficiency,” says Svenja Keller, financial coach and founder of SK Inspire. “In many cases, having a bit of both is a good option to get the best of both worlds.”

Isa or pension?

While selecting the kind of Isa to invest in is one choice that savers make, a bigger decision for many people is between putting money into any Isa or contributing to a pension scheme. Pensions and Isas are the “two key pillars of longer term, tax efficient savings” in the UK, says Jason Hollands, managing director at Bestinvest.

Finding the most tax-efficient option is becoming increasingly important as the UK faces tax rises. From April 6, national insurance is due to increase by 1.25 percentage points, lifting the main rate for employees to 13.25 per cent. Dividend taxes are set to rise by the same amount, with new rates of 8.75 per cent for basic-rate dividend taxpayers, 33.75 per cent for those in the higher rate and 39.35 per cent for additional rate taxpayers.

Isas allow taxed money to grow and be withdrawn tax free. Pensions give you income tax relief on any money paid in at your marginal rate, but you cannot access the money until you are at least 55 (rising to 57 in 2028) and you will pay income tax on money withdrawn from your pension at your marginal tax rate.

Which one should you prioritise? Hollands says “a widespread regret among older workers is not having started contributing to a private pension earlier”.

If you don’t need access to your money, pensions are the more generous vehicle, particularly if you are a member of a workplace pension scheme receiving employer contributions, or if you are a higher or additional rate taxpayer.

While not an issue for most people, there are restrictions on how much those on a high income can pay into a pension. The annual pension allowance is £40,000 per year, but this allowance tapers down by £1 for every £2 your income goes over £240,000, with the minimum reduced annual allowance currently £4,000 for anyone with an income of £312,000 or higher.

If you have a spouse or civil partner and they haven’t maxed out their allowances, you can also contribute to their pension and Isa, notes Helen Morrissey, senior pensions and retirement analyst at Hargreaves Lansdown. You can pay up to £40,000 a year or up to 100 per cent of their earnings (whichever is lower) into their pension, and if they aren’t working then you can contribute up to £2,880 per year and they will get tax relief topping it up to £3,600.

If you are in retirement, it might make sense to draw an income out of your Isa savings before turning to your pension. You will not have to pay income tax on Isa money withdrawn, and your pension will not form part of your inheritance tax estate when you die.

For those saving for children, Junior Isas allow you to pay in up to £9,000 per year. But note that as soon as the child reaches 18 — like Poppy Lyons — control of the money goes to them. If you don’t want them to have access to the money at 18, you could consider paying into a Junior Sipp or setting up a trust.

These are uncertain times for markets, but we do know that taxes will rise, inflation will erode the value of cash and equities have protected against rising prices over long periods. It makes sense to spend time considering how Isas, along with other tax-efficient vehicles like pensions, can help maximise the power of your savings.

What is a Flexible Isa?

Flexible Isas allow you to move money in and out of an Isa without it counting towards your annual Isa allowance — as long as the money is replaced within the same tax year. They were introduced in April 2016 as a way of giving savers the chance to make the most out of their allowance, but it was not made compulsory for Isa providers to offer them.

While most of the big banks have made their cash Isas flexible, the largest investment platforms — Hargreaves Lansdown, Interactive Investor, Fidelity Personal Investing and AJ Bell’s Youinvest — have not.

Alan Forsyth, in his 60s, retired and now living in Bedfordshire, says he “really misses” having a flexible Isa, which he had at the Share Centre but is no longer available to him since it was taken over by Interactive Investor in 2020.

“When I was with the Share Centre I needed a new cooker, fridge freezer, washing machine and microwave, so I took a couple of thousand out of my flexible stocks and shares Isa to buy the goods,” he says. “Then I topped up again in my stocks and shares Isa through my small pensions.” He adds that having a flexible Isa is a “massive advantage”, and says he had used his flexible Isa on a separate occasion to buy a car.

“Flexible Isas might be useful in certain scenarios, for example as an alternative to a bridging loan,” says Jemma Jackson, head of public relations at Interactive Investor. “But this is not what the Isa regime was intended for — Isas are designed for investors who want to grow their wealth long term. We want to keep our offering simple.”

Vanguard, which does offer them, says that about 10 per cent of its Isa clients have withdrawn money and put it back in again since its platform was launched in 2017, suggesting there is an appetite for flexibility.

Other brokers offering flexible Isas include Bestinvest, Barclays Smart Investor, Charles Stanley Direct, IG, Redmayne Bentley and Willis Owen.

What happens to my Isa when I die?

Ali Walsh, who runs a gluten-free cake making business in Bristol, was recently talking to her parents about what might happen to their Isas after their deaths. Mike Gregory, a former engineer, and Nancy Gregory, a former classics teacher, from Cambridgeshire, are both in their 80s.

“If they leave their Isas in their wills to me or my siblings, or split between us, what happens to the Isas?” Walsh asks, unsure whether the money would stay protected within the tax-free wrapper or be subject to tax.

Isas are not exempt from inheritance tax and form part of the estate of the deceased, says Kay Ingram, chartered financial planner. “When a person dies their Isa goes into their estate and may continue to be invested tax free while probate is being sought, for a period of up to three years. It is known as a continuing Isa.”

During this period, no money can be added to the Isa but the executor or administrator of the estate can make changes to the investments or cash it in.

The surviving partner of an Isa owner may invest an amount equivalent to the value of their deceased spouse’s or civil partner’s Isa at the date of death or when the Isa is closed, whichever is higher, she adds.

“This additional allowance can be used alongside their own annual allowance of £20,000 per tax year. It must be used within three years of the date of death.”

[ad_2]

Source link