[ad_1]

This article is an on-site version of our Britain after Brexit newsletter. Sign up here to get the newsletter sent straight to your inbox every week

The war in Ukraine puts all aspects of life into perspective, including the post-Brexit chill in relations between London and Brussels.

The sapping disagreement over the treaty on post-Brexit trade in Northern Ireland has meant that areas of obvious common interest to both sides, like UK participation in the €95bn Horizon Europe science programme, have been stalled.

The disputes are both technical (how to operate the Irish Sea border with minimum impact) but also fundamentally political, both locally in Northern Ireland and at an EU-UK level where trust has been destroyed by UK threats to renege on legal Treaty commitments.

The Ukraine crisis doesn’t suddenly make that problem go away, but it does surely put into perspective a disagreement that has consumed far too much time and space in trying to reach a post-divorce modus vivendi between the EU and UK.

The good news is that Liz Truss, the UK foreign secretary who took over the Northern Ireland file from Lord David Frost, had dropped the deliberate diplomatic boorishness consistently deployed by her predecessor to such damaging effect. Truss, to her credit, has managed to lower the temperature of the debate.

The bad news, as became very clear when I went to Belfast last week with the cross-party UK Trade and Business Commission, is that when it comes to technical issues, the two sides are still a long way from finding mutually agreed solutions.

The independent commission is co-chaired by Hilary Benn and the Virgin Group chair Peter Norris, and was set up to try to find pragmatic solutions to post-Brexit challenges after the government decided to disband the Brexit select committee that Benn had chaired.

During a full day of meetings which drilled down into the technical rather than political aspects of the Northern Ireland protocol, the Commission met small business owners, large food retailers and a broad range of business groups that are all wrestling daily with the protocol.

While there were gripes and grumbles — of which more later — at the same time the business groups that spoke to the commission were consistently far less apocalyptic about the protocol than some of the Unionist and Conservative backbench political rhetoric on this issue.

Yes, there are problems, but from milk processors to manufacturers, the emphasis was overwhelmingly on getting closer to that ‘best of both worlds’ situation, with access to both UK and EU single markets. No one was talking about scrapping the protocol.

As Victor Chestnutt, the President of the Ulster Farmers’ Union, put it. “We can’t be left as second class UK citizens and second class EU citizens . . . we want to land in a sweet spot where we have the best of both worlds. What we need is a softening of actions to land in that spot.”

As with GB businesses trading directly with the EU, it is small businesses that are clearly hardest hit, having less time, people and cash flow to deal with the new bureaucracy, which they clearly resent, but equally they are ultimately managing, painful though it be.

More needs to be done to help them, but there are no magic wands. The protocol leaves Northern Ireland in the EU single market for goods, and that means border and customs controls.

There was still some wishful thinking on show. One small business owner suggested using VAT returns and Intrastat declarations that monitors intra-EU goods trade to separate out goods remaining in NI and those going into the EU.

But this misses the basic point of a border — you need to know what is crossing it, in real time. Still, there should be ways to reduce burdens, including more digitisation of customs processes.

Overwhelmingly the biggest fears about the protocol stemmed from a concern about what might happen if the EU demanded the introduction of full export processes on goods travelling from Great Britain to Northern Ireland.

It’s easy to forget that the protocol is currently operating on so-called ‘grace periods’ which were initially designed to give businesses six to nine months to adapt to the new Irish Sea Border but are now effectively operating on a “until further notice” basis.

One big UK supermarket chain has estimated that imposing full controls on mixed loads of products heading to Northern Ireland, could mean 7mn additional documents a year to maintain its current delivery levels. That is clearly not sustainable.

Even with the current ‘easements’, as Stuart Lendrum, of the Iceland chain told the commission, there is additional costs and paperwork, but as supermarkets are demonstrating, this is ultimately manageable with the current arrangements.

It’s the future that worries them. Particularly the issue of handling the divergence of UK food and product standards from EU ones, which is inevitable over time. If UK goods heading to NI have to comply with divergent EU standards, that creates a world of pain.

For example, the EU is phasing out a food whitening compound called titanium dioxide. That begs the question: will products heading from GB into NI need to comply with that new standard? You can see how quickly that would scramble a supply chain set up to deliver food to a UK network of supermarkets.

Disaggregating GB products for the NI market alone, making sure they comply with all EU rules, becomes as bureaucratic as exporting to the EU. UK businesses might choose to follow the EU standard on titanium dioxide, but that won’t apply to all areas of divergence. Over time, the businesses warned, this is only going to get harder and harder to manage.

For example, last month the UK authorised the emergency use of neonicotinoid pesticide treatment to protect sugar beet crops. The EU has different rules. Which begs another question: will products made with sugar beet that potentially has higher neonicotinoid residue levels than are allowable in the EU legally be able to be sold in NI, which is part of the EU single market for goods? Last week, there was not a clear answer to this.

In short, managing diverging EU-UK standards is going to be a huge and complex challenge.

One suggestion from the food industry is that the EU should agree to recognise UK standards as “equivalent” for goods destined for sale in NI only, but given those standards are diverging (and the UK is on record saying it will have fewer border controls than the EU) the consensus was that it’s deeply unlikely Brussels will agree to that.

Privately, it was clear from conversations with industry groups there is little confidence that an overarching technical agreement can be reached on this, so the solution will have to be both political and piecemeal, addressing individual issues of particular concern to the EU, as they arise.

Because the reality is that the UK government will not crystallise a full blown trade border in the Irish Sea, and Brussels will not formally accept a free-for-all, or reimpose a North-South border — and yet, as the fundamental stand-off continues, the system of easements is basically working.

As Benn and Norris write in a post-trip letter to Truss and her EU counterpart Maros Sefcovic, one important way of removing some of the politics from this is to hold “formalised, regular, tripartite meetings between EU, UK, and Northern Ireland business to address and resolve operational issues”.

That way issues around products of particular concern — say, the biosecurity issues on citrus products — can be addressed directly while avoiding creating blanket structures that are unworkable for existing supply chains.

In summary, the ultimate solution might, in practice, be found by not pressing too hard for a definitive solution: maintain current easements; iron out specific issues; and keep muddling on until the political weather changes a bit.

Do you work in an industry that has been affected by the UK’s departure from the EU single market and customs union? If so, how is the change hurting — or even benefiting — you and your business? Please keep your feedback coming to brexitbrief@ft.com.

Brexit in numbers

One of the things that has been perplexing trade specialists and economists is data showing that, by the end of last year, UK exports to the EU had returned to 2019 levels — while imports from the EU had fallen by 30 per cent.

That would, on the face of it, seem to be highly counterintuitive, given the raft of business sentiment surveys in 2021 consistently showing companies reporting that Brexit ‘red tape’ is hitting their businesses.

There are a number of possible reasons being mooted — for example, that the concerns of small businesses are given too much weight in the public discussion on Brexit impacts, while big businesses are getting on with it.

At the same time, post-Brexit supply chains are reorienting, which means that fewer goods from Asia and the rest of the world are being imported into the UK via the EU, to avoid facing two sets of paperwork. This might help partly explain the drop in imports from the EU.

But John Springford at the Centre for European Reform, a think-tank, has a different answer. He says that comparing UK exports to the EU in 2019 and 2021 gives a false impression that things are somehow back to normal. They are not.

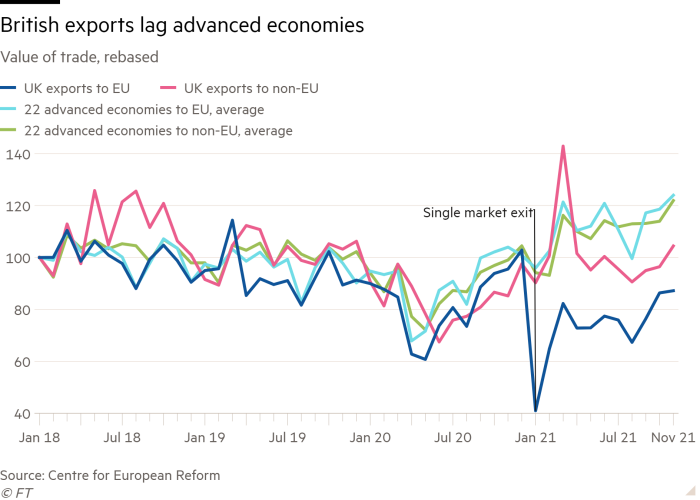

In a new paper for the CER, Springford compares the UK performance with our peers in the global trade arena and finds that the UK is underperforming badly when compared to these countries that have experienced a post-Covid export boom in 2021.

Springford uses a basket of these similar, advanced economies (that haven’t endured Brexit upheaval) to create a “doppelgänger UK” that models how the UK would have performed had it remained in the EU.

The model, which was cited by the Office for Budget Responsibility in its October 2021 Brexit update, finds that UK exports are 15.7 per cent smaller than the exports of the alternative UK. Looking at UK exports to the EU and to the rest of the world, Springford also finds that both have underperformed relative to other advanced economies.

Overall, Springford calculates that the trade “loss” for the real UK, when compared to the doppelgänger, is £12.9bn for the month of December 2021.

Given that 65 per cent of UK exports are used as “intermediate” inputs into the production process in the EU and other countries, it would seem logical that erecting such high non-tariff barriers to the trade of those inputs would have an impact.

Springford also argues that these figures challenge the Brexiter assumption that the UK would be better equipped to tap faster-growing Asian and US export markets when ‘set free’ from EU membership.

“But leaving the single market and customs union appears to have reduced goods exports to the rest of the world as well as the EU,” he says. “This isn’t entirely surprising, since many multinationals used the UK as a base for exporting to both the EU and countries around the world. Now that the UK has left the EU, it’s more costly to do that.”

In manufacturing, at least, concludes Springford “Brexit has made ‘Global Britain’ harder to achieve.”

And, finally, three unmissable Brexit stories

Robert Shrimsley returns to the war in Ukraine in his column this week by looking at what it means for Boris Johnson’s leadership of the Conservative party. The UK prime minister’s chances at the next election have much improved, he says, but points to the government’s failings on sanctions and refugees as highlighting “his continuing inability to get a grip”.

Since the UK voted to leave the EU in 2016, its stock market returns have lagged behind those of international peers. Valuations are cheap on almost every measure, writes our Lex team. But by crunching the numbers they have discovered there is more to the story than just heightened political and economic risks.

In October 2018 Theresa May danced on to the stage at the Conservative party conference and promised “a year-long festival of Great Britain and Northern Ireland”. The assumption was that May’s Brexit festival would be jingoistic propaganda but four years later ‘Unboxed’ has become something much weirder as Henry Mance explains.

[ad_2]

Source link