[ad_1]

For years BHP has focused on investing in safe and stable countries such as Australia, Chile and Canada. But faced with the challenge of supplying the metals and minerals that will be needed in the shift to the low-carbon economy, the world’s biggest mining company is starting to take on more risk.

It has already taken a stake in SolGold, a London-listed explorer seeking to develop a huge underground copper deposit in Ecuador and last month threw its considerable weight behind a huge nickel project in a remote part of Tanzania as part of a strategy to “capture opportunities in future-facing commodities”.

BHP is not the only big miner looking to increase exposure to the metals needed for a huge increase in electrification. Just before Christmas, arch rival Rio Tinto announced its first major acquisition in decade, paying $825mn for a lithium project in Argentina, which has a floundering economy beset by surging inflation.

What these deals have in common is a realisation that the shift to a low-carbon economy will lead to increased demand for metals at the same time as long-term supply growth is constrained by a sparse project pipeline, rising opposition to mining both at a local and national level and geology, as companies tackle ever more difficult sites.

Miners have four key decarbonisation metals in focus: lithium, nickel and cobalt, which are all key raw materials for rechargeable batteries, and copper, the mainstay of electrical circuits for over a century, which is needed to help build the infrastructure of a new electrically powered age.

“As more events get attributed to climate change, the urgency of switching to electric vehicles and renewable energy can only escalate,” says Darryl Cuzzubbo, the former BHP executive who is now running SolGold. “At the same time there are less and less mines being identified.”

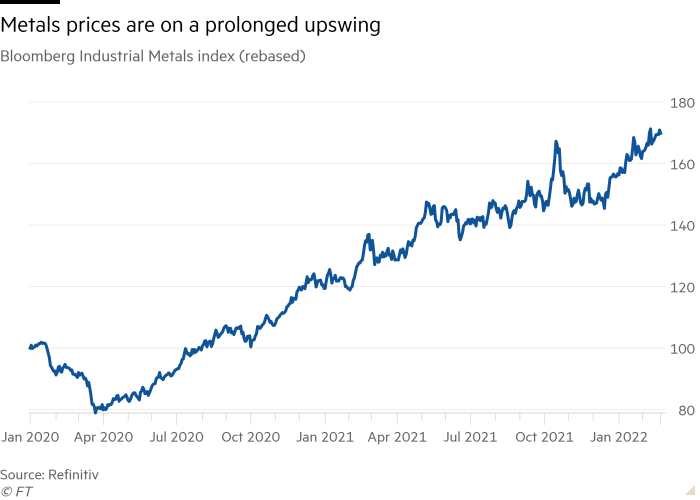

For investors, the key issue is to examine the markets for these raw materials to see whether the current price rises will be shortlived or evidence of a new supercycle — a prolonged period of structurally higher raw material prices as demand outstrips supply — creating outsized investment opportunities.

Rising prices

The last similar price boom took place during China’s rapid industrialisation starting in the late 1990s. It petered out as a tsunami of new production finally came on line and commodity markets entered a deep funk in 2014 from which they are only just emerging.

That setback — which drove miners to reduce investments — combined with the economic recovery triggered by the easing of lockdown restrictions is now starting to boost metal prices and the stock prices of major mining groups.

“Price is the mechanism to balance undersupplied commodity markets as rising prices incentivise supply growth as well as substitution and demand destruction,” said Christopher LaFemina, analyst at Jefferies. “That is where this cycle is likely heading and will end, but this will take years to play out.”

Lithium has had a dizzying run over the past year with battery-grade carbonate up more than 400 per cent to a record high above $60,000 a tonne in the Chinese spot market, a key reference point. Prices are being driven by the rapid increase in global sales of electric vehicles, which more than doubled last year to 4.5mn units.

Rio Tinto reckons lithium demand will grow by 25 to 35 per cent a year over the next decade with a significant supply-demand deficit expected to open up over the second half of this decade.

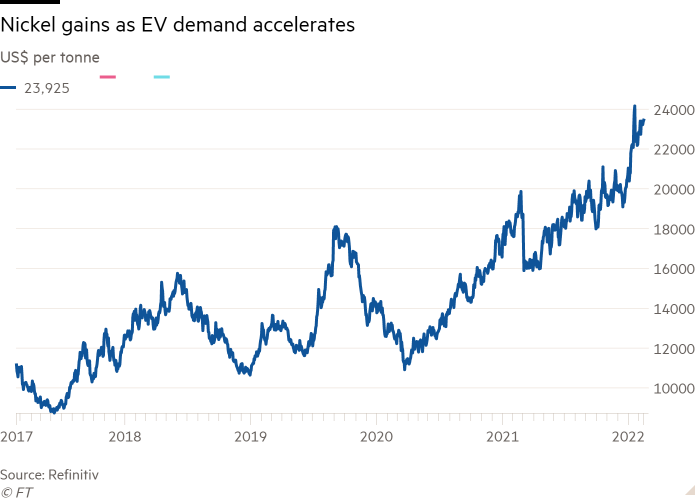

Nickel, which is also used in the batteries that power electric vehicles recently hit an 11-year high as stockpiles have dwindled at the London Metal Exchange due to strong demand from automakers. An intensification of sanctions on Moscow following its invasion of Ukraine could push prices higher. Russia is a large producer of nickel as well as copper and cobalt.

Copper, used in wind turbines and power grids, hit a record high above $10,500 a tonne last year and has doubled since the depths of pandemic. Cobalt, a common byproduct of copper mining, has climbed more than 40 per over the past six months.

Goldman Sachs says peak production is “fast approaching” in copper and yet there have been very few announcements of additional investments in new mines that “traditionally push this peak further away”.

The challenge of supplying the metals needed to avoid the worst effects of global warming were laid bare in a report published last year by the International Energy Agency.

It found that in a scenario consistent with the goal of the Paris Agreement on climate change, supply from existing mines and projects would only meet half of lithium and cobalt requirements by 2030 and 80 per cent of copper needs.

“Today’s supply and investment plans for many critical minerals fall well short of what is needed to support an accelerated deployment of solar panels, wind turbines and electric vehicles,” the report says.

“The long lead times to bring new mineral production on stream, the declining resource quality in some areas and various environmental and social aspects all raise concerns around reliable and sustainable supplies of minerals to support the energy transition.”

Batteries, panels and grids

A typical electric vehicle battery pack needs around 8kg of lithium, 35kg of nickel, 20kg of manganese and 14kg of cobalt, according to research by the IMF, while charging stations require substantial amounts of copper.

Solar panels use large quantities of copper, silicon, silver and zinc, while wind farms require copper, steel and zinc.

As the world’s most important industrial metal, the role of copper in the energy transition has received a lot of attention from analysts, investors and the industry.

“Copper is indispensable . . . It’s foundational to the mega trends of electrification and decarbonisation,” says Daniel Earle, chief executive of Solaris Resources, a Canadian exploration company also focused on Ecuador.

Due to the growth of EVs and renewable energy and decline in ore grades from existing mines, BMO Capital Markets sees a 9mn tonne supply demand imbalance in the copper market by 2030. To put that figure in perspective, refined copper production last year was around 24m tonnes.

While there are enough projects on paper to fill the gap, BMO analyst Colin Hamilton says it is folly to assume all of them will be developed for a number of reasons that are well known in the mining industry.

For a start, it is increasingly difficult to obtain the licences and permits needed to extend or build new mines because of resistance from local communities and activists.

The US Department of the Interior recently cancelled two mineral leases to Antofagasta, the UK-listed miner, for a proposed Twin Metals copper and nickel mine in Minnesota. The decision has effectively ended the project.

Meanwhile, Resolution, a giant underground mine in Arizona that has enough copper to satisfy 25 per cent of US demand for 40 years, has been left in limbo after the Biden administration rescinded an environmental impact study that was needed to complete a key land swap agreement.

“New mines take much longer to develop now than they did 10 or more years ago, in part due to more stringent environmental policies. Projects today are also more difficult geopolitically and geologically than they were a decade ago,” said LaFemina.

At the same time proposed tax changes in key mining jurisdictions around the world are making it more challenging for foreign miners to invest in these countries and make the returns demanded by shareholders.

In Chile, a new mining royalty bill and nationalisation are being discussed in parliament while Peru’s new leftist government is pushing for higher taxes. These two countries account for 40 per cent of the world’s copper production.

“Countries around the world are demanding more of miners in terms of revenues and that goes beyond Chile and Peru, ranging all the way from Asia to central American and Africa,” Richard Adkerson, chief executive of US copper producer Freeport-McMorRan, told investors on a recent earnings call. “All of these things add to supply constraints at a time where the world needs more copper.”

Taking all these factors into account, Hamilton reckons 4mn tonnes of new supply growth, costing just over $75bn, is the maximum amount of copper that can practically be supplied from new projects, whatever the underlying copper price.

As such, a combination of increased scrap utilisation (an extra 3mn tonnes by 2030 versus 2021) and the substitution of aluminium for copper in products such as cabling will be needed to balance the market, something that will only be brought about by high prices.

“We can all talk about these big supply-demand gaps but they are not going to happen,” says Hamilton. “The price in copper will have to be one that drives substitution in the medium term.”

Others agree. “I think we will shift to scarcity pricing or security of supply type pricing,” says Earle.

Could price surges fizzle out?

Not everyone is convinced that metals are set for a new supercycle. The growth of renewable energy and electrical vehicles will boost demand for metals but that could be offset by a contraction in demand from China, still the world’s biggest consumer of raw materials.

Some economists believe China has peaked and are forecasting a very sharp deceleration in economic growth over the next decade, more than offsetting increased metals demand from decarbonisation initiatives.

Technology — either through innovation in extraction technology or exploration — could also boost supplies.

BHP and Freeport have both invested in a privately owned company called Jetti Resources, which claims to have found the answer to one of the biggest riddles in the copper mining industry — how to economically extract the metal from abundant but low-grade ores.

In nickel, Tsingshan Holding Group, the Chinese company that has blazed a trail across the stainless steel industry, has converted a form of the metal used in stainless steel production to one suitable for electric vehicle batteries, opening another source of supply for the industry. Carmakers are also searching for alternatives to cobalt for use in batteries.

As for copper, analysts point out that for the immediate future, the copper market will get extra supplies over the next couple of years as developments approved and permitted years ago — such as Ivanhoe’s Kamoa Kakula in the Democratic Republic of Congo and Anglo American’s Quellaveco in Peru — begin production and reach full capacity.

These planned production increases only push back the feared supply crunch to later in the decade. But in the meantime, there could be some serious swings in the market as traders balance the short- and long-term considerations.

The lithium market is likely to be much tighter than copper in the near term, although analysts expect some big producers such Albemarle and SQM to increase supply as they look to cash in on higher prices. That could tilt the market back towards a balance by 2025 before big supply-demand deficits emerge.

It is far from certain that metals will enter a new supercycle. But, at the very least, it is becoming increasingly clear that the backdrop for metals is the most positive it has been since China’s rapid industrialisation in the early 2000s. That should underpin prices, boost the profitability of the mining industry and work wonders for mining equities.

How to invest in the sector

Industrial metals are traded on big futures exchanges in London, New York and Shanghai — venues that are all but impossible for retail investors to access.

However, there are ways to get exposure to the contracts listed on the London Metal Exchange and Comex through exchange-traded products (ETPs), which can be bought and sold like listed shares.

WisdomTree Securities has listed several ETPs that track the performance of copper, nickel, aluminium, zinc, tin or lead — the six main metals traded on the LME — or basket of metals that tracks the Bloomberg Industrial Metals Index.

While these are a relatively “simple product”, says Nitesh Shah, WisdomTree’s director of research, it is important to remember these are total return investments, which means they include any gains or losses from rolling over futures contracts month to month. It also offers an enhanced product that is much more volatile.

However, trying to play the full spectrum of energy transition metals through ETPs is not possible, because for these products to function correctly they require an underlying liquid futures contract. “Lithium futures are relatively new and although cobalt contracts have been around for some time on the LME they have not yet got to scale,” says Shah.

An easier way to gain exposure to metals is through listed mining companies. Anglo American, BHP, Glencore and Rio Tinto — the world’s big four diversified mining companies — are listed in London and all offer varying degrees of exposure to electrification metals.

However, BHP and Rio have huge iron ore businesses, which means their share prices are sensitive to the health of the Chinese steel industry. Anglo American also owns iron ore mines, though it has boosted its large copper division and is a major producer of platinum group metals.

Glencore has the highest exposure to energy transition metals, but it is also a major producer of thermal coal, the world’s most polluting fossil fuel, something that might not sit easily with every investor.

Also listed in London are more focused metals companies, such as FTSE 100 constituent Antofagasta, which mines all of its copper in Chile, and smaller explorers such as Aim-listed SolGold.

London does not have a big lithium miner, so investors need to look further afield, either to Australia or North America, for exposure to the battery metal.

Most of the big miners have targets or ambitions to achieve net zero emissions and have outlined implementation plans. However, it can be difficult for non-experts to evaluate these plans.

Investors can also get exposure to mining companies through funds such as BlackRock’s World Mining Trust.

Another way is through streaming and royalty companies, which have historically focused on gold and other precious metals but are now expanding into metals such as cobalt, nickel and lithium.

In return for an upfront cash payment, these companies acquire the right to future production or revenues from a miner at an agreed discounted price.

Typically, streaming deals are transferred by the physical transfer of metal while royalty deals are settled in cash. It is an arrangement that suits both parties. Miners get a regular income while streamers get exposure to commodities and are not directly exposed to the capital or operating costs of the underlying asset.

Paul Smith, former head of strategy at Glencore and now the chair of Aim-listed Trident Royalties, says royalty companies offer investors a spread of income across assets and different metals that is very difficult to replicate either by investing in a diversified miner or basket of mining stocks. “I have almost as many assets as Anglo American,” says Smith.

Trident last month secured an option to buy a royalty on the Sonora Lithium Project in Mexico, increasing its exposure to the battery metal. It also has royalty over the Thacker Pass Lithium Project in the US. At spot prices, these two deals alone could generate around $75mn a year of revenue if the projects reach their full potential.

Smith reckons hundreds of billions of dollars will need to be invested in copper supply over the next decade. A portion of that will be sunk into projects from small and mid-cap miners, who will need financing from either the equity market or other sources like streaming companies.

“It’s boom time for alternative providers of capital,” says Smith. “Shares in Trident are up 35 per cent since the start of year.”

[ad_2]

Source link