[ad_1]

Sponsored by

As we emerge from the pandemic, we do so having changed profoundly in light of the experiences of the past two years. Capital markets are no different. They, too, have emerged quite different than they commenced in January of 2020. At the height of the pandemic induced sell-off in March 2020, we saw volatility precipitously spike, and while the sell-off and subsequent rebound was extremely quick, it marked a shift into a more volatile market that we continue to experience today- even as the world slowly gets back to the (new) normal. The following analysis examines this seismic shift and makes the case for the ongoing need to hedge against market uncertainty stemming from more frequent and higher spikes in equity volatility.

Then & Now, Higher & More Frequent Volatility

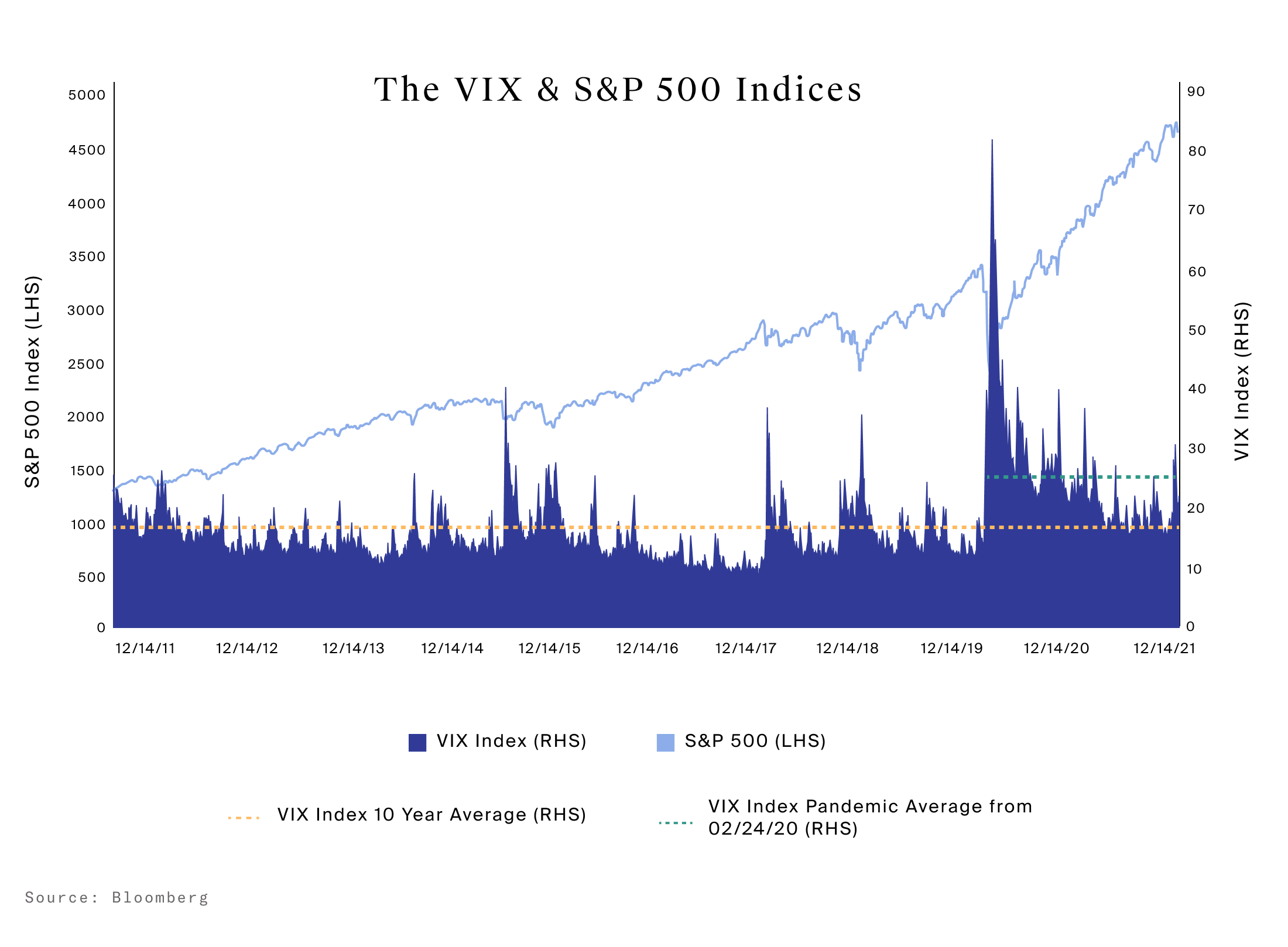

Historically, after periods of extreme and prolonged volatility it is typical for investors to ‘feel’ like the markets have returned to normal levels relatively quickly placing greater emphasis the recent lower relative volatility, displaying a general recency bias[1]. However, it takes substantial time for an unpredictable environment to dissipate and return to stability. To illustrate this, we can look at the CBOE VIX Index over the past 10 years which displays general expectations for future volatility. Over this period, the VIX Index averaged a level of 17.1 which compares favorably to the actual realized volatility of the S&P 500 Index, which had a standard deviation over the same period of 16.4%. If we zoom in to focus on the point at which the VIX moved through its 10-year average on February 24, 2020 to present, the VIX pandemic period average jumps to a level of 25.4 and the realized volatility more than doubles to 27.0%. While the VIX is trending lower recently, volatility has a long runway before it normalizes. This implies that investors should expect heightened volatility near term.

In addition to experiencing a volatile equity environment, we are also facing more frequent and higher spikes in the VIX Index. Of the 10 largest spikes in the VIX over a 10-year period, seven of them occurred within the current pandemic. The frequency between spikes in the VIX has also accelerated considerably, going from 589 days and reaching an average peak index level of 38.0 prior to the pandemic, to now occurring every 75 days and reaching an average peak index level of 43.1. At the crest of the pandemic, the S&P 500 dropped -33.9% in just 24 days. It then took 104 days (4x’s the duration) to recover on August 18, 2020. More frequent and higher spikes in volatility, like the ones we are currently experiencing, have the potential to significantly impact an investor’s ability to build wealth, and adds uncertainty to the timing it will take to do so. As such, it may be prudent for investors to consider flexible, shorter dated hedging strategies that can adapt to the dynamic nature of the broader market volatility environment.

For example, we have seen financial advisors guide their clients to invest in defined outcome strategies, such as structured notes which may offer downside protection through buffers and barriers, acting as a potential hedge against this type of volatility. Additionally, we have seen strong demand for equity hedge and multi-strategy hedge funds given their potential to offer non-correlated returns within a tightly controlled risk framework.

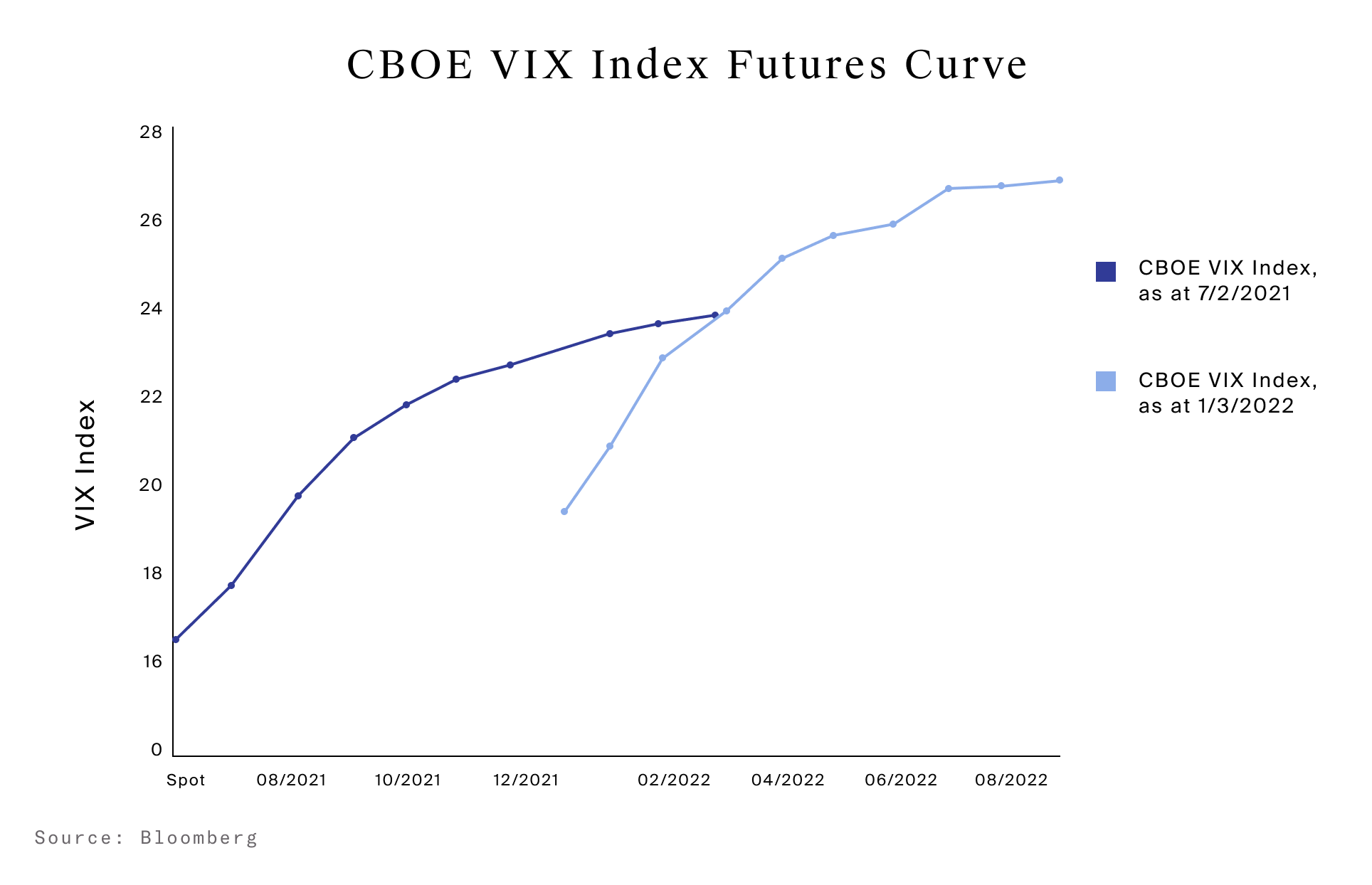

Finally, recently we have seen significant shifts in the VIX Index futures curve. Over the last few months, the futures curve shifted higher, indicating that expectations are for volatility in the U.S. equity market to remain elevated over the next several months. This move higher was also augmented by a move of the curve into backwardation for 6 days ending December 3, 2021, essentially reflecting the extreme current volatility while also expecting it to remain high into the future. Bloomberg noted that the last time this occurred was in January when the meme stock fueled rally ended. This look through into current expectations for future volatility in U.S. equities via the VIX futures curve confirms the continuation of the trend towards higher and more frequent spikes in volatility – a trend that we have witnessed since the pandemic started..

In summary, we believe that the current volatile market is here to stay as we work through the potential end of the pandemic, and monetary and fiscal policy normalizes. In such an environment, financial advisors are best served by managing their clients’ portfolios through this lens.

1. Morningstar, “Is Recency Bias Swaying Your Investing Decisions?”, 27 April, 2020, https://www.morningstar.com/articles/979322/is-recency-bias-swaying-your-investing-decisions

[ad_2]

Source link