Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

Arm bets on Wall Street in a ‘huge potential blow’ to London

When SoftBank swooped in six years ago to buy Arm Holdings for £24.3bn, Baillie Gifford opposed the deal. But the Scottish fund manager failed to garner enough support from fellow shareholders to rebuff the approach, said James Anderson, joint manager of Baillie Gifford’s £20.7bn Scottish Mortgage Investment Trust.

The deal went ahead and Arm was taken private by the Japanese technology group. Anderson and other investors rued the departure of one of Britain’s most successful tech companies from the FTSE 100.

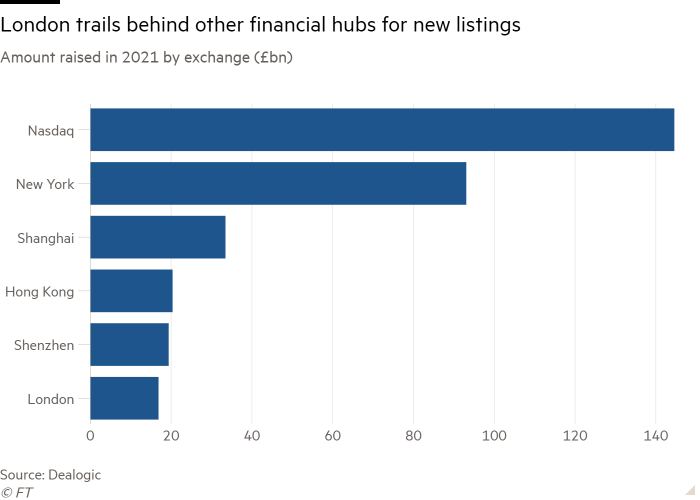

This week Arm was once again the subject of serious soul-searching in the City of London. After a $66bn sale to Nvidia collapsed over competition concerns, SoftBank announced its plans to bypass the UK and list the company on the Nasdaq stock exchange in New York.

Anderson was unequivocal. Arm’s mooted flotation on the Nasdaq is “a huge potential blow” to London. He said:

“It’s a real problem because if you have the remaining large British technology company that could be quoted in London opting not to be, your chances of building an ecosystem, giving people experience and having that presence goes away to quite a large extent.”

In this analysis I wrote with Daniel Thomas and Philip Stafford, we look at both London’s long-term decline in listings and a deeper concern: the UK’s ability to create, scale and retain homegrown technology champions. High-profile flops such as the Deliveroo IPO, structural trends like the fallout from the EU’s Mifid rules, and cultural differences with the US (notably vis à vis risk taking) are all playing a part.

There’s much at stake. Refreshing the listings regime is just one part of the equation in the UK’s push to build world-class companies. “It’s the latest missing piece of the ecosystem,” says Julien Cordoniou, a London-based partner at venture capital firm Felix Capital.

“We have the talent, the business angels, the seed funds, venture funds and now the late-stage investors. The final thing we need to nurture local champions is that financial marketplace that will provide liquidity, visibility and exits for all players.”

Meanwhile here’s columnist Cat Rutter Pooley on why London can’t muscle in on Arm’s listing plans. Her conclusion? “London has already lost the war for truly big tech: it is the fight for the next Arm that it can still win.”

What do you think can be done to reinvigorate London’s moribund listings market? Email me: harriet.agnew@ft.com

Newsletter exclusive: deconstructing Millennium’s performance

Reading Millennium Management founder Izzy Englander’s 2021 letter to investors, there are some performance statistics that I found particularly striking.

Over the past decade, Millennium’s multi-strategy fund has delivered annualised gains of 11.17 per cent a year. In the previous 10-year period — when the fund was roughly four times smaller — it returned 10.96 per cent a year. And its Sharpe ratio — a measure of return adjusting for risk — has also improved from 2.65 in the earlier period to 2.78 over the past 10 years.

This means that, as Millennium grew its asset base, returns have actually got better. Englander writes:

“We believe that these numbers demonstrate that, as in most industries, scale is a benefit, not a cost. While we have no intention of growing for the sake of growth, on balance, we think continued scale will lead to benefits that exceed costs.”

Scale is indeed a benefit in most industries but not historically in the hedge fund industry. Typically, the bigger a fund grows, the harder it becomes to generate returns without taking on too much risk. Millennium looks like an anomaly here.

This is likely down to its structure. Unlike hedge fund firms that rely upon a single star manager or a series of big bets, Millennium employs 278 trading teams, diversified across asset classes, investment strategies and geographies. Each of them operate within strict risk limits. (If you break them, you could be out.)

Of course a key challenge for Millennium is to provide an environment that is more appealing for portfolio managers than rival multi-strategy hedge funds like Ken Griffin’s Citadel or Steve Cohen’s Point72. In the investor letter, Englander outlined some of the steps it took to attract investment talent in 2021, a year in which the fund gained 13.61 per cent with a Sharpe ratio of 4.82:

-

introducing a new title, senior portfolio manager, to acknowledge investment team leaders

-

building out its technological platform: “we now compete for talent with technology companies as we do with financial services firms,” writes Englander

-

improving flexibility by opening offices in Dubai, Paris, Miami and West Palm Beach

-

strengthening its capital base by locking investors’ money in for longer

It’s worth reminding yourself of the pandemic battle for top traders in Laurence Fletcher’s must-read piece that shows why Millennium and its ilk can’t afford to be complacent.

Chart of the week

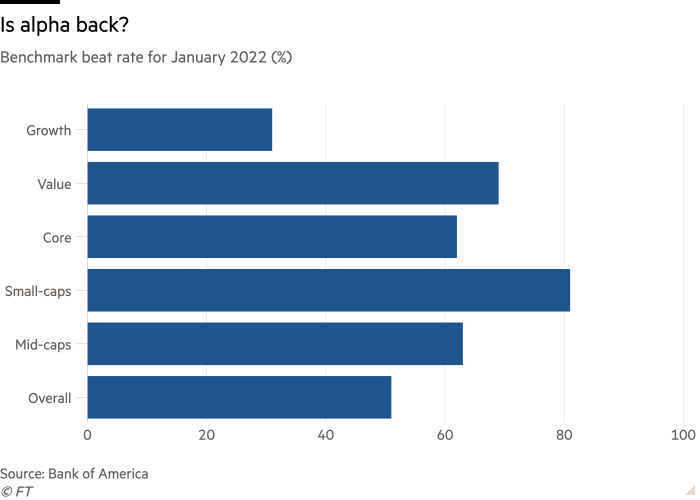

As surely as new year resolutions fall by the wayside, January brings declarations that the coming era will be a good one for stockpickers. Will they prove true in 2022? Morgan Stanley beat the rush to declare in November that 2022 would be “the year of the stockpicker”. The ferocious economic and financial cross-currents would make it an unusually fertile environment for active equity fund managers, the bank’s strategist Michael Wilson argued. Some investors agree. After almost unceasing outflows for two decades, active equity funds globally took in $111bn last year, their best year since at least 2000 according to research group EPFR. Despite the recent choppiness of financial markets, 51 per cent of US equity fund managers out performed the stock market in January, according to Bank of America. In this column, my colleague Robin Wigglesworth explores whether this year will truly, finally be “the year of the stockpicker”.

10 unmissable stories this week

Ministers are closing in on a deal with City watchdogs to unleash what Boris Johnson has called an “investment big bang”, as the prime minister seeks to prove that post-Brexit regulatory changes can boost the economy.

The US Securities and Exchange Commission is seeking to compel hedge funds and private equity groups to disclose quarterly performance and fees charged to investors, as the agency pushes back against activities it warned were “contrary to the public interest”.

On top of this, SEC chair Gary Gensler wants to halve the time hedge funds and other activist investors have to amass secret stakes in US public companies, shortening the disclosure window to five days.

Brookfield Asset Management is weighing a spin-off of its asset management business into a separate public company, a move that would mark a dramatic shift in strategy by one of the world’s largest alternative investment groups.

Binance plans to take a $200mn stake in US business media group Forbes, which it once sued for defamation, as the century-old publisher aims to go public via a special purpose acquisition company.

Morningstar has removed more than 1,200 “sustainable” funds with a combined $1.4tn in assets from its European sustainable investment list after closely examining disclosures provided to investors such as prospectuses and annual reports.

Fidelity’s little-known passive investment business Geode Capital Management surged to $1tn in assets last year, underscoring its quiet emergence as a major player in the index fund industry.

Australia’s largest pension scheme, AustralianSuper, which has already invested in London’s Heathrow airport and the King’s Cross redevelopment project, plans to put another £23bn into the UK and Europe over the next five years, joining other global mega funds pushing further into private markets.

Amundi’s assets under management have passed €2tn for the first time, following its acquisition of Lyxor’s exchange traded funds business. Here’s Lex on why being big and diversified means Europe’s largest asset manager is staying ahead of the pack.

Axel Springer’s chief Mathias Döpfner fought to protect a top editor from misconduct claims, according to an FT investigation which sheds light on the involvement of the German publisher’s investors, including private equity giant KKR and Canadian state pension fund CPP Investments.

And finally

Fabergé conjures up delicious thoughts of lavish Easter eggs, Russian empresses and James Bond. This exhibition at the V&A invites us into the opulent world of master goldsmith Carl Fabergé and his London clientele.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

Comments are closed, but trackbacks and pingbacks are open.