[ad_1]

One nuts scoop to start: The start-up behind Bored Ape Yacht Club, the non-fungible token collection that counts celebrities like Gwyneth Paltrow and Snoop Dogg as owners, is in talks to raise financing that would value the group at up to $5bn as investors continue to pour money into digital collectibles.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

Discovering Europe’s unicorns

When it comes to discovering and nurturing tech companies to unicorn status, Europe has long lagged the US.

While highly valued companies have emerged from the continent, Europe’s tech ecosystem remains vastly overshadowed by that of its American peers.

Now, Silicon Valley’s venture capitalists, with their record of turning raw start-ups into multibillion-dollar businesses, are turning their attention to Europe, seeking to transform the region from tech bystander to tech contender.

In this FT Weekend essay and excerpt from his book The Power Law, Sebastian Mallaby explores how and why venture capitalists are now rushing to find Europe’s unicorns.

Sequoia Capital, the venture capital firm that backed unicorns including Airbnb and DoorDash, believes that Europe is ripe to produce new tech companies, and it’s readied itself for a slice of the action.

In 2019, Sequoia partner Matt Miller set out to expand the firm’s footprint in Europe. He poached Luciana Lixandru from rival Accel, convincing her that European tech groups were ready for take-off. Last summer Sequoia hired Anas Biad from rival Silver Lake, continuing to entrench its position in Europe.

The region has become home to multiple unicorns over the past decade — “buy now pay later” group Klarna, banking app Revolut and streaming group Spotify.

It’s the executives at these companies, and others, that US venture capital firms have their eyes on. The firms believe that after Europe’s tech veterans experienced the thrill of going from a zero revenue start-up to multibillion-dollar company, they will once again seek out the rush, by founding, advising or financially backing new companies.

US venture capital firms including Sequoia are pinning their ambitions on Silicon Valley’s tried and tested model that successful entrepreneurs will chase more success through becoming investors or executives yet again. Firms including Lightspeed Venture Partners and General Catalyst have set up European offices in the past few years.

Europe’s start-up scene has historically remained lacklustre due to a range of cultural factors including a lesser appetite for risk compared to the US.

But the ingredients necessary to launch are plentiful: Europe is home to three of the world’s top five computer-science programmes — Oxford, Cambridge and ETH in Zurich — and thanks to heavy government investment in coding literacy, the continent in 2019 boasted 5.7mn software developers compared with 4.4mn in the US.

US venture capitalists are hoping to replicate in Europe the success that they’ve seen in China.

Internet group Tencent raised early money from IDG Capital, a VC firm founded in Boston that focuses on investment in China, and the company later poached Martin Lau from Goldman Sachs’ Hong Kong office.

Search engine Baidu received capital from DFJ ePlanet, a fund led by the Silicon Valley investor Tim Draper, and three early Chinese internet companies — Sina, Sohu and NetEase — all took foreign venture capital.

US seed money transformed China’s digital economy. It now hopes to do the same in Europe.

A sit-down with Satya Nadella at Microsoft

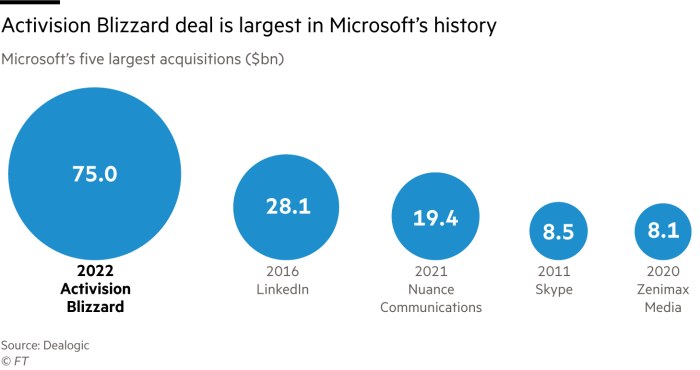

Microsoft’s record breaking $75bn plan to buy gaming group Activision Blizzard will boost the tech group’s ability to develop not just traditional games, but the metaverse too.

That’s according to chief executive Satya Nadella who explained Microsoft’s plans in this extensive interview with the FT’s Richard Waters.

The gaming deal announced last month has sent the industry into fierce competition mode (see Sony‘s $3.6bn acquisition of Bungie this week), but Nadella sees his deal as an investment beyond traditional gameplay.

He sees the purchase as a pivotal step in developing the company’s metaverse offering, which will one day enable users to play games, host virtual conferences and carry out work simulation exercises in a new version of the internet.

Nadella believes the technology behind current games, such as Activision’s hugely popular first-person shooter series Call of Duty, is central to the development of the metaverse.

“You and I will be sitting on a conference room table soon with either our avatars or our holograms or even 2D surfaces with surround audio. Guess what? The place where we have been doing that forever . . . is gaming,” he said.

“Being great at game building gives us the permission to build this next platform, which is essentially the next internet: the embodied presence. Today, I play a game, but I’m not in the game. Now, we can start dreaming [that] through these metaverses: I can literally be in the game, just like I can be in a conference room with you in a meeting,” he added.

It’s a bold bet on the future of the metaverse, and Microsoft’s largest bet to date. Nadella acknowledged that regulators are likely to scrutinise the deal’s effect on the future development of the metaverse, rather than solely on the current gaming industry.

It comes in the face of fierce competition from rivals, most notably Facebook-owner Meta, who are also ramping up their investments in the internet of the future.

As a plethora of companies seek to capitalise on the looming metaverse, Nadella highlighted the need for new standards that would let people take their digital avatars smoothly from one company’s metaverse into another’s, rather than existing in disconnected units, and he committed to building open platforms.

“All I care about is having equal rules of the road for all participants,” he said.

DAZN fails to score

For a while it seemed like DAZN, the sports streaming service owned by billionaire Leonard Blavatnik, was the favourite to seal the deal to take over BT Sport, the UK television sports channels owned by telecoms group BT.

Such an acquisition would cement DAZN’s status in European football, adding Uefa Champions League and English Premier League matches to a repertoire that includes domestic rights to Spain’s La Liga and Italy’s Serie A.

But the lossmaking streaming company was thwarted at the last minute by Discovery, the US media group that already screens the Olympic Games in Europe, the FT’s Anna Gross and Sam Agini report.

BT’s board members have decided to pursue a joint venture with Discovery instead, lured by Discovery’s merger with WarnerMedia and the prospect of joining forces with a global media giant.

DAZN’s failed bid raises a broader issue for the group: how to generate a return on Blavatnik’s investment.

Shay Segev, the newly installed chief executive who joined from gambling group Entain last year, may yet take DAZN into new markets besides streaming.

Either way, Kevin Mayer, the former Disney executive who chairs DAZN, says the company is “fully committed to growing our business and investing in the UK, as you will see in the near future”.

Job moves

Smart reads

Under attack China has cracked down on Hong Kong but its forced closure of Jimmy Lai’s respected pro-democracy newspaper Apple Daily shows just how far Beijing is willing to go. (Bloomberg)

Meta’s mega disaster Young users fleeing to TikTok aren’t the only ones leaving Meta. Privacy changes and a number of scandals have led to investors dumping more than $200bn worth of stock, reflecting expectations for a bleak future. (FT)

News round-up

Amazon shares surge as it raises price of Prime membership (FT)

US stocks record worst day in almost a year after downbeat tech results (FT)

Investors wipe more than $220bn from value of Facebook owner Meta (FT)

Bank of England raises interest rate to 0.5% in effort to tame inflation (FT)

Ken Griffin’s Citadel posts 5% gain during January’s market slump (FT)

KPMG sued for £1.3bn over Carillion audit (FT)

Merck, Eli Lilly Covid-19 treatments power quarterly sales gains (WSJ)

Joe Biden’s nominee for top Fed watchdog defends views on climate risks (FT)

[ad_2]

Source link