[ad_1]

In North Devon, Edmund Greaves and his partner are struggling to find their first home. In the area where they are looking, which spans 20 sq miles and two sizeable towns, just one or two properties in their price range hit the market each week. They are gone within days.

In Hackney, east London, houses are listed so rarely that one woman estimates she has leafleted more than 300 desirable properties, hoping to coax their owners into a sale.

In Cambridgeshire, Edward Clarke and his young family have spent two years shuttling between rental homes and are despairing as runaway price growth and high demand force them to rip up their original plans and look further and further afield.

All are victims of a supply crunch in the UK housing market, the likes of which some experts say they have never experienced. Demand is at historic highs — the number of prospective buyers contacting estate agents about properties is close to double the recent average, according to property portal Zoopla — and supply has dwindled.

At the start of this year there were 350,980 properties for sale in the UK, according to consultancy TwentyCi, 36 per cent fewer than at the start of 2020, and the lowest amount since the company began collecting data in 2008. At the same time, the number of homes available to rent is also at rock bottom, with prospective tenants reporting they have had to jostle their way on to shortlists just to view a property.

“In my living memory, we’ve never been in this situation before,” says Colin Bradshaw, managing director at TwentyCi. “The lack of supply has broken the sale and lettings markets.”

So how did we get here?

Richard Donnell, executive director at Zoopla, says demand has consistently run above supply for the past two years. Boris Johnson’s election as prime minister in December 2019 made the outcome of protracted Brexit negotiations more certain and banished the prospective tax implications of a Corbyn-led government. That gave some buyers confidence to enter the market.

While the pandemic halted the buying and selling of homes in England for seven weeks in spring 2020, when the market reopened in May, buyers came out in force. Demand was only boosted in July of that year, when chancellor Rishi Sunak introduced a stamp duty holiday on the first £500,000 of all property purchases, providing a tax break of up to £15,000 in the process.

In the intervening 18 months, the UK’s average house price has risen by nearly 16 per cent, according to mortgage provider Nationwide. Despite the tax holiday’s withdrawal in September last year, demand is as high as it was when it was introduced. “It’s bananas,” says Donnell. In recent years around 1.2mn homes have traded annually, but Donnell estimates that in the

past year about 1.5mn were exchanged.

The pandemic has also shifted what buyers are looking for, making the supply crunch particularly acute in some pockets of the market. Larger homes with gardens and spare bedrooms that can double as home offices are top of most buyers’ wish lists; flats are bottom.

This is especially a problem in London, where there is a growing mismatch between what is for sale and what buyers want. The number of homes listed for sale in the capital has actually gone up in the past two years, from 71,850 in January 2020 to 75,470 last month, according to TwentyCi. During that time, the number of detached and semi-detached houses on the market has dropped by about a third, but the number of flats has risen by about 20 per cent. Today, four out of five homes for sale in London are flats.

Emily, 32, and her partner, have been hunting for a house in Islington, north London, for close to 18 months. “This year it is definitely a dry January. I’m not seeing anything fairly priced on the market, I’m not seeing much at all come up,” she says.

Emily, who asked to be anonymous, admits the couple are picky: he wants a garden, she wants a study. But with a budget of up to £2.5mn, they are surprised at the lack of suitable homes they’ve seen and at the premiums paid for those which do come up for sale. “I’ve taken the view that I’m not going to get sucked into that,” she says. But where they have been interested in making an offer, they have been beaten out by cash buyers.

In a marketplace where many buyers are also sellers, why is it that the stock is depleting so fast? Around a third of homes are bought by first-time buyers, who have nothing to sell, and a further 10 per cent are sold to buy-to-let investors, explains Donnell.

In recent years between 200,000 and 240,000 new homes have been added to the mix each year, and tens of thousands more become available when their owners die. But the delivery of new housing in England fell back last year for the first time in almost a decade as lockdowns and supply chain issues slowed construction work. The country’s biggest developers have warned that ramping up building will be made harder by housing secretary Michael Gove’s tough new stance on the sector. Gove has told developers they will have to find billions of pounds to fix flats caught up in the cladding crisis, which has ballooned in the four and half years since a fatal fire at Grenfell Tower in west London exposed deep and widespread building safety issues.

The effect of those homes — which could number more than 800,000 across the UK — on the supply crunch is complicated. Many are effectively unsaleable: until they have been signed off by a fire safety expert, lenders will not issue mortgages against them. While this is stopping these homes coming to market, it also prevents their owners from trading up from a flat

to a house.

But the anecdotal experience of agents, buyers and sellers suggests that the building safety issues exposed by the Grenfell inquiry are having a wider impact on the market for apartments. The revelations have sown doubt in the minds of buyers looking at any flat — even those which are likely to be safe — which may go some way to explaining the glut of apartments for sale on property portals.

One seller describes a prospective buyer of her flat, in a three-storey block with no dangerous cladding, demanding that two separate surveyors sign off the property as safe before she would move ahead with a sale.

A combination of concern over flats and surging demand for larger homes has made a nonsense of the idea of a “housing ladder”, which homeowners scale in neat steps, from a small flat, to a house, to a larger property. Where buyers are able to build up a large enough deposit, they are preferring to skip flats altogether, compounding the supply crunch for larger properties.

Edward Clarke describes his efforts to buy a home like running the hurdles, and falling at every one. Clarke, 31, and his wife Sarah sold their family home outside Ely in Cambridgeshire in September 2020, when the market was running hot on the back of the stamp duty holiday’s introduction. “We got a really good price, we were flying high,” says Clarke.

But finding a place in Cambridge — where Clarke is keen his daughters go to school — was a struggle. The couple eventually found an apartment and made an offer on it, but couldn’t get a mortgage because the building was clad in the same material as Grenfell Tower. “We found ourselves in complete limbo,” he says.

A year after selling their home, the couple found a property on sale for £675,000 — outside their budget, but not by much. “When we turned up it had been on the market for four days and the offers were over £700,000. It eventually went to sealed bids and sold for over £750,000,” he says.

The family are now renting outside Cambridge and have broadened their search to a 15-mile radius of the city — a distance which encompasses their old home. “The most frustrating thing is that when we started looking there were properties we could afford but we were on a knife edge about whether they were right. Twelve months later they were no longer affordable for us,” says Clarke, who says he visits property portal Rightmove as many as eight times a day.

He describes the mood among his fellow buyers as “panic”. But recognising it and resisting it are two different things. “If we don’t get on this train now are we just going to be further behind?” he says.

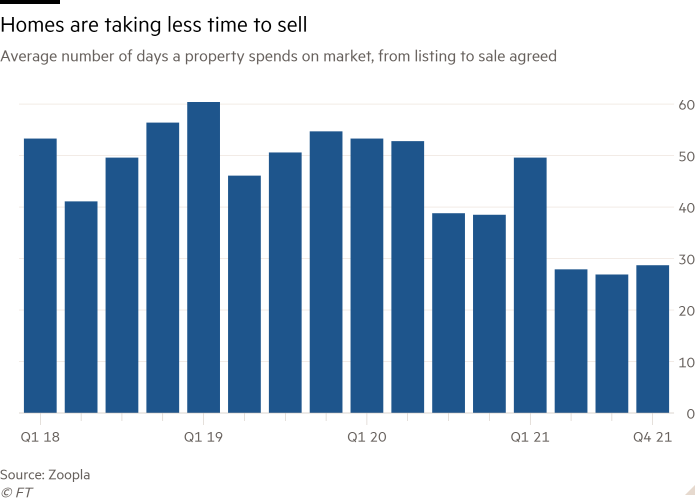

When properties do appear in estate agents’ windows, they are rarely there long, piling more pressure on to buyers who have a paucity of options. At the outset of 2020, two-thirds of homes for sale had been listed for six months or more, according to TwentyCi. Last month, fewer than one in five had been on the market so long. Roughly half of homes now sell in less than eight weeks, a quarter are gone in under four.

But again, it depends on what and where you’re selling: in the last three months of 2021, it took on average 23 days for houses outside of London to be sold subject to contract, according to Zoopla. Flats in the capital took 64 days on average to shift.

The result is that power currently resides with sellers, enabling them to push up prices in high-demand areas. Most sellers will also be buying a property, but many are choosing to find their future home before jettisoning their present one, says Donnell. That is making supply appear even tighter than it might otherwise be, and the crunch would be partially alleviated if sellers listed their homes while they themselves were hunting somewhere new.

But few are doing so, partly out of fear that if they sell up they might spend months in rental limbo and miss out on house price growth they would otherwise have benefited from.

Emily, in London, sold her previous house so she could move fast on a new home, but that decision is also fraught with risk. “We needed a larger place and wanted to be chain-free. But we didn’t expect to still be waiting,” she says.

Jumping without knowing where you are going to land carries other dangers too. Adding to the frustration Clarke and his wife have faced trying to find a home in Cambridge, the mortgage they had lined up has since expired.

With demand still running unseasonably high, it is not obvious when their wait will end. In the meantime, many prospective buyers and renters look likely to be frustrated and priced out — particularly those without a large deposit or the ability to tap the Bank of Mum and Dad.

Clarke works for a planning consultancy. His wife is the finance director of a wedding business. “We’ve got a decent budget, we’re both in professional roles. It adds to the frustration,” he says. “If we are struggling my heart goes out to those on lower incomes: how would they afford to own a home anywhere near somewhere like Cambridge, Oxford or London? It shouldn’t be like this.”

George Hammond is the FT’s property correspondent

Follow @FTProperty on Twitter or @ft_houseandhome on Instagram to find out about our latest stories first

[ad_2]

Source link