[ad_1]

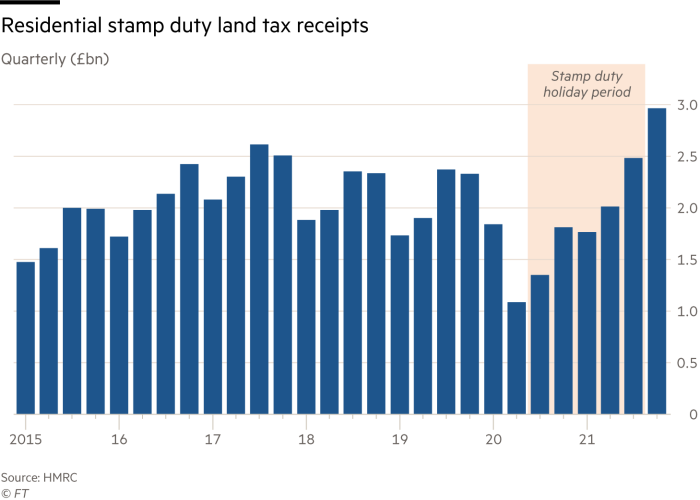

Home buyers paid more stamp duty in the last three months of 2021 than in any quarter on record, sending nearly £3bn to the Treasury and underlining the feverish demand in the housing market at the end of last year.

The quarter was the first in which the government was able to reap the full benefits of a pandemic boom in the housing market, having seen receipts fall during a stamp duty holiday in England and Northern Ireland from July 2020 to September 2021.

The record £2.95bn in stamp duty receipts, published on Friday, came in spite of some home buyers having rushed to complete their purchases in the previous quarter to clinch savings before the end of the holiday.

Transaction levels in the fourth quarter were 10 per cent down on the previous three months and 13 per cent down on the fourth quarter of 2020. But after the stamp duty holiday ended, 73,000 home sales once again incurred the tax — a 66 per cent rise in transactions bearing stamp duty compared with a year earlier, according to calculations by estate agent Savills.

Stamp duty receipts for October to December were £348mn up on the previous quarterly record of £2.6bn in the third quarter of 2017. The takings were also fuelled by robust demand for more expensive homes, which incur higher levels of stamp duty.

Lucian Cook, Savills residential research director, said: “Recent residential receipts have been supported by strong activity at the top end of the market.”

The number of sales of homes priced at over £1mn was 36 per cent higher than in the fourth quarter of 2019. The stamp duty charge on a £2mn home is £153,750; or £213,750 if bought as a second home or buy-to-let property.

“Transaction levels have stood up much more strongly in the higher price bands where people have been perhaps less concerned about the cost of living squeeze or the prospect of interest rates rising and where they’ve probably had a bit more equity at their disposal to continue to act on that desire to find more space,” Cook said.

House prices are another factor. These have risen sharply over the pandemic, pushing more homes into higher brackets of stamp duty, as people sought lockdown-friendly homes with more outside space or properties better suited to homeworking.

While house prices have continued rising into January, according to figures this week from Nationwide, economists and housing market experts predicted the market frenzy will abate this year under the influence of rising interest rates and stretched affordability.

Robert Gardner, chief economist at Nationwide, said: “House price growth has outstripped earnings growth by a wide margin since the pandemic struck and, as a result, housing affordability has become less favourable . . . Household finances are also coming under pressure from sharp increases in the cost of living.”

The lender pointed to the difficulties facing younger buyers, for whom a 10 per cent deposit on the average first-time buyer home had now reached a record high of 56 per cent of total gross annual earnings.

“I think we’re going to look back at this as a high water mark in terms of stamp duty receipts,” said Cook.

[ad_2]

Source link