[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning and happy Friday. How well did you keep up with the news this week? Take our quiz.

Boris Johnson was publicly criticised on Thursday by Chancellor Rishi Sunak over his conduct on a day of chaos in which four of the prime minister’s most senior aides left Downing Street.

Munira Mirza, Johnson’s policy unit chief and a close ally for almost 15 years, quit, denouncing Johnson’s claim on Monday that Labour leader Sir Keir Starmer had failed to prosecute the late sex offender Jimmy Savile.

Rather than defending Johnson, Sunak describe Mirza as a “valued colleague” at a Downing Street press conference and undermined the prime minister, saying: “Being honest, I would not have said it.”

Within hours, Johnson had launched a brutal though long-expected clear-out of his team, with other senior advisers heading for the exit. Martin Reynolds, Johnson’s principal private secretary, who had organised the lockdown-breaking “bring your own booze” party at Downing Street, also resigned.

Thanks for reading FirstFT Europe/Africa. Some Conservative MPs had demanded the shake-up as a price for continuing to support the PM. Share your thoughts at firstft@ft.com — Gary

Five more stories in the news

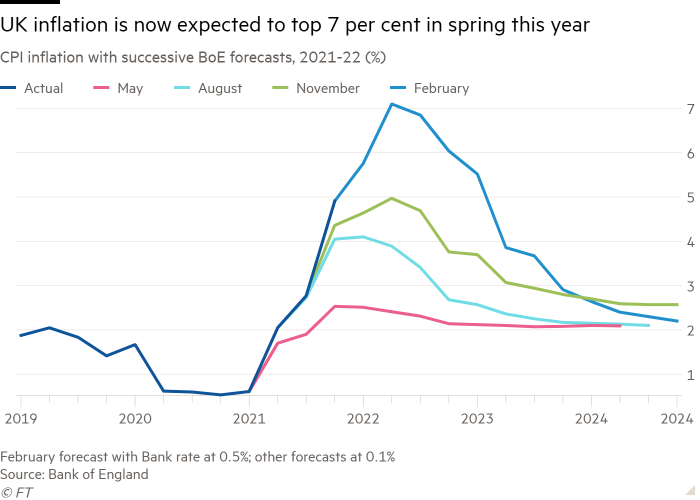

1. UK households face disposable income crunch The Bank of England warned that households face the worst squeeze on disposable incomes for at least 30 years, with inflation set to rise to 7.5 per cent as economic growth slows, unemployment rises and taxes increase. The BoE raised interest rates a quarter-point to 0.5 per cent, its first back-to-back increase since 2004.

-

BoE dishes out tough love: To return inflation to its 2 per cent target, the central bank announced action that will hit households at the worst possible moment.

2. Amazon shares surge on Prime price rise Amazon’s stock surged in after-hours trading after the company announced a 17 per cent price rise for its popular Prime membership scheme and strong earnings from its cloud computing and advertising divisions, broken out for the first time.

3. Traders struggle in volatile US market Huge swings in US tech stocks including Meta, PayPal and Snap this week reflected surprises in financial results but also pointed to what investors said was a dramatic recent deterioration in liquidity, hindering their capacity to transact large batches of shares.

-

Wall Street’s woes: US stocks slid on Thursday, with the S&P 500 falling 2.4 per cent and the Nasdaq Composite shedding 3.7 per cent, its worst day since September 2020, driven by drops in tech stocks.

4. Xi Jinping brushes off ‘Genocide Olympics’ furore The head of the International Olympic Committee said the Games should not be a forum for “political issues” and organisers dodged questions about the persecuted Uyghur population ahead of the opening of the Beijing Winter Olympics, which marks a new chapter for China’s most powerful ruler since Mao Zedong.

5. Renewed Russia tensions inject Nato with new lease of life Moscow’s military build-up around Ukraine has given the security alliance a fresh sense of purpose, reinvigorating support for its original concept: a defensive collective to deter a Russian attack. The US accused Russia on Thursday of preparing to fabricate such an attack as a pretext for an invasion.

Coronavirus digest

-

The most virulent known HIV variant has been discovered in the Netherlands, but researchers said it provided a valuable insight into the way viruses such as the one behind Covid-19 can evolve.

-

The UK has authorised the Novavax Covid-19 vaccine as a two-dose shot for adults. It will be Britain’s fifth approved vaccine.

-

Opinion: Covid entrepreneurs can lead a new wave of creative destruction, John Thornhill writes.

The days ahead

Beijing Winter Olympics The 2022 Winter Games kick off with the opening ceremony today, while China’s president Xi Jinping meets his Russian counterpart Vladimir Putin in Beijing. Follow the FT’s coverage here.

Corporate earnings Results are expected for Aon, Bristol-Myers Squibb, Carlsberg, Intesa Sanpaolo, Regeneron Pharmaceuticals, Sanofi-Aventis, Sumitomo and Suzuki.

US employment The US is bracing for a bleak January jobs report, with growth expected to have slowed and the unemployment rate to have steadied at 3.9 per cent after several months of rapid declines as a wave of Omicron cases sidelined workers and shuttered businesses.

Queen Elizabeth’s Platinum Jubilee Sunday marks 70 years of Queen Elizabeth’s reign. She is the first British monarch to reach the milestone.

What else we’re reading and listening to

Why real inflation is so hard to measure While the current average level of UK inflation is 5.4 per cent, a poverty campaigner pointed out that baked beans in her local supermarket had gone up from 22p to 32p in a year. When it comes to inflation, we need to fill the gaps in our knowledge, writes Tim Harford.

Venture capital’s new race for Europe The continent has been slow to develop tech unicorns. But tech ecosystems are like start-ups: winners advance exponentially, with each step forward making the next easier. Can Silicon Valley’s creativity and cash spark a winning streak?

‘After the Tories ditch Johnson, they need to reset their values’ Boris Johnson’s premiership has been largely spent sabotaging his own “oven-ready” Brexit agreement and mismanaging Covid-19. It’s time to write his political obituary, says Simon Kuper.

Japan’s Olympic recycling success The Tokyo Summer Games marked the first time that all 5,000 gold, silver and bronze medals were made from recycled materials, the result of an unprecedented urban mining project underpinning what Japan hailed as a uniquely sustainable Games.

Is the Orban era coming to an end? In the latest episode of the Rachman Review, Gideon Rachman talks to Hungary’s opposition leader Peter Marki-Zay about his chances of overcoming Viktor Orban and his Fidesz party’s powerful political machine in April’s elections.

Wellbeing and fitness

Ready to head out and socialise again? This collection of stories will help you navigate the life-long art of making friends.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. For more of the Financial Times, follow us on Twitter @financialtimes.

[ad_2]

Source link