[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

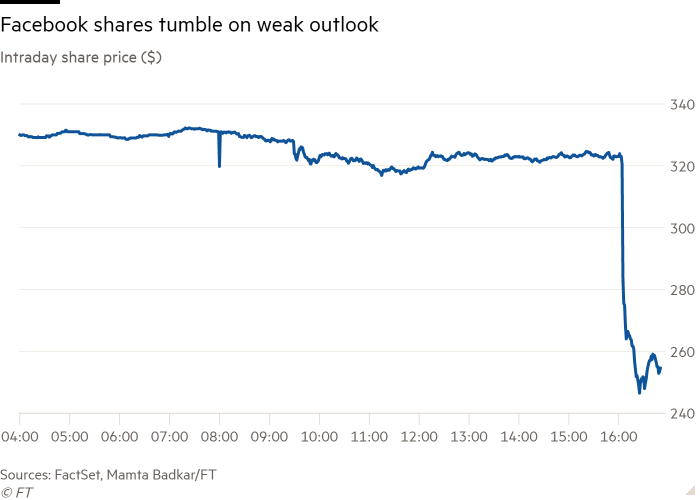

Investors wiped almost $200bn from the market valuation of Facebook owner Meta as the company warned that its users were spending more time on newer rivals such as ByteDance’s TikTok.

Shares in the company plummeted more than 20 per cent in after-hours trading yesterday after Meta said it expected its first-quarter revenues to fall short of Wall Street forecasts because of “increasing competition”, in the latest evidence that it was losing the “attention battle” over users.

If the shares do not recover, it would be the worst day for the stock since the social media group listed in 2012 and one of the biggest one-day declines in a company’s market value on record.

“People have a lot of choices for how they want to spend their time, and apps like TikTok are growing very quickly” — Mark Zuckerberg, Meta chief executive.

Shares in PayPal also tumbled more than a quarter in early trading after the payments company warned that inflation, supply chain pressures and weakening ecommerce figures would hit growth.

Spotify, meanwhile, delivered a weak outlook for first-quarter subscriber growth, sending shares down as much as 23 per cent in after-hours trade. But its chief executive said it was “too early to know” if the backlash over Joe Rogan’s Covid-19 jab podcast had cost the company customers.

-

Opinion: Rogan’s thoughtful response to public criticism illustrates why his show has become the platform’s most popular, writes Jemima Kelly.

Thanks for reading FirstFT Europe/Africa. What do you think of today’s newsletter? Tell us at firstft@ft.com — Jennifer

Five more stories in the news

1. US sends 2,000 extra troops to Europe Joe Biden has ordered the additional deployment to strengthen Nato’s response to a possible Russian invasion of Ukraine. Washington also said it would redeploy roughly 1,000 troops from Germany to Romania. Biden and Volodymyr Zelensky, Ukraine’s president, are trying to play down any sense of division.

-

Too hot to handle? Hedge funds are scooping up Russian and Ukrainian assets after declines since last autumn, while institutional investors are staying clear.

-

Go deeper: What is behind the crisis and how might a conflict play out? Here are five books about Vladimir Putin, Russia and former Soviet republics.

-

The FT View: There are limits to western sanctions on Russia. The US and Europe must be prepared to take their share of economic pain.

2. UK plan to contain soaring energy bills Boris Johnson is preparing to announce a package of measures today to contain soaring bills, including a £200 household rebate and extra help for vulnerable people, as Ofgem is due to unveil a sharp increase in the cost of electricity and gas from April.

3. CNN chief Jeff Zucker resigns The longtime head of the network and a singular figure in US television news has resigned after failing to disclose a romantic relationship with a colleague. The affair came to light during an investigation into claims against former host Chris Cuomo.

4. Opec and allies agree oil production increase The Opec+ group agreed yesterday to boost its production quota by another 400,000 barrels a day in March, its eighth consecutive monthly increase, even as data showed some countries were struggling to keep pace.

5. Kim Jong Un has ‘withered away’ The North Korean leader has “suffered” on behalf of his people during chronic food shortages, according to a state television documentary that has intensified speculation about his health and the future of the regime.

Coronavirus digest

-

Switzerland is considering ending all pandemic restrictions on public life on February 16.

-

Three more Conservative MPs declared they had no confidence in Boris Johnson after it emerged that he attended lockdown parties at Downing Street.

-

The world’s first study in which volunteers were deliberately infected with Covid-19 found that people became infectious much quicker than expected.

-

An Omicron coronavirus sub-variant named BA.2 has become the dominant strain in Denmark, India and South Africa. Here’s what we know about it.

-

Opinion: The kids aren’t alright — and neither are their parents, writes Alice Fishburn. The silence from politicians is deafening.

The day ahead

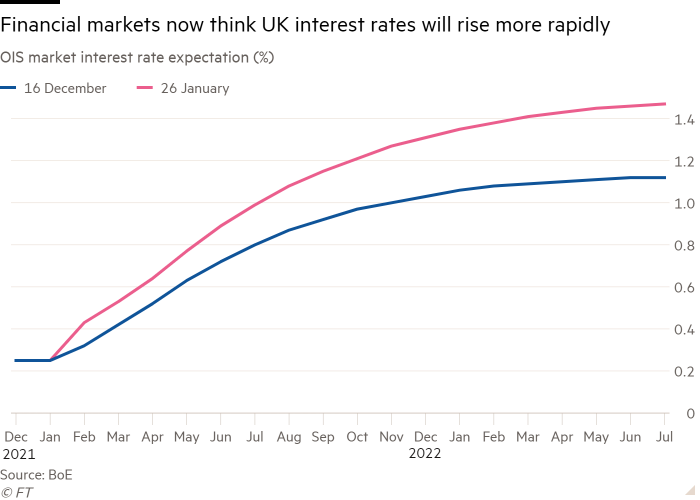

UK interest rate decision Andrew Bailey, Bank of England governor, is expected to announce a rise in interest rates from 0.25 per cent to 0.5 per cent in an effort to tame inflation. Chancellor Rishi Sunak will also unveil plans to slash soaring domestic energy bills. Tony Danker, director-general of the CBI, will raise concerns about the impact of next year’s corporation tax rise on business activity.

-

In the EU: Christine Lagarde, European Central Bank president, will speak after a monetary policy meeting. Economists expect the ECB will stick to its timetable for reducing asset purchases and will keep interest rates at negative levels.

Economic data IHS Markit will have services purchasing managers’ indices for the eurozone, France, Germany, Italy, the UK and the US, while Turkey, whose president recently sacked the statistics chief over inflation tensions, reports consumer price index data.

UK-EU Brexit talks Maros Sefcovic, the bloc’s Brexit commissioner, holds virtual talks with Liz Truss, UK foreign secretary, on reforming the Northern Ireland protocol.

Southend West by-election Voters will choose a candidate to replace Conservative MP David Amess, who was killed last October. (ITV)

Corporate earnings British telecoms group BT delivers an update, while in the US, Amazon’s holiday quarter results will be compared with a bumper Christmas a year earlier. Social media platforms Snap and Pinterest have results out along with gaming groups Activision Blizzard, Nintendo and Unity. Here is a full list.

What else we’re reading and listening to

Beijing Olympics: a front line in the US-China cold war US lawmakers have been critical of companies they believe are caving to Chinese pressure to maintain market access, with multinational sponsors of the Winter Games accused of ignoring the plight of more than 1mn Uyghur Muslims detained in Xinjiang. Should corporate America speak up about human rights in China? Vote in our poll.

Tories do not fear Labour The prime minister’s resilience over the “partygate” scandal tells us three things about Tory thinking. It says the governing party is unsure who should replace him and feels no urgency about acting. But above all, it shows they do not fear the opposition, writes Robert Shrimsley.

Hopes and doubts for levelling-up More than two years after Boris Johnson promised to “level up” Britain, his government yesterday published the policy agenda. Here are five takeaways from the white paper, and whether the plan will meet its promise to transform Britain’s economic and social geography.

British Airways’ nostalgia problem Passengers may yearn for silver service in the skies. They are getting a free bottle of water and a packet of crisps. Any premium service British Airways can offer will inevitably end in disappointment, but it is the right approach, writes Cat Rutter Pooley.

The reality of whistleblowing at work This week’s Working It podcast takes a step back from day-to-day workplace life and explores whistleblowing. What drives people to speak up against their employers — and what happens to them? Work and Careers editor Isabel Berwick talks to Siri Nelson, executive director of the US National Whistleblower Center.

FT stockpicking contest

Turbulent markets can create opportunities for the quick-thinking investor. Pit your wits against FT journalists in our annual stockpicking contest.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link