[ad_1]

The “witching hour” was long said to be the time of night where demons, ghosts, ghouls and witches were at their most powerful. It turns out that it is also when the US stock market is at its mightiest.

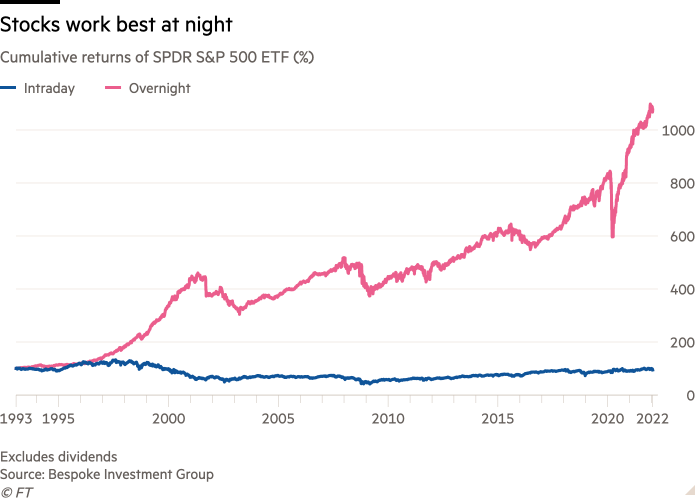

American bourses officially open between 9.30am and 4pm in New York, yet weirdly most of the gains actually accrue in the sparser, more informal after-market trading that happens on various electronic exchanges, according to a study by the New York Federal Reserve. Early morning returns, on the other hand, tend to be negative. The phenomenon has long puzzled many analysts.

It gets weirder. Research by Bruce Knuteson, a former quantitative analyst at the hedge fund DE Shaw, indicates that “overnight drift” and “intraday reversal” also happens in international markets, from Japan to Norway. Knuteson also has a far more controversial, conspiratorial interpretation of the pattern than other researchers who have probed it over the years. He reckons that it is caused by systematic market manipulation on a Herculean scale by some quantitative hedge funds.

Here is how Knuteson thinks it works. “Quant” funds that use algorithmic or systemic strategies take advantage of the bigger impact that trades can have when markets are closed and liquidity is thinner. They aggressively buy shares they already own, driving their price higher.

Then, as markets open and trading conditions improve, they can gradually ditch the purchases without undoing all of their earlier impact. By the end of the day, Knuteson says they should be left with a slightly higher-valued portfolio. Systematically doing this, day-in-day-out, would produce the pattern of overnight gains and gentle intraday declines, he argues.

Given his DE Shaw background, Knuteson’s theory is certainly more intriguing than the usual conspiracy theories that clog up the internet. DE Shaw declined to comment. But how plausible is it? Not very.

First, the US stock market is only officially open for a fraction of the hours in a day. But you can in practice trade equities around the clock. George Pearkes at Bespoke Investment Group has calculated that if one adjusts for the different lengths of trading windows, then average intraday and overnight returns are not that dissimilar.

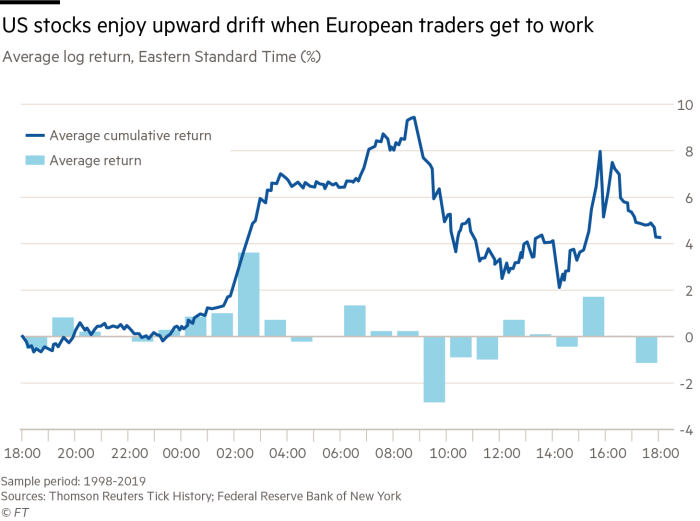

Second, a New York Federal Reserve study of S&P 500 futures patterns showed that returns actually spike most notably between 2am and 3am in New York. Tellingly, this is roughly when European traders get to work, and not what Knuteson’s theory would suggest.

Third, a quarter of US corporate earnings releases are published right after the market closes, and another 60 per cent before trading starts in the morning. Most companies tend to beat estimates and therefore enjoy subsequent price spikes in the overnight trading session, helping explain the phenomenon.

There are many other technical factors that probably play a big role, such as derivatives or index funds buying in the closing auction. Quants scoff at Knuteson’s theory, arguing that the costs of trading and insuring against any disastrous tumbles while the portfolio is bloated would almost certainly gobble up any gains from such a strategy anyway.

And the idea that big hedge funds could systematically manipulate markets on a stunning scale over several decades and across multiple countries without a single regulator, trading firm or money manager noticing defies belief.

Of course, these explanations don’t satisfy Knuteson. He suggests regulators are either incompetent and unable to discern even the obvious market footprint this trading would leave, or consciously turning a blind eye because people like stock markets going up.

Over the years he tried to convince some journalists to write about his paper and when they mostly declined he started publishing his anonymised correspondence with them (including me) in a paper he titled “They Chose to Not Tell You”. Earlier this month he published a sequel catchily called “They Still Haven’t Told You”, again excoriating hapless regulators and journalists. “Their callously self-interested, intellectually dishonest and cowardly contribution continues,” he wrote.

Given my scepticism, why even write about this? Partly to let others make up their minds. But mostly to show how markets, in their infinite madness, can produce all sorts of delightfully weird anomalies caused by under-appreciated, often boring technical factors, most of which are in practice impossible to exploit but can lead to all sorts of fantastical theories.

robin.wigglesworth@ft.com

[ad_2]

Source link