[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

US president Joe Biden predicted Russia would “move in” on Ukraine and warned an invasion would be a “disaster” for Vladimir Putin, as he urged the west to remain united in holding Moscow “accountable” for any aggression.

At a news conference in Washington on Wednesday, Biden said Russia would “pay a stiff price, immediately, short-term, medium-term and long-term” in the event of an invasion of its neighbour Ukraine.

However, the US president’s comments on the western response to Russian aggression were muddied by his suggestion that a “minor incursion” into Ukraine might yield lighter retaliation, which the White House was later forced to clarify.

“If any Russian military forces move across the Ukrainian border, that’s a renewed invasion, and it will be met with a swift, severe and united response from the United States and our allies,” said Jen Psaki, the White House press secretary.

-

Related news: EU officials sought to reassure the US that Brussels remains committed to Washington-led negotiations with Russia over averting further conflict in Ukraine. French president Emmanuel Macron on Wednesday broke ranks to call on EU states to “conduct their own dialogue” rather than engage with diplomatic efforts involving the US and Nato.

Thanks for reading FirstFT Europe/Africa. Here’s the rest of today’s news — Will

Five more stories in the news

1. Top Wall Street banks paid out $142bn in pay and benefits last year Wall Street’s leading banks increased pay by nearly 15 per cent last year as they fought a war for talent. JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America said they handed out $142bn in pay and benefits in 2021, up from $124bn in 2020.

2. Biden backs Fed shift to monetary tightening Joe Biden backed the Federal Reserve’s shift towards tighter monetary policy to fight inflation, using his first formal press conference in months to defend his handling of the economy and reboot his presidency.

3. Luckin Coffee plots relisting Once touted as the biggest challenger to Starbucks in China, Luckin Coffee is exploring plans to relist its shares in the US, according to two people familiar with the matter. The development comes nearly two years after an accounting scandal in which the Chinese coffee chain fabricated more than $300m of sales.

4. University regulator cracks down on ‘poor quality’ courses in England Universities and colleges in England that fail to meet standards on dropout rates and graduate employment could lose out on funding, under “tough” new measures proposed by the regulator. The Office for Students, which oversees quality in higher education, announced strict thresholds that it proposes institutions must meet to avoid investigation and potential restrictions on access to student loan funding.

5. Johnson buys time as Tories rally behind leader Boris Johnson secured a fragile truce with his Conservative party after he was told to quit by a senior former minister and a Tory MP defected to Labour. Christian Wakeford, MP for Bury South, crossed the floor of the House of Commons to join the opposition, blindsiding Johnson just minutes before prime minister’s questions.

Coronavirus digest

-

Businesses hailed the government’s decision to lift most coronavirus restrictions in England from next week as a welcome boost to city centres and consumer confidence.

-

Bill Gates has issued a warning of pandemics far worse than Covid-19 and called on governments to contribute billions of dollars to prepare for the next global outbreak.

-

Hong Kongers leaving the increasingly isolated city are chartering private jets for their pets — the only way many can take their animals with them as pandemic restrictions squeeze freight space on commercial flights.

-

Cathay Pacific is offering bonuses of up to $3,700 to incentivise to pilots to fly into Hong Kong and stay in hotel quarantine for weeks.

The day ahead

ECB The European Central Bank Governing Council publishes its December monetary policy meeting minutes and monthly inflation figures. Eurozone inflation rose to 5 per cent in December, setting a record high since the single currency was created more than two decades ago.

Other data France releases its January business confidence survey and Germany publishes its producer price index figures for December. (INSEE)

Earnings Netflix will report earnings after it arguably delivered its strongest-ever slate of original content in Q4 led by Squid Game, but analysts suspect the streaming pioneer may have struggled to reach its subscriber goal.

Doomsday The Bulletin of the Atomic Scientists will announce the location of the minute hand on the Doomsday Clock that records the perceived threat of global apocalypse. (BAS)

What else we’re reading and watching

A year on, we haven’t absorbed the lessons of the GameStop saga Last year’s influx of new-wave investors exposed the degree to which finances are being reshaped by digitisation and highlighted populist anger, writes Gillian Tett. As the stock market hits new highs, it may be a signal the bubble is ready to burst, but what would happen to smaller investors?

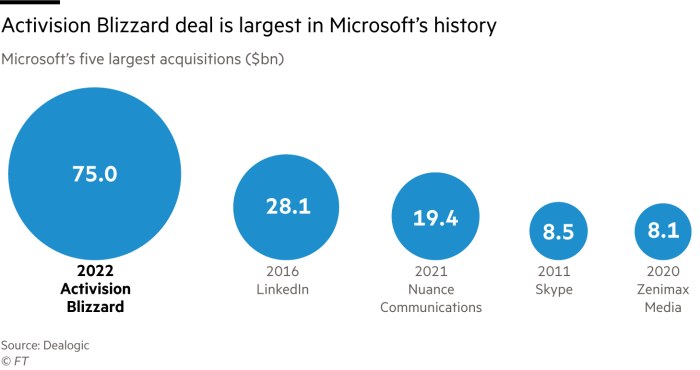

Microsoft’s $75bn bet on Activision sets off next era of consumer technology Analysts are calling the defining deal a catalyst for “the new content war”. It is also likely to provoke intense scrutiny from antitrust regulators around the world, for whom any move by the biggest US tech companies to buy their way to the top of important new markets has become a worry.

How to get a pay rise in 2022 As the cost of living spirals, earning more is probably top of your financial to-do list for 2022. FT money and career experts discuss the dos and don’ts, offer practical tips and reveal the moment when employees have the most leverage to ask for a raise.

How the UK high street was hit by the pandemic What do Manchester, Dartford and Tower Hamlets have in common? They are among the places in the UK whose high streets have been worst hit by the economic impact of the pandemic. Check how your local area fared with our interactive list.

Boris Johnson’s fall would not change the Conservative agenda If the UK prime minister is toppled by the so-called “partygate scandal”, the next leader is still going to be a Conservative. While Johnson’s lockdown breaches and failings may leave him terminally discredited, few in his party are questioning the manifesto on which he won, Robert Shrimsley writes.

Travel

Insomniac and FT columnist Lucy Kellaway took a trip to the Cliveden House hotel to try out a cannabidiol oil massage called the OTO Sleep Experience. During her stay, she’s delighted by the light switches and cheese soufflé. The Tibetan bowls and CBD? They were simply not enough to remedy a sleepless night.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link