[ad_1]

The global startup fundraising boom has lifted nearly every sector you can name: Edtech took off during the pandemic, software in general got a lift, and even more risky and long-term wagers like space tech and biotech are seemingly doing well in today’s risk-on startup fundraising market.

But no single category or niche in startup land has done better than financial technology, or fintech.

Around the world, fintech startups have raised simply astounding amounts of capital, with geographies like Latin America, Africa, North America, and more seeing neobanks, payments companies, new consumer-facing lending services, cryptocurrency on-ramps from the traditional banking world, trading apps, and other sub-sectors raising tectonic rounds from investors hungry to get their own capital to work in the craze.

No surprises

Global venture funding reached a record $621 billion in 2021, according to the CB Insights 2021 State of Venture Report. That’s more than double 2020’s total of $294 billion.

In 2021, global fintech funding jumped to a new record of $131.5 billion across 4,969 deals. That compares to $49 billion across 3,491 deals in 2020. As you can see, the pace at which capital was invested into fintech startups in 2021 grew much more rapidly than total deal count, leading to larger rounds on average. The CB Insights data that we’re citing here also helps put the pace of fintech investing into context compared to its peer startup groups, with financial technology companies raising one in every five venture capital dollars last year, or some 21%.

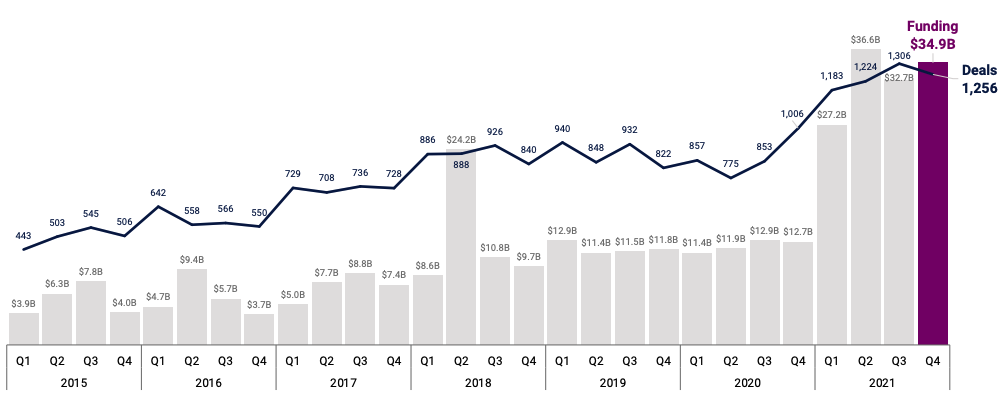

The fevered pace at which fintech startups attracted external capital continued: In the fourth quarter of 2021, fintech funding reached $34.9 billion – second only to Q2 2021, which saw funding total $36.6 billion. Deal flow was similar – 1,256 in Q4 compared to 1,224 in Q2.

To make those numbers a bit more understandable to our monkey brains, in the fourth quarter inclusive of weekends, holidays, and other non-working periods, some 14 fintech deals were announced every day, worth $387,777,777 every 24 hours. That’s pretty fucking rapid.

The fintech venture market is so big, in fact, that its outlines mirror those of the venture capital market itself. The United States, for example, led in fintech funding in Q4, as it did in total venture capital dollars in the year. The U.S. was followed by Asia and Europe in fintech investment – with $18.2 billion invested in U.S. fintechs, compared to $8.2 billion and $5.6 billion in Asia and Europe, respectively.

While still lagging globally, Latin America came in at an impressive fourth place with $1.9 billion in funding in fintech startups. (Note: In Q3, LatAm fintechs reaped $4.2 billion in funding; smaller numbers tend to be more variable quarter-to-quarter.)

But those are just the top-line figures. What happened on an individual round basis? Let’s talk about it.

Average deal size

Average and median fintech deal sizes reached new records last year. The average fintech startup round in 2021 was $32 million, up sharply – nearly double! – from $18 million in 2020. Meanwhile, the median deal size was $5 million, compared to $4 million in 2020, a more modest increase of 20%.

[ad_2]

Source link